Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

IRS Form 5498 is used to report Individual Retirement Account (IRA) contributions, rollovers, conversions, recharacterizations, and the fair market value (FMV) of IRA accounts to both the IRS and IRA owners.

The form is informational and helps taxpayers verify the accuracy of their IRA-related transactions reported by financial institutions.

Table of Contents

What is Form 5498?

- Form 5498 reports IRA contributions (traditional, Roth, SEP, SIMPLE), rollovers, Roth conversions, recharacterizations, and the FMV of the IRA as of December 31 of the tax year.

- It is issued by the trustee or issuer of the IRA to the account owner and the IRS.

- Form 5498 is generally sent by May 31 following the tax year to allow for contributions made up to the tax filing deadline.

Who Needs Form 5498 Instructions?

- Individuals making IRA contributions or rollovers.

- Financial institutions and trustees responsible for reporting IRA transactions.

- Tax professionals prepare returns involving IRA information.

- Retirement plan administrators managing IRA accounts.

- Investors converting traditional IRAs to Roth IRAs or making recharacterizations.

What is the information required to file form 5498?

These are the information that required to file IRS form 5498

- Trustee/issuer basic information and TIN

- Participant basic information, TIN and account number

- Detailed reporting of contributions by account type (IRA, Roth, SEP, SIMPLE)

- Rollovers contributions and Roth IRA conversions

- Recharacterized- contributions and repayments (if any)

- Required minimum distributions (RMDs) information

- Fair market value of the account as of December 31

Important Deadline for Form 5498

The deadline to file tax Form 5498 for the 2025 tax year is June 01, 2026 . For full details, visit our Form 5498 Deadline page.

| Form 5498 | Deadlines |

|---|---|

| Sending participant copies | February 02, 2026 |

| IRS e-filing | June 01, 2026 |

| Paper filing | June 01, 2026 |

| Reporting IRA contributions | June 01, 2026 |

⏰ Need More Time to File Form 5498?

No worries! Get a 30-day extension with Form 8809 to avoid penalties and stress-free.

Form 5498 instructions-how to fill out?

Let see the step-by-step instructions to file form 5498

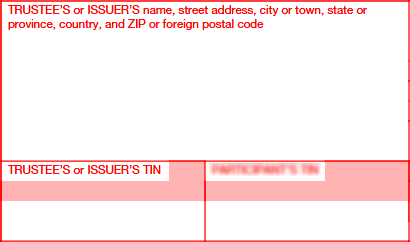

Step 1: Enter the Trustee’s details

- Enter the trustee’s name, address, and telephone number along with their Taxpayer Identification Number (TIN).

- Most filers of IRS Form 5498 are banks, credit unions, or financial institutions that manage IRA accounts.

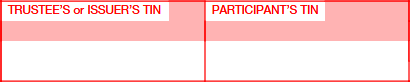

Step 2: Enter the Participants details

Participant's TIN:

- For your protection, this form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN).

- However, the trustee or issuer has reported your complete TIN to the IRS.

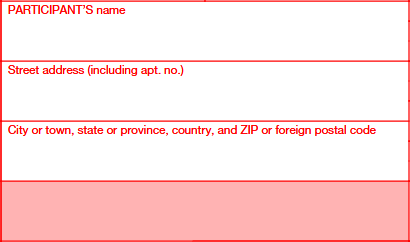

Enter the Participant's name, complete address, including street address, city or town, state or province, country, and ZIP or foreign postal code.

Step 3: Contribution and Account details

Account Number

If you're filing more than one Form 5498 for the same person, you must include an account number. The IRS also recommends adding an account number on all Form 5498 filings to help with tracking.

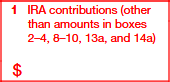

Box 1: IRA Contributions (Other Than Amounts in Boxes 2–4, 8–10, 13a, and 14a)

Include all traditional IRA contributions made in 2025 and through April 15, 2026, for the 2025 tax year.

Include:

- Total contributions (even if part is for life insurance)

- Excess contributions

- Employer contributions not made under SEP or SIMPLE plans

Exclude:

- SEP (Box 8), SIMPLE (Box 9), Roth (Box 10)

- Rollovers (Box 2), Recharacterizations (Box 4), Roth conversions (Box 3)

Box 2: Rollover Contributions

Report rollover contributions to an IRA made in 2026, excluding conversions to a Roth IRA (box 3). Include military death gratuity or SGLI payments to a Roth IRA. Late rollovers go in box 13a.

Box 3: Roth IRA Conversion Amount

Enter amounts converted from a traditional, SEP, or SIMPLE IRA to a Roth IRA during 2025.

Box 4: Recharacterized Contributions

Report any recharacterized contributions transferred between different types of IRAs, along with any associated earnings or losses.

Box 5: FMV of Account

Report the Fair Market Value of the IRA as of December 31, 2025. If the account holder has died, this may reflect the value as of the date of death. If the FMV is shown as $0, the estate’s executor or administrator can request the correct date-of-death value from the financial institution.

Box 6: Life insurance cost included in Box 1

Report the portion of Box 1 contributions used for life insurance within the account.

Box 7: Checkboxes

Check one of the following:

- IRA: Check this box if you're reporting information for a Traditional IRA.

- SEP: Check this box if reporting for a SEP IRA.

- SIMPLE: Use this box if reporting for a SIMPLE IRA.

- Do not use Form 5498 for SIMPLE 401(k) plans.

- Roth IRA: Check this box when reporting a Roth IRA.

- Roth SEP IRA: Check both "SEP" and "Roth IRA" for a Roth SEP IRA.

- Roth SIMPLE IRA: Check both "SIMPLE" and "Roth IRA" for a Roth SIMPLE IRA.

If unsure of the type, default to “IRA.”

Box 8: SEP Contributions

Report employer contributions made under a SEP plan in 2025, including late contributions for 2024. Do not include contributions made in 2026 for the 2025 tax year.

Report only contributions made under a valid SEP arrangement. If employer contributions exceed the SEP formula or aren't part of a SEP plan, report them in Box 1 instead.

Also include self-employed SEP contributions and Roth SEP IRA contributions in Box 8.

Box 9: SIMPLE Contributions

Enter employer contributions, including salary deferrals, made to a SIMPLE IRA in 2025—this includes contributions for 2024 made during 2025, but not made in 2026 for 2025.

Box 10: Roth IRA Contributions

Report Roth IRA contributions (rollovers from a Qualified Tuition Program) made during 2026 for the 2025 tax year (up to April 15, 2026).

Box 11: Check if RMD for 2026

Check this box if the participant is required to take a Required Minimum Distribution (RMD) for 2026. You must check the box for the year the participant turns 73, even though the first RMD can be delayed until April 1 of the following year.

Box 12a& 12b: RMD Info

- 12a: Enter the RMD start date for the RMD amount contributed

- 12b: Enter the RMD amount, if you’re reporting additional information under alternative one.

Boxes 13a–13c: Postponed/Late Contributions

- 13a: Report any postponed contributions made in 2025 for a prior tax year, such as contributions allowed due to military service or federally declared disasters. Also report late rollover contributions made in 2025, including:

- Rollovers certified by the participant

- Qualified plan loan offsets

- Disaster-related rollovers

This amount is not included in Box 1 or Box 2.

- 13b: Enter the applicable tax year for the contribution which is in Box 13a.

- 13c: Use the correct code, in which the contribution made in Box 13a

- The code such as:

- FD (federally declared disaster)

- SC (self-certified late rollover)

- PO (qualified plan loan offset rollover)

Boxes 14a & 14b: Repayments

- 14a: Report repayments related to birth/adoption, qualified disaster, emergency expenses, or abuse/domestic violence

- 14b: Use the correct repayment code which is given below:

- BA (birth/adoption),

- EP (emergency expenses),

- DA (domestic abuse),

- TI (terminal illness),

- QR (qualified reservist)

Boxes 15a & 15b: Specified Assets

- 15a: Report FMV of specified non-publicly traded assets

- 15b: Enter the appropriate codes in which value is entered in Box 15a.:

- A (private stock), B (private debt), D (real estate), E (partnership interest), G (other), H (more than two assets listed A through G) are held in IRA.

Simplify your Form 5498 filing with TaxZerone

With TaxZerone you can e-file Form 5498 easily in 3 simple steps:

Step 1: Log in to your TaxZerone Free Account

Step 2: Choose tax Form 5498 and enter the details of Trustee, participant and IRA information

Step 3: Review and transmit it to the IRS and send participant copies through ZeroneVault or postal mailing.