Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 5498-SA is an IRS form used to report contributions to Health Savings Accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), and Medicare Advantage MSAs (MA MSAs). This resource page provides an overview, filing requirements, deadlines, and step-by-step instructions for completing and submitting Form 5498-SA.

Table of Contents

What is Form 5498-SA?

Form 5498-SA is used by trustees or custodians for Health Savings Account reporting, including contributions (such as rollovers and qualified funding distributions) to HSAs, Archer MSAs, and Medicare Advantage MSAs for each account holder during the tax year. It also reports the fair market value (FMV) of the account as of December 31 of the tax year.

Simplify your 5498-SA process for HSA, Archer, and Medicare MSA account details.

E-file Form 5498-SA with TaxZerone for fast, accurate reporting today.

Who must file Form 5498-SA?

The trustee or custodian of Health Savings Accounts (HSAs), Archer MSAs, or Medicare Advantage MSAs must e-file form 5498-sa with the IRS and issue a copy to the account holder. A separate form needs to be filed for each type of account plan. This Form has two copies;

Copy A must be transmitted to the IRS and Copy B should be delivered to the participants.

What is the information required to file form 5498-SA?

These are the information that required to file IRS form 5498-SA

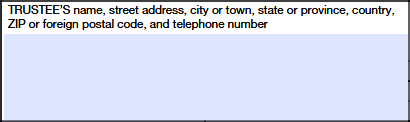

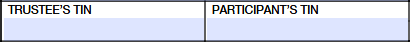

- Trustee/custodian basic information and TIN

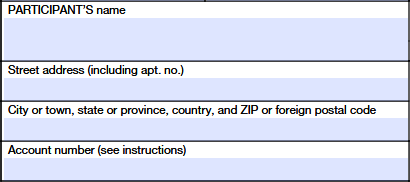

- Participant’s basic information, TIN and Account number

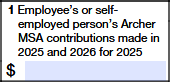

- Contributions made by employee/self-employed individual on Archer MSA

- Total HSA or Archer MSA contributions made in 2026 for the tax year 2025

- Rollover contributions

- Fair market value of the account as of December 31

- Account type (HSA, Archer MSA, or MA MSA)

Important dates for filing Form 5498-SA

Make sure you don’t miss important HSA and MSA reporting dates—check the Form 5498-SA due date to stay compliant.

| Form 5498-SA | Deadlines |

|---|---|

| Send FMV statement | February 02, 2026 |

| Send participant copy | June 01, 2026 |

| IRS E-filing | June 01, 2026 |

| Paper filing | June 01, 2026 |

⏰ Need More Time to File Form 5498-SA?

No worries! Get a 30-day extension with Form 8809 to avoid penalties and file stress-free.

Instructions to file Form 5498-SA

Follow these step-by-step instructions to file your form accurately with IRS.

Enter the trustee’s or custodian’s full legal name, complete address including City, State, country, ZIP code and telephone number.

Enter the trustee’s and participant’s TIN (Taxpayer Identification Number) in the appropriate field.

Enter the Participant's legal name, address including apartment number, city, state, country, ZIP code and account number.

Line 1

Enter the total contributions made by the employee or self-employed individual to the Archer Medical Savings Account in 2025 and through April 15, 2026, for the tax year 2025. Also report the gross contributions, including any excess contributions, even if they were withdrawn.

Line 2

Enter the total contributions made to HSA or Archer MSA in 2025, and include any contributions made in 2025 for the year 2024. Also include any qualified HSA funding distributions received by participant’s during 2025. These are trustee-to-trustee transfers from an IRA to an HSA, under section 408(d)(9). No need to report Medicare Advantage MSA contribution for the year.

Line 3

Enter the total contributions made to Health Savings Account or Archer Medical Savings Account in 2026 for the year 2025.

Line 4

Enter any rollover contribution from one Archer MSA to another Archer MSA or from an Archer MSA or a Health Savings Account (HSA) to another HSA.

Line 5

Enter the Fair Market value of the participant’s account such as Health Savings Account (HSA), Archer Medical Savings Account (Archer MSA) or Medicare Advantage MSA (MA MSA) as of December 31, 2025

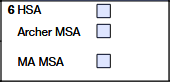

Line 6

Check the participant account type such as Health Savings Account (HSA), Archer Medical Savings Account (Archer MSA) or Medicare Advantage MSA (MA MSA) that is being reported on this form.

Simplify your filing 5498-SA form with TaxZerone

With TaxZerone you can file IRS form 5498-SA with easy 3 steps:

Step 1: Log in to your TaxZerone Free Account

Step 2: Choose tax form “5498-SA” and enter the details of Trustee, participant and HSA, MSA, rollover contribution.

Step 3: Review and transmit it to the IRS and send participant copies through ZeroneVault or postal mailing.