Form 941 Instructions

E-file your IRS Form 941 for the 2025 tax year with these easy instructions.

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 941, Employer’s Quarterly Federal Tax Return is used by employers to report the taxes withheld from employee wages such as federal income tax, social security tax and Medicare tax.

What's New for 2025

The IRS has introduced key updates for Form 941 in 2025, impacting wages, thresholds, and electronic filing.

- Social Security Tax: 6.2% for both employee and employer; wage base limit is $176,100.

- Medicare Tax: 1.45% for both, no wage base limit (same as 2024).

- Household Workers: Taxes apply if you pay $2,800 or more in cash wages.

- Election Workers: Taxes apply if paid $2,400 or more in cash or an equivalent.

- Electronic filing option: Form 941-X can now be filed electronically.

E-filing Form 941 is faster, safer, and IRS-recommended.

File with TaxZerone and receive instant IRS status updates—accurate and secure.

Who must file Form 941?

Form 941 is filed quarterly by most businesses that pay wages to employees and withhold taxes such as federal income tax, Social Security tax, and Medicare tax. You can efile IRS Form 941 online for a faster and more accurate submission.

Exceptions

- Employers who received notification from IRS to file Form 944 instead of quarterly 2025 form 941

- Seasonal employers are not needed to file Form 941 for the quarter if the wages are not paid.

- Employers of household employees should file schedule H of Form 1040 instead of 941 form.

- Employers of farm employees should file Form 943 instead of tax form 941 for wages paid for agricultural labor.

When are Form 941 due?

The deadline for filing Form 941 is typically the last day of the month that follows the end of the calendar quarter.

| Quarter | Quarter Includes | Deadline |

|---|---|---|

| Q1 | January, February, March | April 30 |

| Q2 | April, May, June | July 31 |

| Q3 | July, August, September | October 31 |

| Q4 | October, November, December | January 31 |

How to File IRS Form 941: Required Information

- Business Details - Legal name, EIN, and business address.

- Employee Details - Number of employees and total taxable wages paid during the quarter.

- Taxes -

- Federal income tax withheld from employee wages

- Social Security and Medicare taxes

- Taxable Social Security and Medicare wages and tips

- Any Additional Medicare tax withheld (if applicable)

- Deposits - Any federal tax deposits made during the quarter toward your payroll tax liability.

- Schedule B (Form 941) - Required only if you're a semiweekly schedule depositor or if you accumulate $100,000 or more in tax liability on any day in the quarter. Use this form to report daily tax liabilities.

Instructions for Form 941

Follow these instructions to file accurately with the IRS.

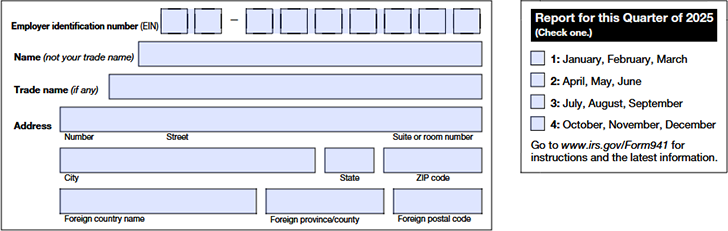

Enter the Employer Identification Number (EIN), legal name of the employer, Business name, complete address including street name, city, state, and Zip code.

On the right side of the form, check the appropriate box such as Quarter 1 or Quarter 2 or Quarter 3 or Quarter 4 for the quarter you are filing.

Part 1: Quarter Details

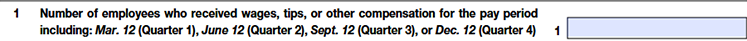

Line 1

Enter the number of employees who received wages, tips or other compensation during a specific pay period - March 12 (Quarter 1), June 12 (Quarter 2), September 12 (Quarter 3), or December 12 (Quarter 4).

Don't include these employees:

- Household employees

- Employees in non-pay status for the pay period

- Farm employees

- Pensioners

- Active members of the U.S. Armed Forces.

Line 2

Enter the wages, tips and other compensation paid during the quarter. This includes

- Sick pay paid by your agent

- Sick pay paid by third party that is not your agent (e.g.: insurance company) if you were notified on time that the payments were made

- The third party has transferred the liability for paying the employer’s taxes (like Social Security and Medicare) to you.

Line 3

Enter the federal income tax withheld from employees on this quarter's wages, tips, and other compensation benefits. Enter the federal income tax withheld or required to withhold by a third-party payer of sick pay.

Line 4

Check the box on line 4, if wages, tips, and other compensation are not subject to Social Security or Medicare tax and proceed with line 6. If this question does not apply to you, leave the box blank.

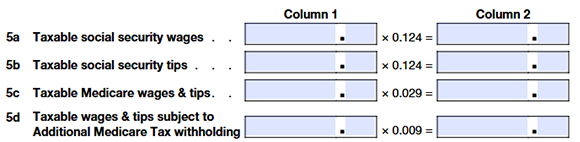

Line 5a: Taxable Social Security Wages

- In Column 1, enter the total amount of employee wages that are subject to Social Security tax and multiply that number by 0.124 to get the tax. Enter the result in Column 2.

- Employers should stop collecting social security tax once an employee attains a taxable wage and tips of $176,100. Income and Medicare taxes must still be withheld on all wages and tips.

Line 5b: Taxable Social Security Tips

In column 1, enter the total tips your employees reported that are subject to Social Security tax and multiply that number by 0.124. Enter the result in Column 2.

Line 5c: Taxable Medicare Wages and Tips

In column 1, enter the total wages, tips, sick pay, and taxable fringe benefits subject to Medicare tax and multiply the total by 0.029. Enter the result in Column 2.

Line 5d: Wages & Tips subject to Additional Medicare Tax

- Enter all wages, tips, sick pay, and taxable fringe benefits that are subject to Additional Medicare Tax withholding. Employers are required to withhold additional Medicare tax for employees who earned more than $200,000.

- In column 1, enter the amount over $200,000 that is subject to the Additional Medicare Tax and multiply by 0.009 (0.9%). Enter the result in Column 2.

Line 5e: Total Social Security and Medicare Taxes

Add all amounts in Column 2 from lines 5a through 5d and enter the result on line 5e.

Line 5f: Section 3121(q) Notice and Demand - Tax Due on Unreported Tips

- Enter the amount of tax due from unreported tips on line 5f.

- Section 3121(q) Notice and Demand is issued by the IRS to inform an employer about the amount of tips that employees have either failed to report or have underreported.

Line 6: Total Taxes Before Adjustments

To calculate the total taxes before adjustments, add the amount entered in

- Total federal income tax withheld from wages, tips, and other compensation (line 3)

- Total social security and Medicare taxes (line 5e)

- Tax due under Section 3121(q) Notice and Demand (line 5f)

Enter the result on line 6.

Line 7: Current quarter's adjustment for fractions of cents.

Enter any adjustments for fractions of cents (due to rounding) that occur when calculating Social Security and Medicare taxes in column 2 of lines 5a–5d.

Line 8: Current quarter's adjustment for sick pay

- If your third-party payer of sick pay (not an agent) has withheld and deposited the employee share of social security and Medicare taxes and transfers the employer tax share to you, enter a negative adjustment on line 8.

- If you are the third-party sick pay payer and transfers employers tax share to the employer, then enter a negative adjustment on line 8

- No need to adjust on line 8 if the sick pay is paid by third party (employers' agent)

- Include the sick pay on line 5a, line 5c, and line 5d if the withholding threshold is met.

Line 9: Current quarter's adjustments for tips and group-term life insurance.

Enter a negative adjustment for any uncollected employee share of social security and Medicare taxes on tips and group-term life insurance premiums paid for former employees.

Line 10: Total Taxes After Adjustments

Add the amounts on line 6 through 9 and enter the result.

Line 11: Qualified Small Business Payroll Tax Credit for Increasing Research Activities

Enter the amount of the credit from Form 8974, line 12. If applicable enter line 17. Attach Form 8974 to this return.

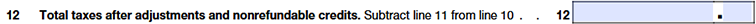

Line 12: Total Taxes After Adjustments and Nonrefundable Credits

Subtract line 11 from line 10 and enter the result on line 12 which cannot be less than zero.

1. If Line 12 or last quarter’s Line 12 is less than $2,500, and you didn’t have a $100,000 next-day deposit obligation.

You can pay the amount with Form 941, or you may deposit separately. You must pay on time to avoid penalties.

2. If line 12 or last quarter’s Line 12 is $2,500 or more and you incurred a $100,000 next-day deposit obligation.

You must deposit your taxes according to your deposit schedule (monthly or semiweekly). The amount on Line 12 must match the “Total liability for the quarter” on Line 16 or Schedule B (Form 941).

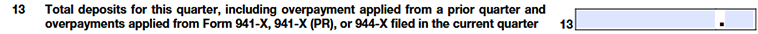

Line 13: Total Deposits for This Quarter

Enter total deposits you made for this quarter, including any overpayment from a previous quarter that you decided to apply to this return (instead of getting a refund). Also include any overpayment that you applied for from filing Form 941-X, 941-X (PR), or 944-X in the current quarter.

Line 14: Balance Due

The amount entered on line 12 is more than line 13, enter the difference on line 14.

Line 15: Overpayment

If line 13 is greater than line 12, enter the difference on line 15. If you made over payment, you can either get a refund from the IRS or apply it to your next return.

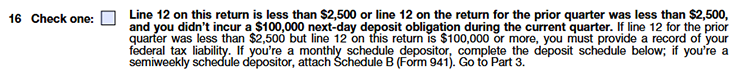

Part 2: Deposit Schedule and Tax Liability for this Quarter

Line 16:

For this current quarter or previous quarter, Line 12 is less than $2,500 and you didn’t owe $100,000 next-day deposit obligation during the quarter. check the first box on line 16 and go to Part 3.

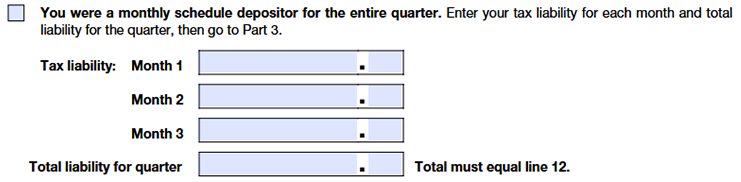

Check the second box on line 16, if you are a monthly schedule depositor. Enter the tax liability for each month. Add the amounts for each month and enter the result in the “Total liability for quarter” box which should be equal to amount entered on line 12.

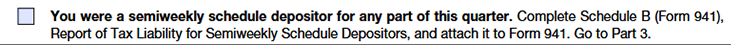

Check the third box on line 16, if you are a semiweekly depositor for any quarter. Submit Schedule B with your form 941 2025 and go to part 3.

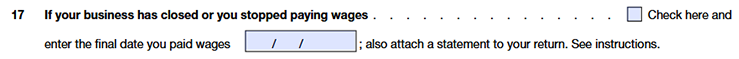

Part 3: About Business

Check the box on line 17 if your business has closed or stopped paying wages. Enter the last date wages were paid.

Additionally, attach a Final Payroll Statement that includes all relevant payroll details, such as the name of the person responsible for maintaining payroll records and the address where the records will be stored. This statement is crucial for ensuring proper documentation of your final payroll.

During e-filing, additional details will be collected to ensure compliance and accurate processing of your return.

Check the box on line 18, if you are an employer who hires employees seasonally and doesn’t file every quarter with the IRS.

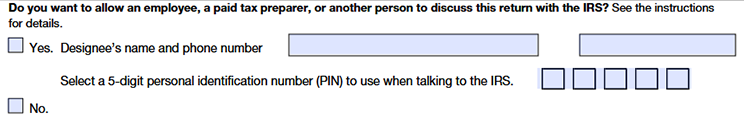

Part 4: Third-Party Designee

- Select the “Yes” box if an employer allows an employee or tax preparer to discuss IRS Form 941 return with the IRS. You must provide the designee’s name, phone number, and a 5-digit personal identification number (PIN) for security when talking to the IRS.

- Select the “No” box, if only you can discuss the return with the IRS.

Part 5: Signature and Authorization

Choose one of the following signature options:

- Form 8453-EMP Signature Document

Enter the signatory details and e-sign on Form 8453-EMP - (OR)

- 94x Online Signature PIN

Enter the name, title of signer and 10-digit signature PIN provided by the IRS to authenticate you as an authorized signer.

TaxZerone supports easily allowing e-signatures, ensuring a seamless process for your filing.

E-file Form 941 with TaxZerone

E-File IRS Form 941 easily with TaxZerone starting at just $6.99/return.You will only have to enter the required information,

pay and sign Form 941, and transmit the return to the IRS.

The filing process gets completed in less than 5 minutes!

You will also get email updates on your return status as soon as the IRS processes it.