Form 5498-ESA Instructions

Follow our step-by-step instructions to file accurately with IRS

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 5498-ESA Coverdell ESA Contribution Information is an IRS form used to report contributions to a Coverdell Education Savings Account (ESA). This resource page provides an overview, filing requirements, deadlines, and step-by-step instructions for completing and submitting Form 5498-ESA.

Table of Contents

What is Form 5498-ESA?

Form 5498-ESA is used by trustees or custodians to report contributions-including rollover contributions to any Coverdell ESA for a beneficiary during the tax year. The form provides the IRS and the beneficiary with information about annual contributions, rollovers, and the account’s identifying details

Simplify your 5498-ESA filing for Coverdell ESA contributions and fair market values.

E-file Form 5498-ESA with TaxZerone for fast, accurate education savings account reporting today.

Who must file Form 5498-ESA?

Trustees or issuers must file 5498-ESA Form to report Coverdell Education Savings Account (ESA) such as a bank or financial institution that holds the account. This form has two copies: Copy A must be submitted to the IRS and Copy B should be issued to the beneficiary.

Important dates for filing 5498-ESA

Staying on top of Form 5498-esa deadlines is essential for accurate and timely reporting of Coverdell ESA contributions.

| Form 5498-ESA | Deadlines |

|---|---|

| Send Beneficiary copy | April 30, 2026 |

| IRS E-filing | June 01, 2026 |

| Paper filing | June 01, 2026 |

⏰ Need More Time to File Form 5498-ESA?

No worries! Get a 30-day extension with Form 8809 to avoid penalties and file stress-free.

Information Required to file Form 5498-ESA

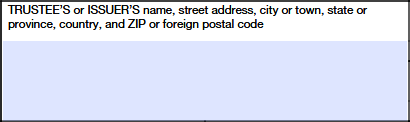

- Trustee’s name, address, and TIN

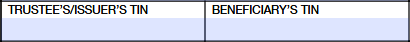

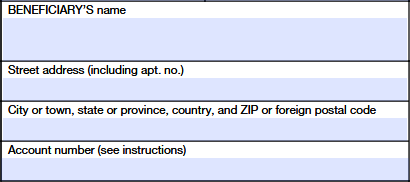

- Beneficiary’s legal name, address, account number, and TIN

- Total contributions made for the tax year (including those made by the April 15 deadline for the prior year)

- Rollover contributions, if any

- Account number (if multiple accounts for one beneficiary)

Instructions to file Form 5498-ESA

Read the step-by-step instructions to ensure a smooth filing with the IRS.

Enter the Trustee’s or Issuer’s legal name, address including City, State, country and ZIP code.

Enter the trustee’s or Issuer’s and Beneficiary’s TIN (Taxpayer Identification Number) in the appropriate field.

Enter the Beneficiary's legal name, address including apartment number, city, state, country, ZIP code and account number the trustee/issuer given to distinguish the account.

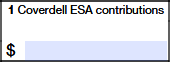

Line 1: Coverdell ESA Contributions

Enter the Coverdell Education Savings Account (ESA) contributions made by beneficiary for the year 2025 and through April 15, 2026. For the tax year 2025, total contributions made to the beneficiary’s Coverdell Education Savings Account exceeded $2,000, the excess amount along with earnings must withdraw by June 01, 2026 to avoid penalties.

Line 2: Rollover contributions

Enter the rollover contributions made by beneficiary in the year 2025 including direct rollovers and contributions of a military death gratuity. The amount which is rolled over from one to another Coverdell ESA of the same beneficiary or a family member under age 30 (excluding beneficiaries with special needs) are not taxable.

Simplify your Form 5498-ESA filing with TaxZerone

With TaxZerone, you can easily e-file Form 5498-ESA in just 3 steps:

Step 1: Log in to your TaxZerone Free Account

Step 2: Choose “Form 5498-ESA” and enter the details of Trustee, participant and IRA information.

Step 3: Review and transmit it to the IRS and send participant copies through ZeroneVault or postal mail.