IRS Form 1120-S Instructions: Complete Guide for S Corporations

Easily file IRS Form 1120-S and ensure your S Corporation stays compliant with IRS requirements.

Excise Tax Forms

Employment Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

If you run an S Corporation, IRS Form 1120-S is your most important annual tax filing. Unlike a traditional C Corporation (which files Form 1120 and pays corporate income taxes), an S Corporation operates as a pass-through entity. This means the corporation itself doesn’t pay federal income tax - instead, the income, deductions, and credits “flow through” to shareholders, who report them on their personal tax returns.

That’s why filing IRS Form 1120-S is critical. It doesn’t just satisfy IRS compliance; it ensures your shareholders can file their personal returns accurately using Schedule K-1.

Table of Contents

What Is Form 1120-S and Why It Matters

Form 1120-S, U.S. Income Tax Return for an S Corporation, is the IRS form used to report:

- The corporation’s income and losses

- Deductions and credits

- Balance sheet details

- Shareholder distributions

- Supporting schedules (K, K-1, L, M-1, and M-2)

Why it matters:

- Compliance – Failure to file can result in penalties.

- Transparency – Shareholders rely on timely K-1s.

- Accuracy – Mistakes can cause delays in both corporate and personal filings.

Who Must File Form 1120-S?

You must file Form 1120-S if your business:

- Has elected to be treated as an S Corporation by filing Form 2553 (Election by a Small Business Corporation).

- Operates as a domestic corporation with 100 or fewer shareholders.

- Meets shareholder eligibility rules (only U.S. citizens, residents, and certain trusts/estates can hold shares).

- Has issued Schedule K-1 to shareholders.

Filing Deadlines and Penalties

Filing Deadline

- Calendar-year S Corporations (most common): File by March 16, 2026 for the 2025 tax year.

- Fiscal-year S Corporations: File by the 15th day of the 3rd month after your fiscal year ends.

Extensions

- You can file Form 7004 to request a 6-month extension.

- Example: For a calendar-year S Corp, the extended deadline is September 15, 2026.

Penalties

| Situation | Penalty Amount | Notes |

|---|---|---|

| Late filing | $245 per shareholder, per month | Up to 12 months |

| Incomplete return | $310 per shareholder | Missing K-1s trigger this |

| Intentional disregard | $630+ per shareholder | Higher if negligence is proven |

Comparison Table (1120-S vs. 1120 vs. 1065)

Instead of repeating what’s in your Resource Center, make it instruction-focused:

Key Documents You Need Before Filing

Before filling out Form 1120-S, gather:

- Year-end financial statements (Profit & Loss, Balance Sheet)

- Shareholder ownership records (percentages, contributions, distributions)

- Supporting schedules (depreciation schedules, COGS details, credit documentation)

- Last year’s 1120-S (for consistency and carryovers)

- Payroll records (if you pay shareholder-employees)

Key Schedules for IRS Form 1120-S

Filing Form 1120-S involves several required schedules and supporting attachments. Here’s a breakdown of every major schedule, what it records, and when you need it:

| Schedule | Purpose | Required When |

|---|---|---|

| Schedule B-1 | Information on indirect/nominee shareholders | Any indirect/nominee ownership |

| Schedule D | Capital gains and losses | Any sale/exchange of capital assets |

| Schedule K | S Corp’s total annual income, deductions, and credits | All S Corporations |

| Schedule K-1 | Individual shareholder allocations | Every shareholder |

| Schedule L | Year-end balance sheet | Gross receipts/assets exceed IRS thresholds |

| Schedule M-1 | Book-tax reconciliation | Assets/receipts > $250,000 |

| Schedule M-2 | AAA balance/distributions analysis | S Corps distributing to shareholders |

| Schedule K-2/K-3 | International tax compliance items (where relevant) | Foreign activity/cross-border tax items |

| 1125-A | Cost of Goods Sold computation | Product-based businesses |

| 4562 | Depreciation and amortization | Assets depreciated/amortized |

| 4797 | Sales of business property | Asset/property sales |

| Additional Attachments | Rental income, vehicle credits, opportunity funds, and others as applicable | Specific events or transactions |

Each schedule should be prepared and attached in the precise order recommended by the IRS to avoid processing delays and audit risk.

How These Schedules Fit

- Schedules B, K, L, M-1, and M-2 are integral parts of the main Form 1120-S and assembled at the end.

- Schedules K-1 are distributed to shareholders for personal filings.

- Attach other forms (D, 1125-A, 4562, 4797, K-2/K-3, etc.) if specific business activity applies.

Line-by-Line Instructions for Form 1120-S

Let’s now explore the line-by-line instructions of Form 1120-S. This section provides a detailed summary of your corporation’s financial activity and tax reporting.

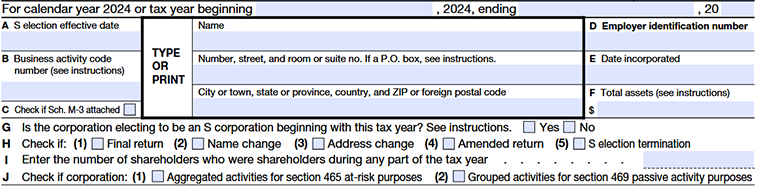

Basic Information Section

- Name and Address – Enter the exact legal name of your corporation as it appears on incorporation documents. Include full mailing address.

- Employer Identification Number (EIN) – This is your corporate tax ID, not a personal SSN.

- Date Incorporated – Enter the month, day, and year of incorporation.

- Total Assets – Enter the corporation’s total assets at year-end (from your balance sheet, Schedule L).

- Final Return / Name Change / Address Change – Check these boxes if applicable.

Example: If your S Corp closed in 2025, check “Final Return.”

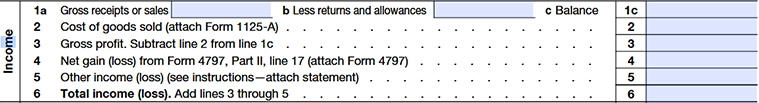

Income Section (Lines 1a–6)

This section reports your S Corporation’s income from business operations and other sources for the tax year. It begins with total gross sales and subtracts returns and allowances to calculate net sales. Then, if applicable, it accounts for the cost of goods sold (COGS) to determine gross profit. Gains or losses from selling business property and other income like rental or interest income are added to calculate total income. Accurate reporting here is essential to reflect your corporation’s financial activity correctly.

- Line 1a – Gross Receipts or Sales

Enter your total sales revenue before deducting returns or allowances.

Example: $500,000 in gross sales. - Line 1b – Returns and Allowances

Report refunds, rebates, or returned goods.

Example: $5,000 in product returns. - Line 1c – Balance (Net Sales)

Subtract Line 1b from Line 1a to get net sales.

Example: ($500,000 – $5,000 = $495,000). - Line 2 – Cost of Goods Sold (COGS)

Enter the total cost of producing or acquiring the goods sold. Attach Form 1125-A to detail this amount.

Example: $200,000 in materials and inventory costs. - Line 3 – Gross Profit

Subtract Line 2 from Line 1c to calculate gross profit.

Example: $495,000 – $200,000 = $295,000. - Line 4 – Net Gain (Loss) from Form 4797

Enter any gains or losses from the sale of business property as reported on Form 4797, Part II, Line 17. Attach Form 4797.

Example: Gain of $15,000 from sale of machinery. - Line 5 – Other Income (Loss)

Report other income or loss, such as rental income, interest income, or tax refunds. Attach statements as needed

Example: $3,000 in interest income. - Line 6 – Total Income (Loss)

Add Lines 3, 4, and 5 to get total income or loss.

Example: $295,000 + $15,000 + $3,000 = $313,000.

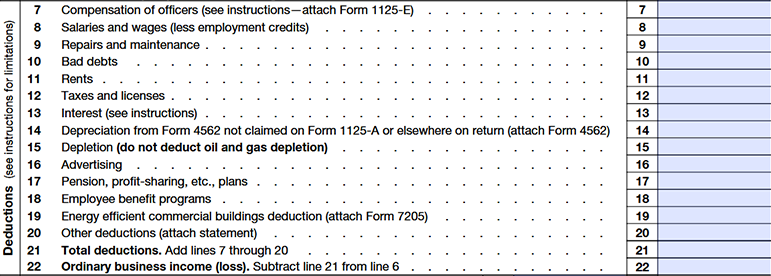

Deductions Section Overview (Lines 7–22)

This section lists your S Corporation’s allowable business expenses that reduce taxable income. Each deduction must be ordinary, necessary, and well-documented. Properly reporting deductions ensures accurate calculation of your corporation’s ordinary business income or loss, which flows through to shareholders.

Line-by-Line Instructions

- Line 7 – Compensation of Officers

Report salaries paid to shareholder-officers actively working in the business. IRS requires this compensation to be reasonable based on industry standards.

Example: The CEO’s salary is $80,000. - Line 8 – Salaries and Wages

Include wages paid to non-officer employees; do not include officer compensation here.

Example: Administrative staff wages total $150,000. - Line 9 – Repairs and Maintenance

Expenses to keep business property in good working order (not capital improvements).

Example: Repainting office space or fixing machinery. - Line 10 – Bad Debts

Deduct accounts receivables that are uncollectible and were previously included in income.

Example: A $5,000 client invoice that cannot be collected. - Line 11 – Rents

Rent paid for business property or equipment.

Example: Office lease payments totaling $24,000 annually. - Line 12 – Taxes and Licenses

Includes state and local business taxes, payroll taxes, and licenses but excludes federal income taxes.

Example: State franchise tax of $10,000. - Line 13 – Interest

Interest on loans or business mortgages.

Example: $8,000 paid on a business loan interest. - Line 14 – Depreciation

Report depreciation expense recorded on Form 4562.

Example: Depreciation for equipment is $5,000 for the year. - Line 15 – Depletion

For businesses extracting natural resources like mining or oil.

Example: Depletion expense related to oil extraction. - Line 16 – Advertising

Marketing and promotional expenses.

Example: $20,000 spent on online ads and brochures. - Line 17 – Pension, Profit-Sharing, etc.

Contributions to employee retirement plans.

Example: $12,000 paid into a SEP IRA plan. - Line 18 – Employee Benefit Programs

Costs for employee health insurance, life insurance, and other benefits (excluding pension).

Example: Company-paid health insurance premiums of $18,000. - Line 19 – Energy Efficient Commercial Buildings Deduction

Deduct expenses for qualifying energy-efficient improvements (attach Form 7205).

Example: Costs associated with installing energy-efficient windows. - Line 20 – Total Deductions

List any other ordinary business expenses not listed above (attach itemized statement).

Example: Legal fees, office supplies, utilities. - Line 21 – Total Deductions

Add Lines 7 through 20 to report the total deductible expenses. - Line 22 – Ordinary Business Income (Loss)

Subtract Line 21 (Total Deductions) from Line 6 (Total Income) to calculate your ordinary business income or loss. This amount flows to Schedule K and ultimately to shareholders.

Example Summary:

- Total Income (Line 6) = $295,000

- Total Deductions (Line 21) = $260,000

- Ordinary Business Income (Line 22) = $35,000

Tax and Payments Section

Understanding the Tax and Payments Section (Lines 23a–28)

This section of Form 1120-S reports any corporate-level taxes owed by your S Corporation, estimated tax payments made during the year, penalties (if applicable), and the calculation of either the amount you owe or your overpayment for the tax year.

Because S Corporations generally do not pay income tax at the corporate level, these lines specifically address:

- Taxes on excess passive income or asset recapture,

- Capital gains taxes,

- Tax credits and prepayments,

- Any penalties for underpayment of estimated taxes.

Filing this section correctly ensures accurate tax liability calculation and avoids unexpected penalties or missed refunds. Below, each line is explained with examples to help you complete this important part of your return confidently.

Line 23a – Excess Net Passive Income or LIFO Recapture Tax

Example: If your S corporation had excess net passive income of $4,000 and must pay a recapture tax of $500, enter the total, $4,500, here. Attach a statement calculating each tax.

Line 23b – Tax from Schedule D (Form 1120-S)

Example: After selling business assets, you calculate from Schedule D that your S corporation owes $2,000 in capital gains tax. Enter $2,000.

Line 23c – Total Taxes (Add Lines 23a and 23b plus additional taxes, if any)

Example: If Line 23a is $4,500, Line 23b is $2,000, and you owe $700 from Form 4255 (investment credit recapture), enter $7,200.

Line 24a – Estimated Tax Payments & Prior Year Overpayments

Example: During the year, your S corporation made $3,000 in estimated payments and carried forward a $500 overpayment from last year. Enter $3,500.

Line 24b – Tax Deposited with Form 7004

Example: When filing for an extension, your S corporation prepaid $1,000 with Form 7004. Enter $1,000.

Line 24c – Credit for Federal Tax Paid on Fuels (Form 4136)

Example: If your S corporation qualifies for a $250 fuel tax credit, based on Form 4136, enter $250.

Line 24d – Elective Payment Election Amount (Form 3800)

Example: Your S corp claims a $1,200 elective payment for renewable energy credits, calculated on Form 3800. Enter $1,200.

Line 24z – Total Prepaid Taxes and Credits

Example: Adding Lines 24a ($3,500), 24b ($1,000), 24c ($250), and 24d ($1,200) totals $5,950. Enter $5,950.

Line 25 – Estimated Tax Penalty (if any; Attach Form 2220 if used)

Example: Your S corporation underpaid estimated taxes and owes a $90 penalty. Enter $90. If using Form 2220, check the box.

Line 26 – Amount Owed

Example: If total taxes due (Line 23c + 25) are $7,290 and total prepayments (Line 24z) are $5,950, enter $1,340 ($7,290 – $5,950).

Line 27 – Overpayment

Example: If total prepayments (Line 24z) are higher than total taxes (Line 23c + 25), say by $500, enter $500 here.

Line 28 – Amount Credited or Refunded

Example: Decide to credit your $500 overpayment toward next year’s estimated tax. Enter $500 under “Credited to 2025 estimated tax.” If you want a refund instead, mark the “Refunded” box and enter the amount.

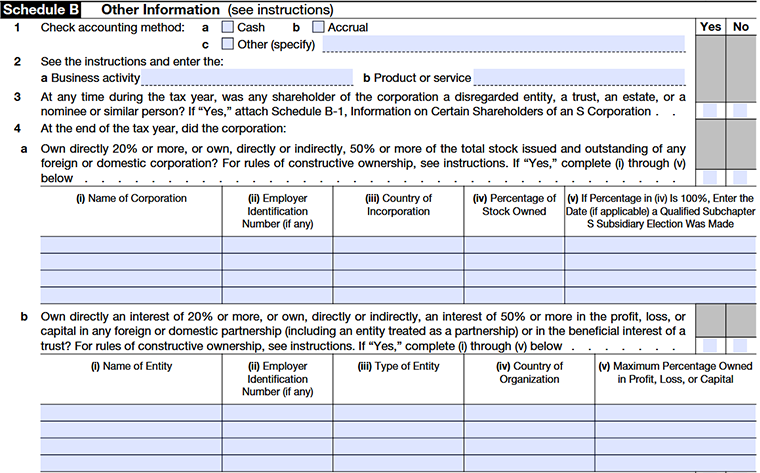

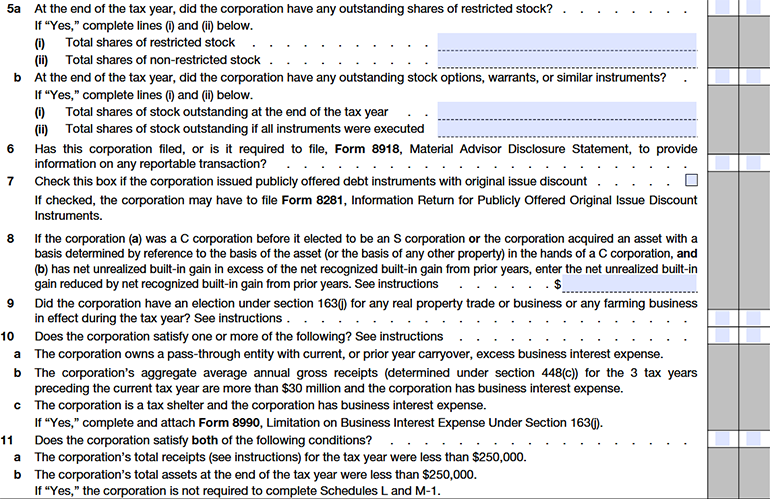

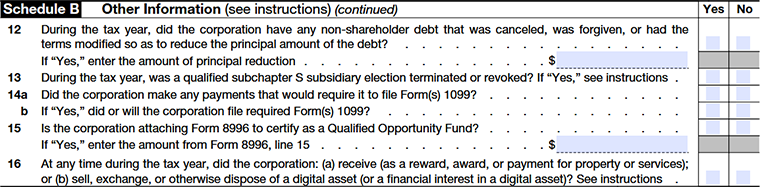

Schedule B – Other Information

Schedule B collects additional details about the S Corporation that are important for IRS reporting but don’t fit elsewhere on the form. It consists mainly of yes/no questions and requests for specific entity and ownership information to help the IRS understand your corporation’s structure, activities, and compliance with tax rules.

Key items covered:

- Accounting Method

Indicate whether your corporation uses the cash method, accrual method, or another accounting method. - Business Activity and Product/Service

Enter your primary business activity and describe the main products or services offered. - Shareholder Entities

Disclose if any shareholder during the tax year was a disregarded entity (e.g.,

single-member LLC), a trust, estate, nominee, or similar person. If yes, you must attach Schedule B-1 providing detailed information. - Ownership of Other Entities

Report whether your S Corporation directly or indirectly owns 20% or more of any other corporation’s stock or has significant interests (20% or more) in partnerships or trusts. Detailed ownership information and related entities must be provided. - Restricted Stock and Stock Options

Disclose any outstanding shares of restricted stock or stock options/warrants at year-end with relevant totals. - Material Advisor Disclosure

Indicate whether you are required to file Form 8918 related to reportable transactions. - Publicly Offered Debt Instruments

If you issued publicly offered debt instruments with original issue discount, disclose here, which may require filing Form 8281. - Net Unrealized Built-in Gain

Report any built-in gain related to previous C corporation status or asset acquisitions from a C corporation. - Section 163(j) Election

Confirm if your corporation had an election under Section 163(j) related to limitations on business interest expense for real property or farming businesses. - Business Interest Expense Limitation

Indicate if your corporation meets criteria requiring Form 8990 related to business interest expense limitations. - Small Corporation Exception

State if total receipts and total assets are below $250,000, which exempts you from filing Schedules L and M-1. - Canceled or Modified Debt

Report any non-shareholder debt canceled, forgiven, or modified during the year. - Qualified Subchapter S Subsidiary Election

Disclose if any such election was terminated or revoked during the year. - Payments Requiring Form 1099

Indicate whether you made payments necessitating Form(s) 1099 filings and whether these were filed. - Qualified Opportunity Fund Certification

- Digital Asset Transactions

Indicate if your corporation received or disposed of any digital assets (such as cryptocurrencies) during the tax year.

Additional Information:

- If you answered “Yes” to having shareholders who are disregarded entities or similar, attach Schedule B-1 to provide their details.

- Attach supporting statements or forms as required for each respective item.

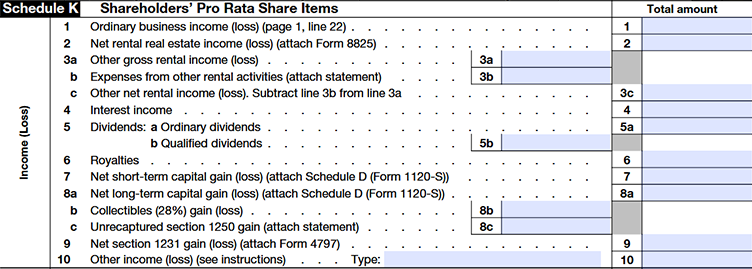

Schedule K – Shareholders’ Pro Rata Share Items

Schedule K of Form 1120-S summarizes all income, deductions, credits, and other tax items that are allocated to shareholders proportionate to their ownership shares. These amounts flow through to shareholders for reporting on their personal tax returns via Schedule K-1.

Income (Loss) Items

- Ordinary Business Income (Loss)

The corporation’s net ordinary income or loss from operations (Page 1, Line 22). - Net Rental Real Estate Income (Loss)

Income or loss from rental real estate activities (attach Form 8825 if applicable). - Other Gross Rental Income (Loss) and Expenses

Report income and expenses from rental activities not involving real estate. Subtract expenses (3b) from gross rental income (3a) for net rental income (3c). - Interest Income

Report interest earned from business investments and bank accounts. - Dividends

- Ordinary Dividends.

- Qualified Dividends (subject to preferential tax rates).

- Royalties

Income received from intellectual property or natural resource rights. - Net Short-Term Capital Gain (Loss)

Gains or losses from assets held one year or less (attach Schedule D). - Net Long-Term Capital Gain (Loss) and Related Gains

- Long-term gains or losses (held more than one year)

- Collectibles (28%) gains or losses

- Unrecaptured section 1250 gains (attach statement).

- Net Section 1231 Gain (Loss)

Gains or losses from sales of business property (attach Form 4797). - Other Income (Loss)

Miscellaneous income or loss not included above (specify type).

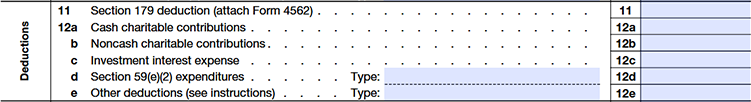

Deductions

- Section 179 Deduction

Expensing election for qualifying property (attach Form 4562). - Charitable Contributions and Investment Interest Expense

- Cash charitable contributions

- Noncash charitable contributions

- Investment interest expense

- Section 59(e)(2) expenditures

- Other deductions (specify).

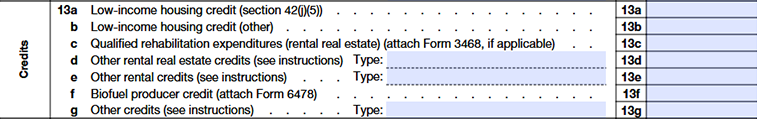

Credits

- Various tax credits such as:

- Low-income housing credits

- Qualified rehabilitation expenditures

- Other rental real estate credits

- Biofuel producer credit

- Other applicable credits (specify)

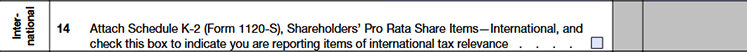

International Tax Items

- Attach Schedule K-2 if reporting international tax items and check the appropriate box.

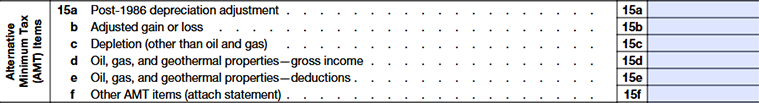

Alternative Minimum Tax (AMT) Items

- Adjustments related to AMT such as:

- Post-1986 depreciation adjustments

- Adjusted gain or loss

- Depletion

- Oil, gas, and geothermal properties income and deductions

- Other AMT-related items.

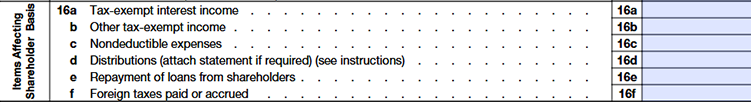

Items Affecting Shareholder Basis

- Items like:

- Tax-exempt interest income

- Other tax-exempt income

- Nondeductible expenses

- Distributions to shareholders

- Repayments of loans from shareholders

- Foreign taxes paid or accrued

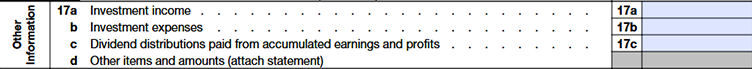

Other Information

- Investment income and expenses, dividend distributions, and other items.

Income (Loss) Reconciliation

- Combine total income amounts (Lines 1–10), then subtract deductions (Lines 11–12e) and foreign taxes (Line 16f) to reconcile the corporation’s income or loss.

This schedule provides shareholders with a complete view of their share of the S Corporation’s financial activities necessary for their individual income tax filings.

Schedule K-1 – Shareholder Information

Each shareholder receives a Schedule K-1 reporting their share of income, losses, deductions, and credits.

What K-1 Includes

- Shareholder’s identifying info (name, SSN, address).

- Ownership percentage (beginning and end of year).

- Allocated share of Schedule K items.

- Foreign transactions, AMT items, and other credits.

Example:

- 2 shareholders, each with 50% ownership.

- Ordinary Business Income = $35,000.

- Each K-1 shows $17,500 for Line 1.

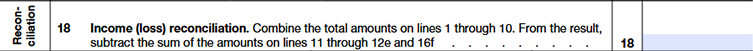

Schedule L – Balance Sheets per Books

Schedule L provides a snapshot of your S Corporation’s financial position at the beginning and end of the tax year. It reports the corporation’s assets, liabilities, and shareholders’ equity as recorded in its books and records. This balance sheet helps the IRS verify income and deductions reported elsewhere on the tax return.

Assets Section

Report amounts for the following asset categories at both the beginning and end of the tax year:

- Cash: All cash on hand and in bank accounts.

- Trade Notes and Accounts Receivable: Amounts owed to the corporation by customers.

- Allowance for Bad Debts: Subtract estimated uncollectible amounts from receivables.

- Inventories: Goods available for sale (see Form 1125-A for details).

- U.S. Government Obligations: Treasury bonds and similar securities.

- Tax-Exempt Securities: Municipal bonds and other tax-exempt investments.

- Other Current Assets: Any other short-term assets (attach statement).

- Loans to Shareholders: Amounts loaned to shareholders.

- Mortgage and Real Estate Loans: Loans made secured by property.

- Other Investments: Additional investment assets (itemize).

- Buildings and Other Depreciable Assets: Cost of depreciable property before depreciation.

- Accumulated Depreciation: Total depreciation taken.

- Depletable Assets: Assets subject to depletion (e.g., natural resources).

- Accumulated Depletion: Total depletion taken.

- Land: Value of land owned (net of amortization).

- Intangible Assets: Amortizable assets such as patents.

- Accumulated Amortization: Total amortization taken.

- Other Assets: Miscellaneous assets not listed above (attach statement).

- Total Assets: Sum of all asset categories.

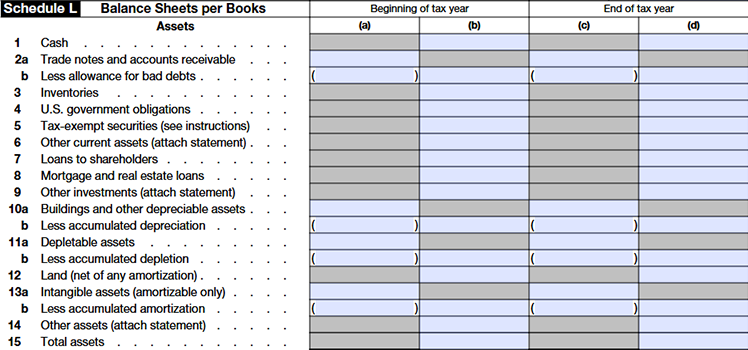

Liabilities and Shareholders’ Equity

Report amounts for liabilities and equity similarly at the beginning and end of the tax year:

- Accounts Payable: Amounts owed to vendors/suppliers.

- Mortgages, Notes, Bonds Payable (due in less than 1 year).

- Other Current Liabilities: Any other short-term liabilities (attach statement).

- Loans from Shareholders: Debt owed to shareholders.

- Mortgages, Notes, Bonds Payable (due in 1 year or more).

- Other Liabilities: Long-term liabilities not included above (attach statement).

- Capital Stock: Value of issued stock at par or stated value.

- Additional Paid-in Capital: Amount received over par value from stock issuance.

- Retained Earnings: Cumulative earnings retained in the corporation.

- Adjustments to Shareholders’ Equity: Includes unrealized gains/losses and other equity adjustments (attach statement).

- Cost of Treasury Stock: Value of shares repurchased by the corporation.

- Total Liabilities and Shareholders’ Equity: Must equal total assets reported.

Filing Notes

- Many smaller S Corporations with total assets and receipts under $250,000 may be exempt from filing Schedule L (see Schedule B, Line 11).

- Ensure Schedule L balances at the start and end of the year reconcile with your income statement and other schedules (M-1 and M-2).

- Attach statements to explain any discrepancies or unusual balances.

- Accurate completion of Schedule L increases compliance, reduces audit risk, and clarifies the financial condition of your S Corporation.

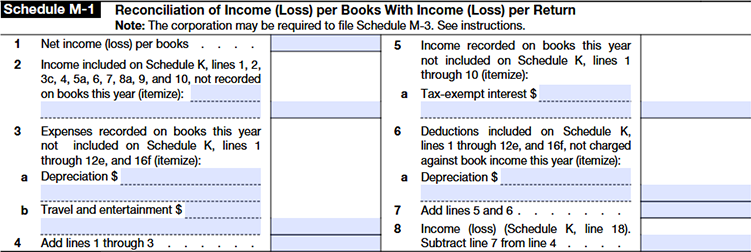

Schedule M-1 – Reconciliation of Income (Loss)

Schedule M-1 is used to reconcile the corporation’s net income or loss reported on its financial accounting books with the taxable income or loss reported on the tax return. This reconciliation is necessary because differences often arise between accounting income and taxable income due to differences in tax law and accounting principles.

Schedule M-1 Line-by-Line Explanation with Example

- Line 1 – Net income (loss) per books

Enter the company’s net income or loss according to its accounting records.

Example: $100,000 net income per books. - Line 2 – Income included on Schedule K but not recorded on books this year

Report income items that appear on Schedule K but were not recorded in the accounting books for the current tax year (itemize).

Example: $5,000 of tax-exempt interest. - Line 3 – Expenses recorded on books this year not included on Schedule K

Include expenses recorded in the books but not deductible for tax purposes (itemize).

Example: - Depreciation per books: $8,000

- Travel and entertainment expenses disallowed: $2,000

Total: $10,000 - Line 4 – Add lines 1 through 3

Sum the amounts from Lines 1, 2, and 3.

Example: $100,000 + $5,000 + $10,000 = $115,000. - Line 5 – Income recorded on books this year not included on Schedule K

Report income recorded on books but excluded from taxable income (e.g., tax-exempt interest).

Example: $5,000 tax-exempt interest. - Line 6 – Deductions on Schedule K not charged against book income

Include deductions reported on Schedule K but not deducted as expenses on the books (itemize).

Example: - Tax depreciation: $12,000.

- Line 7 – Add lines 5 and 6

Sum Lines 5 and 6.

Example: $5,000 + $12,000 = $17,000. - Line 8 – Income (loss) per Schedule K, line 18

Subtract Line 7 from Line 4 to find the taxable income or loss reported on Schedule K.

Example: $115,000 – $17,000 = $98,000 taxable income.

Purpose and Importance

Schedule M-1 helps the IRS verify that your corporation has accurately reported taxable income by explaining differences between accounting and tax figures. Completing it thoroughly reduces audit risks and ensures compliance with tax laws.

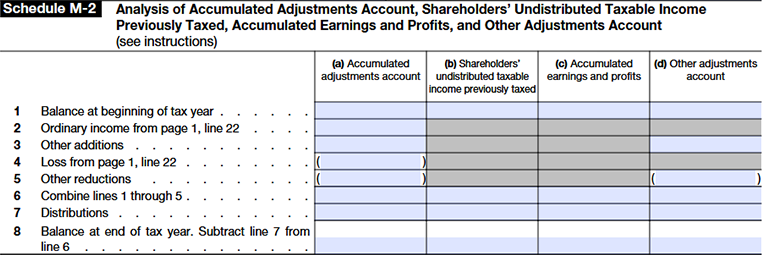

Schedule M-2 – Analysis of Accumulated Adjustments Account

Schedule M-2 tracks changes in your S Corporation’s accumulated adjustments account and other related equity accounts throughout the tax year. These accounts reflect the corporation’s undistributed taxable income previously taxed to shareholders, accumulated earnings and profits, and other adjustments.

Completing Schedule M-2 helps shareholders accurately calculate their basis and determine the tax treatment of distributions and income items.

Line-by-Line Explanation

- Line 1 – Balance at Beginning of Tax Year:

Enter the balance of the AAA, undistributed taxable income previously taxed, accumulated earnings and profits, and other adjustments account at the beginning of the tax year. - Line 2 – Ordinary Income from Page 1, Line 22:

Report the corporation’s ordinary business income (or loss) for the year. - Line 3 – Other Additions:

Include other increases such as tax-exempt income, non-deductible expenses that increase AAA, or other relevant adjustments. - Line 4 – Loss from Page 1, Line 22:

Enter any ordinary business loss for the year. - Line 5 – Other Reductions:

Include decreases such as non-dividend distributions, non-deductible expenses that reduce AAA, or other relevant items. - Line 6 – Combine Lines 1 through 5:

Add all additions and subtract reductions from the beginning balance to compute the adjusted balance before distributions. - Line 7 – Distributions:

Enter total distributions to shareholders that reduce the AAA or related accounts. - Line 8 – Balance at End of Tax Year:

Subtract Line 7 from Line 6 to arrive at the ending balance for each account. This balance carries forward to the next tax year.

Example Summary

- Suppose an S Corporation has the following for its AAA account:

- Beginning balance (Line 1): $50,000

- Ordinary income (Line 2): $35,000

- Other additions (Line 3): $5,000

- Losses (Line 4): $0

- Other reductions (Line 5): $2,000

- Distributions (Line 7): $20,000

- Calculate as follows:

Line 6 = $50,000 + $35,000 + $5,000 – $0 – $2,000 = $88,000

Line 8 = $88,000 – $20,000 = $68,000 ending balance

Important Notes

- Filing Schedule M-2 is required if the corporation’s total assets or receipts exceed $250,000 or if the corporation was previously a C corporation.

- Accurate maintenance of these accounts is critical for determining the tax treatment of shareholder distributions and for basis calculations on Schedule K-1.

- Related schedules (L and M-1) should reconcile with the amounts reported on Schedule M-2.

- Attach clear supporting statements explaining “Other Additions” and “Other Reductions” with appropriate documentation.

Common Mistakes to Avoid

- Incorrect Ownership Percentages

- Always update shareholder changes immediately.

- Mixing Business & Personal Expenses

- Deduct only legitimate business expenses.

- Late K-1 Distribution

- Leads to $310 per-K-1 penalty.

- Not Filing Extensions

- Missing deadlines costs $235/shareholder/month.

- Inconsistent Records

- Schedule L must match corporate financials.

Lesser-Known S Corp Filing Add-Ons

Many S Corps miss filing related forms alongside 1120-S, which can result in IRS follow-ups:

- Form 1125-A – Cost of Goods Sold (for product businesses)

- Form 4562 – Depreciation and Amortization

- Form 4797 – Sale of Business Property

- Form 8949 - Reports sales of capital assets in detail.

- Form 3800 - General Business Credit to claim various credits.

- Form 8825 - Rental real estate income and expenses.

- Form 8938 - Discloses specified foreign financial assets.

- Form 8996 - Qualified Opportunity Fund elections and reporting.

- Form 8941 - Small Employer Health Insurance Premiums Credit.

Common Filing Traps - And How to Avoid Them

- Mixing Personal and Business Expenses: Maintain separate accounts.

- Wrong Ownership Percentages: Double-check corporate records.

- Ignoring State Requirements: Some states require their own S Corp returns.

Digital Document Management with ZeroneVault

With ZeroneVault, TaxZerone’s secure cloud portal, you can store:

- Past tax returns

- Schedule K-1s

- Supporting schedules and receipts

This not only simplifies annual filing but also protects you during audits.

Why File Form 1120-S Online with TaxZerone

Filing manually can be stressful and error-prone. That’s where TaxZerone, an IRS-authorized e-file provider, simplifies the process.

Benefits of E-Filing with TaxZerone

- Real-time error checks – Reduce IRS rejections.

- Instant Schedule K-1 generation – Deliver to shareholders immediately.

- Secure cloud storage (ZeroneVault) – Keep returns and K-1s safe.

- Faster IRS acceptance – No mailing delays.

- Affordable pricing – Ideal for small businesses.

Skip the stress of paperwork. Get compliance, accuracy, and peace of mind - all at an affordable price.

Start Filing 1120-S OnlineFrequently Asked Questions (FAQs)

Here’s a collection of unique, detailed FAQs for the instruction page (different from landing page FAQs).

1. Do all S Corps need to file Form 1120-S every year?

Yes. Even if your S Corp had no income or activity, the IRS requires annual filing to maintain S Corporation status.

2. Can an S Corp have a loss on Form 1120-S?

Yes. Losses pass through to shareholders and may offset other personal income, subject to basis and at-risk rules.

3. What happens if I miss the March 15 deadline?

- A late filing penalty of $245 per shareholder, per monthapplies (up to 12 months).

- File Form 7004 to request a 6-month extension.

4. How do shareholder K-1s connect to Form 1120-S?

Schedule K summarizes total results, while each shareholder’s K-1 breaks down their share. Errors in 1120-S flow directly into K-1s and personal tax returns.

5. Can single-member LLCs file Form 1120-S?

No. A single-member LLC is typically a disregarded entity. To file 1120-S, it must elect S Corporation status with Form 2553.

6. Do states accept IRS Form 1120-S?

Some states do, but others require separate state S Corp returns. Always check your state’s rules.

7. Is e-filing mandatory for Form 1120-S?

Yes, for most corporations with 250+ returns, but the IRS encourages e-filing for all filers. Platforms like TaxZerone make it easier and faster.

Filing your Form 1120-S doesn’t need to be overwhelming.

With TaxZerone, you get:

- IRS-authorized e-filing

- Real-time error checks

- Automatic Schedule K-1 generation

- Secure cloud storage (ZeroneVault)

- Affordable pricing for businesses of all sizes