Form 941 Mailing Address

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 941, the Employer's Quarterly Federal Tax Return, is used by U.S. employers to report income taxes, Social Security tax, and Medicare tax withheld from employees' wages. This form is filed quarterly with the IRS to help businesses remain current with their payroll tax responsibilities.

Employers are required to file this form each quarter, even if no employees are working during a particular period, if the business is still operational. The form reports wages paid, tax amounts withheld, and any adjustments made throughout the quarter.

E-Filing for Faster and More Secure Processing

Want quicker processing? Switch to e-filing with TaxZerone and avoid delays. File Form 941 electronically today - starting at just $6.99!

Where to mail your Form 941?

You can file Form 941 by paper return; the mailing address depends on whether you are including a payment and the state where your business is located.

However, the IRS recommends that you e-file Form 941 instead of mailing — it’s faster, safer, and reduces processing errors. With TaxZerone, you can e-file Form 941 from anywhere, without dealing with paperwork or long wait times.

Mailing Addresses for Form 941

| If you live in one of the following states: | Mail the return without including payment | Mail the return along with payment |

|---|---|---|

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 | Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

| No legal residence or principal place of business in any state, including employers in American Samoa, Guam, the CNMI, the USVI, and Puerto Rico | Internal Revenue Service PO Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

| Special filing address for exempt organizations; governmental entities; and Indian tribal governmental entities; regardless of location | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

If you pay by check or money order,

- Make it payable to 'United States Treasury.'

- Include your EIN, Form 941, and the tax period (e.g., '1st Quarter 2025,' '2nd Quarter 2025,' '3rd Quarter 2025,' or '4th Quarter 2025') on the check or money order.

- Complete Form 941-V and enclose it with Form 941.

When Is Form 941 Due?

Form 941 must be filed quarterly. Here are the deadlines:

- 1st Quarter Jan – Mar : Due by April 30

- 2nd Quarter Apr – Jun : Due by July 31

- 3rd Quarter Jul – Sep : Due by October 31

- 4th Quarter Oct – Dec : Due by January 31

It's important to meet these deadlines to avoid penalties and interest charges from the IRS.

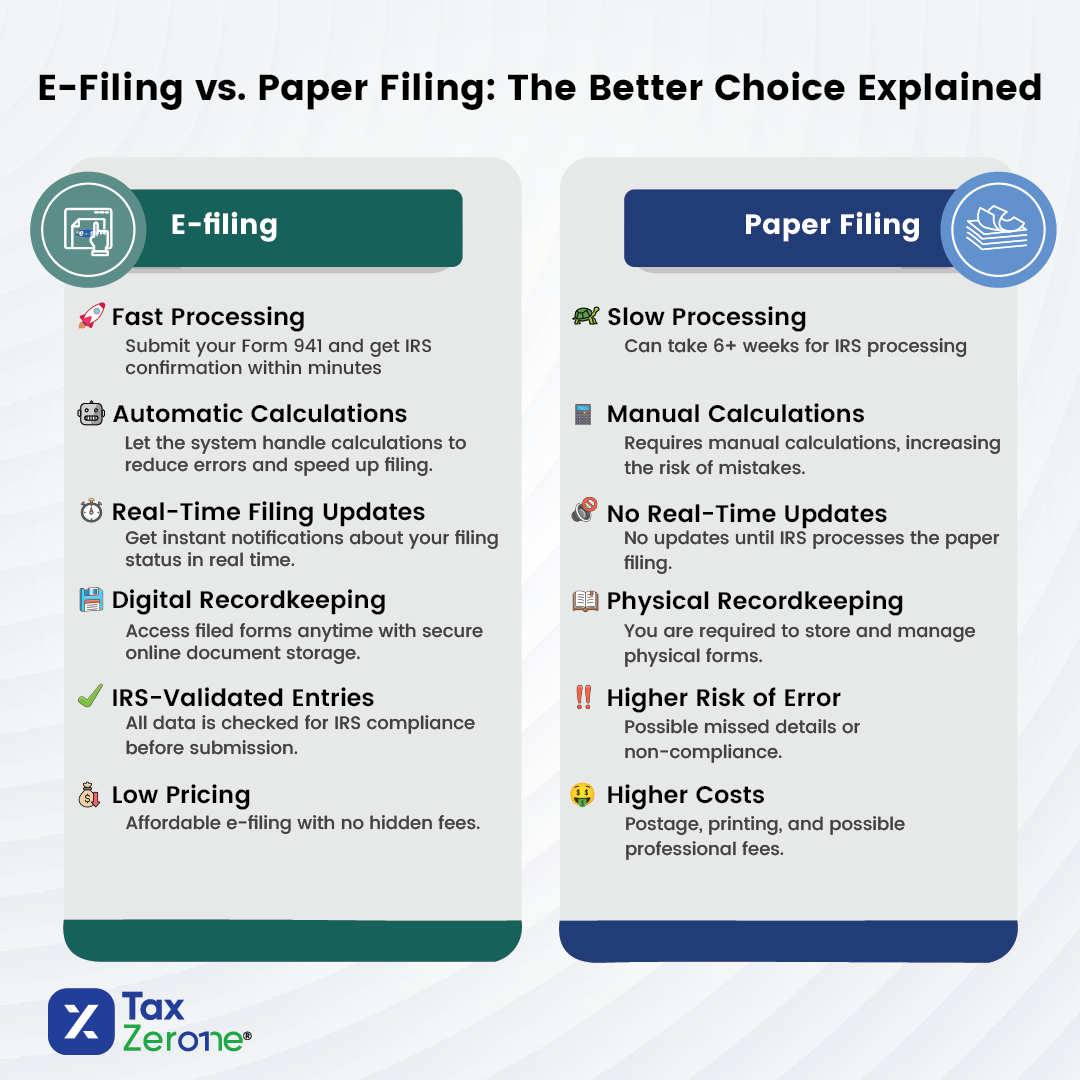

Why E-Filing is Better Than Paper Filing

E-filing offers several advantages over paper filing, making it a more efficient option for employers.

E-File Your Form 941 with Ease Using TaxZerone

E-file your IRS Form 941 through TaxZerone—quick, secure, and affordable for businesses filing single or multiple forms. Need to make corrections? TaxZerone also supports Form 941-X, helping you fix previously filed returns with ease. Starting at just $6.99, our IRS-authorized platform is built for accuracy and efficiency, making your quarterly federal tax filing process smooth and reliable every time.

Ready to Simplify Your Quarterly Tax Filing?

Join thousands of businesses using TaxZerone for Form 941 e-filing. Create your account today

and experience the easiest way to manage your employment tax obligations.