Form 990-T Schedule A Instructions

Excise Tax Forms

Employment Tax Forms

Information Returns

Extension Forms

Business Tax Forms

FinCEN BOIR

General

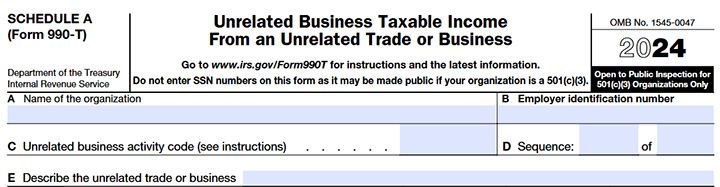

Items A Through E

Item A - Name of the organization

Enter here the same name as entered in the heading area of Form 990-T.

Item B - Employer Identification number

Enter in the line the same EIN as entered in item D of Form 990-T.

Item C - Unrelated business activity code

For each Schedule A, enter a 6-digit business activity code that best describes the unrelated trade or business. If using a 2-digit NAICS code, add four zeros after it. For example, for retail trade (code 45), enter “450000”.

Item E - Describe the unrelated trade or business conducted by the organization.

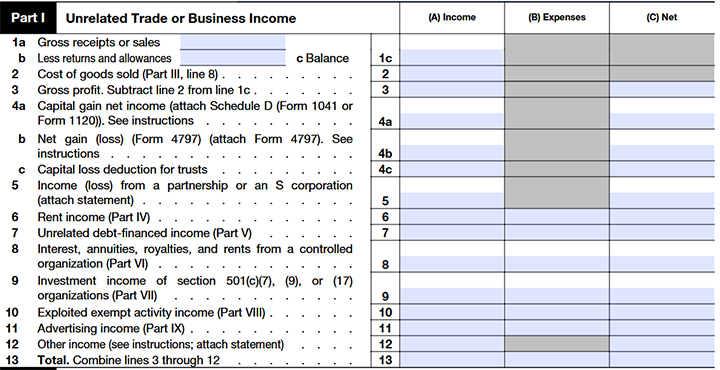

Part I - Unrelated Trade or Business Income

Line 1a - Gross receipts or sales

Enter the gross receipts from an unrelated trade or business regularly conducted that involves the sale of goods or performance of services.

Line 1b - Enter the less returns and allowances on this line.

Line 2 - Enter the cost of goods sold (Part III, line 8) on this line.

Line 3 - Gross profit.

Subtract line 2 from line 1c and enter the difference value here

Line 4a - Most organizations filing Form 990-T don’t pay tax on capital gains from selling property. However, tax applies to:

- Gains from debt-financed property

- Timber sales

- Ordinary gains from certain property (like Sections 1245, 1250, etc.)

S corporation gains/losses are taxable and must be reported on Form 990-T, Part I, line 4.

Capital gains/losses must also be reported using:

- Schedule D (Form 1041) for trusts

- Timber sales

- Schedule D (Form 1120) and Form 8949 for corporations

These forms must be attached to Form 990-T when filing.

Line 4b - Report gains or losses from non-capital assets on Form 4797. Enter the net gain or loss from Part II, line 17.

If the exempt organization is reporting ordinary gains on certain types of property (like sections 1245, 1250, etc.), only include depreciation or similar deductions that were used to calculate taxable income during the period the organization was not tax-exempt.

Line 4c - If a trust has a net capital loss, it is subject to the limitations of Schedule D (Form 1041). Enter on this line the loss figured on Schedule D (Form 1041).

Line 5 - Income or (Loss) From a Partnership or an S Corporation

Some partnerships allow income and related deductions to be grouped together, as explained in Regulations section 1.512(a)-6.

Also, trusts and certain corporations may face limits on how much income or loss they can claim from partnerships or S corporations due to passive activity loss (PAL) rules (section 469) and at-risk rules (section 465). For more details, check the explanation under Part I of the instructions on Unrelated Trade or Business Income.

Line 6 - Rent income

Enter the amount computed on Part IV, line 3, on Part I, line 6, column (A)

Enter the amount computed on Part IV, line 5, on Part I, line 6, column (B).

Line 7 - Unrelated Debt-Financed Income

Enter the amount computed on Part V, line 8, on Part I, line 7, column (A)

Enter the amount computed on Part V, line 10, on Part I, line 7, column (B).

Line 8 - Interest, Annuities, Royalties, and Rents From a Controlled Organization

Enter the sum of columns 5 and 10 from Part VI on Part I, line 8, column (A)

Enter the sum of columns 6 and 11 from Part VI on Part I, line 8, column (B).

Line 9 - Investment Income of a Section 501(c)(7), (9), or (17) Organization

Enter the sum of amounts from Part VII, column 2, on Part I, line 9, column (A).

Enter the sum of amounts in Part VII, column 5, on Part I, line 9, column (B).

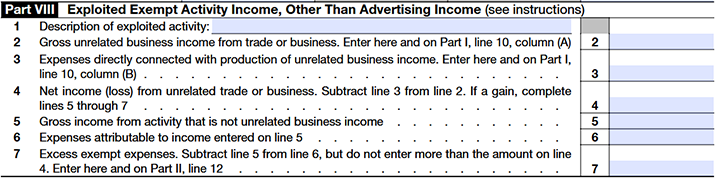

Line 10 - Exploited Exempt Activity Income, Other Than Advertising Income

Enter the amount computed on Part VIII, line 2, on Part I, line 10, column (A).

Enter the amount computed on Part VIII, line 3, on Part I, line 10, column (B).

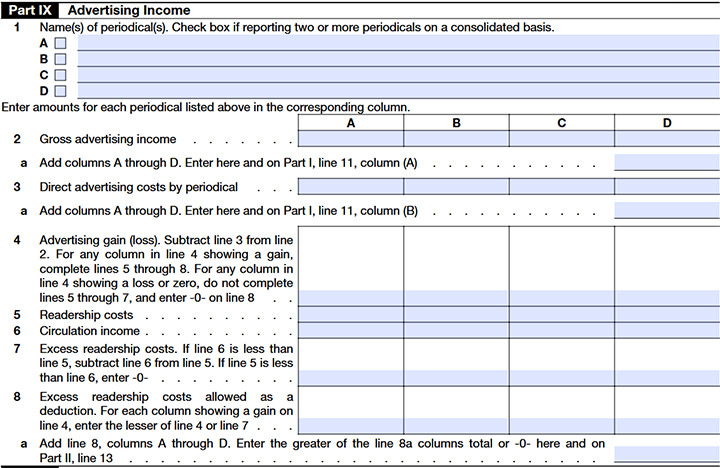

Line 11 - Advertising Income

Enter the amount computed on Part IX, line 2, on Part I, line 11, column (A). Enter the amount computed on Part IX, line 3, on Part I, line 11, column (B).

Line 12 - Other Income

Enter on Part I, line 12, any item of unrelated business income from a particular trade or business that isn't reportable elsewhere on the return.

Attach a statement describing the sources of the other income and their amounts. Such amounts may include:

- Recoveries of bad debts deducted in earlier years under the specific charge-off method;

- The amount from Form 6478, Biofuel Producer Credit (if applicable);

- The amount from Form 8864, Biodiesel, Renewable Diesel, or Sustainable Aviation Fuels Credit (if applicable); and

- Proceeds received from employer-owned life insurance contracts issued after August 17, 2006 (complete and attach Form 8925).

Line 13 - Total Unrelated Trade or Business Income

Use the amount from Schedule A, Part I, line 13, column (C), in the computation of UBTI in Part II.

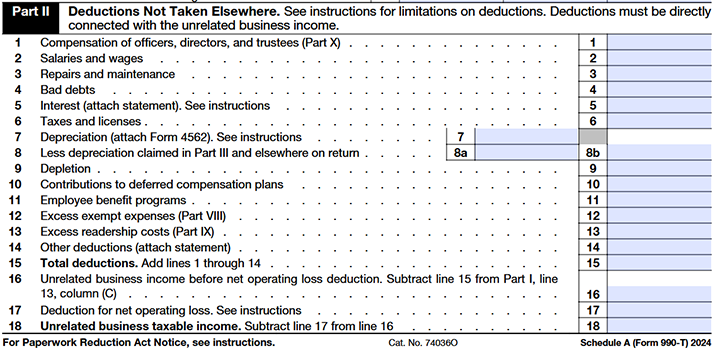

Part II - Deductions Not Taken Elsewhere

If the aggregate sum of the amounts on all Schedules A (Form 990-T), Part I, line 13, column (A), is $10,000 or less, you don't have to complete Schedule A, Part II, lines 1 through 14. However, you must complete the remainder of Schedule A, Part II and include the larger of each total from Schedule A, Part II, line 18, or zero, in the computation of the amount reported on Part I, line 1, of Form 990-T.

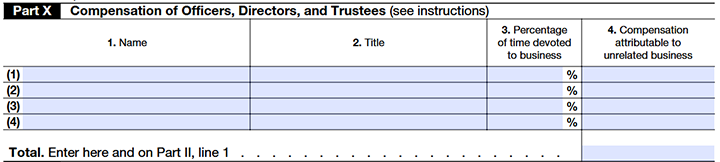

Line 1 - Enter the details of the compensation provided to officers, directors, and trustees.

Line 2 - Enter here the salaries and wages provided for the tax year.

Line 3 - Repairs and maintenance

Enter the cost of incidental repairs and maintenance not claimed elsewhere on the return, such as labor and supplies, that don't add to the value or appreciably prolong the life of the property.

Line 4 - Bad debts

Enter the total receivables from an unrelated trade or business that were previously included in taxable income and that became worthless in whole or in part during the tax year.

Line 5 - Interest

Attach a separate statement listing the interest being claimed on this line.

Interest allocation - If the proceeds of a loan were used for more than one purpose (for example, to purchase a portfolio investment and to acquire an interest in a passive activity), an interest allocation must be made. See Temporary Regulations section 1.163-8T for the interest allocation rules.

Tax-exempt interest - Don't include interest on indebtedness incurred or continued to purchase or carry obligations on which the interest income is totally exempt from income tax. For exceptions, see section 265(b).

Prepaid interest - Generally, a cash basis taxpayer can’t deduct prepaid interest allocable to years following the current tax year, for example, during the tax year a cash basis taxpayer prepaid interest on a loan. The taxpayer can deduct only that part of the prepaid interest that was for the use of the loaned funds during the tax year, not for the use of the loaned funds during the subsequent years.

Straddle interest - Generally, the interest and carrying charges on straddles can’t be deducted and must be capitalized. See section 263(g).

Original issue discount - See section 163(e)(5) for special rules for the disqualified portion of original issue discount on a high-yield discount obligation.

Interest on certain underpayments of tax - Don't deduct interest paid or incurred on any portion of an underpayment of tax that is attributable to an understatement arising from an undisclosed listed transaction or an undisclosed reportable avoidance transaction (other than a listed transaction) entered into in tax years beginning after October 22, 2004.

Interest allocable to the production of designated property - Don't deduct interest on debt allocable to the production of designated property. Interest that is allocable to such property produced by an organization for its own use or for sale must be capitalized. An organization must also capitalize any interest on debt allocable to an asset used to produce the earlier property. See section 263A(f) and Regulations sections 1.263A-8 through 1.263A-15.

Interest on below-market loans - See section 7872 for special rules regarding the deductibility of foregone interest on certain below-market-rate loans.

Line 6 - Taxes and licenses

Enter taxes and license fees paid or accrued during the year, but don't include the following taxes.

- Federal income taxes.

- Foreign or U.S. territory income taxes if a foreign tax credit is claimed.

- Taxes not imposed on your organization.

- Taxes, including state or local sales taxes, paid or incurred in connection with an acquisition or disposition of property. These taxes must be treated as part of the cost of the acquired property or, in the case of a disposition, as a reduction in the amount realized on the disposition.

- Taxes assessed against local benefits that increase the value of the property assessed (such as for paving, etc.).

- Taxes deducted elsewhere on the return, such as those reflected in cost of goods sold.

Line 7 - Depreciation

Besides regular depreciation, include on line 7 any Section 179 expenses for certain property the organization placed in service this year or carried over from last year. See Form 4562 for details.

Line 8 - Enter here the less depreciation claimed in Part III and elsewhere on return.

Line 9 - Depletion

Check sections 613 and 613A for percentage depletion rates for natural deposits. Attach Form T (Timber), Forest Activities Schedules, if a deduction is taken for depletion of timber.

Line 10 - Contributions to deferred compensation plans

Employers who maintain pension, profit-sharing, or other funded deferred compensation plans are generally required to file Form 5500. This requirement applies whether or not the plan is qualified under the Code and whether or not a deduction is claimed for the current tax year.

Section 6652(e) imposes a penalty for late filing of these forms. In addition, there is a penalty for overstating the pension plan deduction. See section 6662(f).

Line 11 - Employee benefit programs

Enter the amount of contributions to employee benefit programs (such as insurance, health, and welfare programs) that aren't an incidental part of a deferred compensation plan included on Schedule A, Part II, line 10.

Line 12 - Excess Exempt Expenses

Enter the amount computed on Part VIII, line 7 (if applicable), on Part II, line 12.

Line 13 - Excess Readership Costs

Enter the amount computed on Part IX, line 8a (if applicable), on Part II, line 13.

Line 14 - Other Deductions

Enter on this line the deduction taken for amortization (see Form 4562) as well as other authorized deductions for which no space is provided on the return. Attach a statement listing the deductions claimed on this line. On each Schedule A, deduct only items directly connected with the unrelated trade or business for which income is reported on that Schedule A.

Extraterritorial income exclusion. Complete Form 8873 and include the deduction from line 52 in other deductions reported on Part II, line 14.

Don't deduct fines or penalties paid to a government for violating any law. The exclusion was repealed generally for transactions after 2004, with some exceptions. See Form 8873 and its instructions.

Line 15 - Total deductions

Add lines 1 through 14 and enter the sum value in this line.

Line 16 - Unrelated business income before net operating loss deduction.

Subtract line 15 from Part I, line 13, column (C) and enter the difference in this line.

Line 17 - Deduction for net operating loss

If your organization has a Net Operating Loss (NOL) carryover from a previous year for a specific unrelated business, enter it on Schedule A, Part II, line 17—but only up to the amount of income reported on line 16 for that business.

Even if you weren’t required to file Form 990-T in earlier years, you can still claim the carryover—just include a statement showing how it was calculated. If that business was closed, sold, or otherwise ended, any remaining NOL is suspended but may be used later if the same business resumes or a new one with the same NAICS code starts.

Line 18 - Unrelated business taxable income.

Subtract line 17 from line 16 and enter the difference in this line.

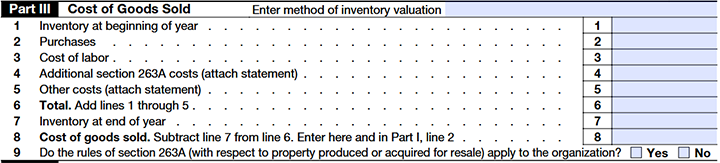

Part III - Cost of Goods Sold

Line 1 - Inventory at beginning of year

If the organization changes its accounting method to stop tracking inventories, it must recalculate last year’s closing inventory using the new method and enter that on line 1. If the new amount is different, explain why and include the difference in the section 481(a) adjustment.

Line 2 - Purchases

Enter the Purchases value in this line.

Line 3 - Cost of labor

Enter in this line the cost of labor made by the organization

Line 4 - Additional section 263A costs

Enter the total of these additional costs on Schedule A, Part III, line 4, but only if they’re not already included on lines 2 or 3.

Only fill out this line if your organization uses the simplified accounting method.

- If you use the simplified production method, report costs that now need to be capitalized under section 263A but weren’t before.

- If you use the simplified resale method, report costs related to

- Off-site storage

- Purchasing

- Handling (like repackaging or transporting)

- Certain admin costs (mixed service costs)

Line 5 - Other costs

Enter here any costs paid or incurred during the tax year not entered on Schedule A, Part III, lines 2 through 4. Attach a statement describing the other costs.

Line 6 - Add lines 1 through 5 and enter the sum value in this line.

Line 7 - Inventory at end of year

If your organization treats inventory like non-incidental materials and supplies, report here the cost of raw materials and merchandise bought for resale (from line 6) that weren’t sold during the year.

Also, for calculating extra costs under section 263A that should be included in ending inventory, refer to Regulations sections 1.263A-1 through 1.263A-3.

Line 8 - Cost of goods sold.

Subtract line 7 from line 6 and enter the difference value here and in Part I, line 2.

Line 9 - Select “Yes” or “No” whether the rules of section 263A (with respect to property produced or acquired for resale) apply to the organization?

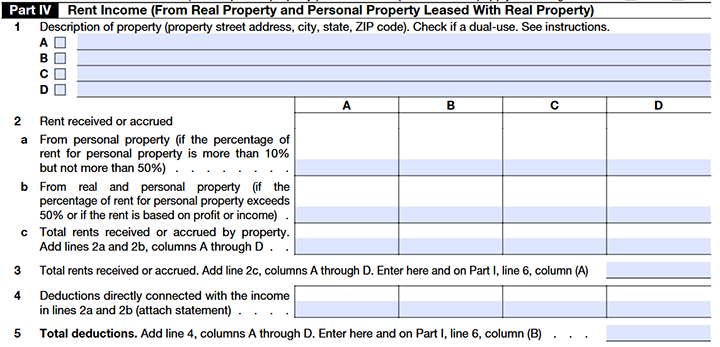

Part IV - Rent Income (From Real Property and Personal Property Leased With Real Property)

All organizations that have applicable rent income, other than section 501(c)(7), (9), and (17) organizations, should complete Schedule A, Part IV.

For organizations other than section 501(c)(7), (9), and (17) organizations, only the following rents are taxable on Schedule A, Part I, line 6.

- Rents from personal property leased with real property, if the rents from the personal property are more than 10% of the total rents received or accrued under the lease, determined at the time the personal property is placed in service.

- Rents from real and personal property if:

- More than 50% of the total rents received or accrued under the lease are for personal property, or

- The amount of the rent depends on the income or profits derived by any person from the property leased (except an amount based on a fixed percentage of receipts or sales).

Line 1 - Check the box next to the property description if the property is used both to carry on exempt activities and to conduct unrelated trade or business activities. Provide description of property (property street address, city, state, ZIP code).

Line 2a - Enter the rent received or accrued from personal property (if the percentage of rent for personal property is more than 10% but not more than 50%)

Line 2b - Enter the rent received or accrued from real and personal property (if the percentage of rent for personal property exceeds 50% or if the rent is based on profit or income)

Line 2c - Add total rents received or accrued by property. Add lines 2a and 2b, columns A through D .

Line 3 - Enter here the total rents received or accrued. Add line 2c, columns A through D. Enter the sum value here and on Part I, line 6, column (A)

Line 4 - For each property, attach a statement describing the directly connected deductions and their amounts.

Line 5 - Total deductions

Add line 4, columns A through D and enter the sum value here and on Part I, line 6, column (B).

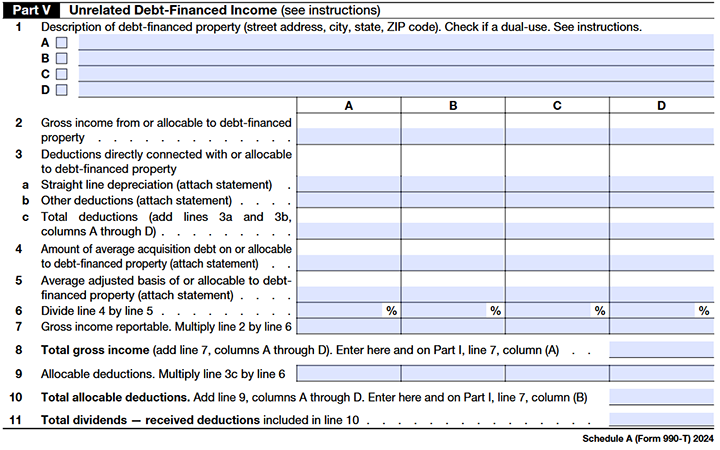

Part V - Unrelated Debt-Financed Income

Use Schedule A, Part V, to compute unrelated debt-financed income described in sections 512(b)(4) and 514 from debt-financed property only to the extent that the income doesn’t constitute income from the conduct of an unrelated trade or business and isn't specifically taxable under other provisions of the Code, such as taxable rents from personal property leased with real property reportable on Schedule A, Part IV (and Schedule A, Part I, line 6), or taxable interest, annuities, royalties, and rents from a controlled entity reportable on Schedule A, Part VI (and Schedule A, Part I, line 8).

Line 1 - Enter the address of the debt-financed property. If the debt-financed property isn’t real property, enter the address where the property is located and describe the property in Part XI, Supplemental Information.

Check the box next to the property description if the property is used both to carry on exempt activities and to conduct unrelated trade or business activities.

Line 2 - Enter the gross income from debt financed property, excluding income otherwise included in UBTI. For example, don't include rents from personal property shown on Schedule A, Part IV, or rents and interest from controlled organizations shown on Schedule A, Part VI.

Line 3 - For amounts shown on line 3a, attach a statement showing, for each property:

- The cost or salvage value,

- The year acquired,

- The property’s useful life (rounded to a whole number if necessary),

- The years remaining (rounded to a whole number if necessary),

- The annual depreciation expense amount, and

- The allowable depreciation expense amount.

Line 4 - Amount of average acquisition debt on or allocable to debt-financed property

To calculate the average acquisition debt for a property during the tax year:

- Add up the amount of outstanding principal debt on the first day of each month the organization owned the property.

- Divide the total by the number of months the property was held.

Then:

- Use this average to figure out how much of the property’s income is linked to the debt (debt-financed income %).

- Multiply the average debt by that percentage to get the portion subject to tax.

Line 5 - To calculate the average adjusted basis of debt-financed property, take the property's adjusted value on the first and last day you held it during the tax year, and average them. The adjusted basis comes from Section 1011 and must be reduced by all depreciation taken in prior years—even if your organization was tax-exempt then. If your organization was taxed on UBTI in certain years, you still reduce the basis by all allowable depreciation, not just the portion used to calculate UBTI.

Attach a statement showing, for each property:

- A brief description of the property,

- The adjusted basis,

- The percent allocable to debt-financed income, and

- The product of (3) multiplied by (4).

If no adjustments to the basis of property under section 1011 apply, the basis of the property is cost.

Line 6 - Divide each property's average acquisition indebtedness for the tax year by that property's average adjusted basis during the period it is held in the tax year. This percentage cannot be more than 100%.

Line 7 - The amount of income from debt-financed property included in unrelated trade or business income is figured by multiplying the property's gross income by the percentage computed on line 6.

Line 8 - Enter on line 8 the sum of amounts computed for each property on line 7. Also enter this amount on Part I, line 7, column (A).

Line 9 - For each debt-financed property, take the total connected deductions (including eligible dividend deductions) and multiply by the debt percentage from line 6.

If the property is depreciable, use only straight-line depreciation and show this amount on Schedule A, Part V, line 3a.

Attach detailed statements showing how you calculated depreciation and other expenses (for lines 3a and 3b).

If you own stock that's debt-financed, use Form 1120 Schedule C to find the dividend deduction to report.

For capital losses carried back or forward, apply the debt percentage when figuring the loss amount to carry — but don’t apply it again in the year you use the loss.

Line 10 - Total allocable deductions

On line 10, enter the sum of amounts computed for each property on line 9. Also enter this amount on Part I, line 7, column (B).

Line 11 - Total dividends

Enter the total dividends-received deductions (after reduction, when applicable, by the debt-basis percentage(s)) included on Schedule A, Part V, line 9.

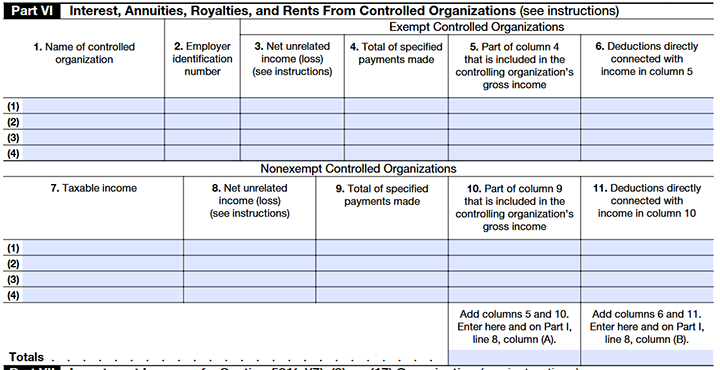

Part VI - Interest, Annuities, Royalties, and Rents From Controlled Organizations

Under Section 512(b)(13), if a controlling tax-exempt organization gets interest, rent, royalties, or annuities from a controlled organization, those amounts may be taxable, even if the controlling organization isn’t actively running a business.

However, there are exceptions—some amounts might be taxed differently under other tax rules (see Reg. 1.512(b)-1(l)(5)).

Column 1 - Enter the name of controlled organization

Column 2 - Enter the organisation’s Employer identification number

Column 3 - Enter the net unrelated income (or net unrelated loss) of each controlled entity listed that is exempt from tax under section 501(a).

Column 7 - Enter the taxable income of each nonexempt controlled organization.

Column 8 - Report the income or loss from each related business that would be taxed like UBTI if it were a nonprofit.

Column 4 or 9 - For each controlled organization, list the total payments received.

If you got both regular specified payments and qualifying specified payments from the same organization, enter them separately on two lines.

Column 5 or 10 - For specified payments, enter the portion of column 4 or 9 to the extent that the payment reduced the net unrelated income (or increased the net unrelated loss) of the controlled entity.

Column 6 or 11 -Enter only the expenses that are directly related to the income shown in column 5 or 10.

For qualifying specified payments, only include expenses related to the portion of the payment that exceeds its fair market value (FMV). Don't include expenses for the part of the payment that's not counted as income.

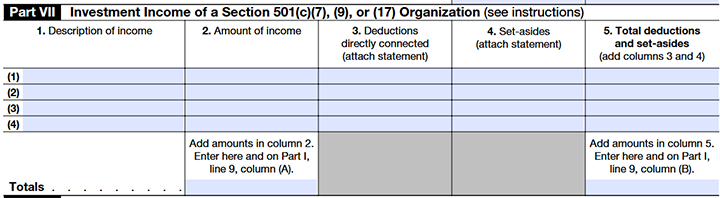

Part VII - Investment Income of a Section 501(c)(7), (9), or (17) Organization

For 501(c)(7), (9), or (17) organizations:

- Report all investment income from non-members on Schedule A, Part VII — including income from securities and debt-financed property (with related expenses).

- Don’t report this non-member income on Part V.

- Exclude interest from state/local government bonds (section 103(a)).

If a 501(c)(7), (9), or (17) organization sells property used for its exempt purpose and buys new exempt-use property within 1 year before or 3 years after the sale, it only pays tax on the gain if it makes more money from the sale than it spent on the new property. The new property doesn't have to be the same type. The IRS must be notified by attaching a statement to the tax return. For figuring out the gain, follow the instructions for Part V, line 5.

Column 1 - Enter here the description of income

Column 2 - Enter here the amount of income

Column 3 - Only deduct expenses that are directly related to net investment income. If needed, split expenses between exempt and other activities. Dividends-received deductions can’t be used since they don’t directly relate to earning income.

Column 4 - Section 501(c)(7), (9), and (17) organizations may set aside income that would otherwise be taxable under section 512(a)(3). However, income derived from an unrelated trade or business may not be set aside and thus can’t be exempt function income. In addition, any income set aside and later used for other purposes must be included in income.

Report income set aside on Schedule A, Part VII, column 4. Attach a statement listing:

- The amount set aside for charitable purposes;

- The amount set aside for reasonable administration costs directly connected with such amount;

- The amount set aside for payment of life, sickness, accident, or other benefit; and

- The amount set aside for reasonable administration costs directly connected with the payment of such benefits.

Amounts set aside aren't deductible under section 170 or any other section of the Code.

Column 5 - Total deductions and set-asides

Add amounts in column 3 and 4 and enter here.

Part VIII - Exploited Exempt Activity Income, Other Than Advertising Income

If an exempt organization earns money from a business activity that takes advantage of its exempt purpose (but isn’t from periodical ads), it should report it on Schedule A, Part VIII. Advertising income that’s not from a periodical also goes in Part VIII.

Line 1 - Trusts taxable at trust rates.

Briefly describe here the exempt activity being exploited in an unrelated trade or business activity.

Line 2 - Enter the gross unrelated business income from trade or business here and on Part I, line 10, column (A)

Line 3 - Enter the expenses directly connected with production of unrelated business income here and on Part I, line 10, column (B)

Line 4 - Net income (loss) from unrelated trade or business.

Subtract line 3 from line 2 and enter the difference amount here. If the value is a gain, complete lines 5 through 7.

To calculate unrelated business taxable income (UBTI):

- Start with gross unrelated business income.

- Subtract directly connected deductions.

- If there's still income left, you can deduct additional expenses related to the exempt activity, but with rules:

- Only deduct the part of expenses that’s more than the income from that exempt activity.

- Limit this extra deduction to the net income from that specific business activity.

- Don’t include income/expenses from the exempt activity when calculating carryovers or income from unrelated activities that don’t exploit that exempt purpose.

Line 5 - Enter the gross income from activity that is not unrelated business income.

Line 6 - Enter the expenses attributable to income entered on line 5.

Line 7 - Excess exempt expenses

Subtract line 5 from line 6, but do not enter more than the amount on line 4. Enter here and on Part II, line 12.

Part IX - Advertising Income

An exempt organization that earned gross income from the sale of advertising in an exempt organization periodical must complete Schedule A, Part IX.

Line 1 - Enter here the Name(s) of periodical(s). Check box if reporting two or more periodicals on a consolidated basis.

Line 2a - Add columns A through D, and enter the sum value here and on Part I, line 11, column (A)

Line 3a - Add columns A through D, and enter here and on Part I, line 11, column (B)

Line 4 - Advertising gain (loss)

Subtract line 3 from line 2. For any column in line 4 showing a gain, complete lines 5 through 8. For any column in line 4 showing a loss or zero, do not complete lines 5 through 7, and enter -0- on line 8.

Line 5 - Enter the readership costs in this line.

Line 6 - Enter the circulation income in this line.

Line 7 - Excess readership costs.

If line 6 is less than line 5, subtract line 6 from line 5. If line 5 is less than line 6, enter -0-

Line 8 - Excess readership costs allowed as a deduction.

For each column showing a gain on line 4, enter the lesser of line 4 or line 7 here.

Line 8a - Add line 8, columns A through D. Enter the greater of the line 8a columns total or -0- here and on Part II, line 13.

Part X - Compensation of Officers, Directors, and Trustees

Complete columns 1 through 4 for those officers, directors, and trustees whose salaries or other compensation are allocable to unrelated business gross income.

However, don't include in column 4 compensation that is deducted on Schedule A, Part II, lines 2 and 14, or any line of Schedule A, Parts III through IX.

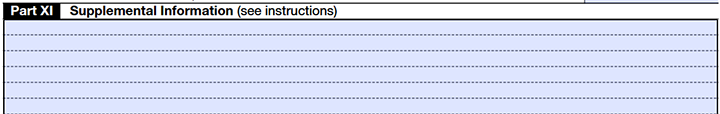

Part XI - Supplemental Information

Use Part XI to explain your organization’s activities, clarify any lines on Schedule A that lack space for extra info, support the amounts reported, or explain changes from prior years (like switching business activity codes).

For each entry, include:

- The Schedule A part and line number,Schedule A part and line number,

- A brief description,

- The amount involved (if any).

If necessary, you may also attach a PDF document to provide supplemental information.

Looking to file Form 990-T online?

File your IRS Form 990-T electronically through TaxZerone for just $129.99 per return.