Time left to file before the deadline (Feb 02, 2026):

E-File Form 5498-QA Online

Report ABLE account contributions, rollovers, and fair market value to the IRS quickly and securely with TaxZerone—an IRS-authorized e-file provider built for accuracy and ease.

Affordable Pricing

Starting at just $2.49 per form, with bulk filing rates as low as $0.59 per form.

For your return volume

What is Form 5498-QA Used For?

Form 5498-QA is used by ABLE program administrators to report contributions, rollovers, and the fair market value (FMV) of Achieving a Better Life Experience (ABLE) accounts. The form provides the IRS and designated beneficiaries with essential information about annual contributions and helps ensure compliance with ABLE program contribution limits and tax benefits.

Understanding ABLE Accounts

An ABLE (Achieving a Better Life Experience) account is a

tax-advantaged savings account for individuals with disabilities. It allows beneficiaries and their families to save for qualified disability expenses without affecting eligibility for federal programs like SSI or Medicaid.

Qualified Disability Expenses Include:

- Education and training .

- Housing and transportation

- Health and wellness

- Employment support

- Assistive technology

- Personal and financial management services

Who Must File Form 5498-QA?

- State-run ABLE programs — or the state agencies or instrumentalities that administer them — are required to file Form 5498-QA with the IRS for every ABLE account they manage. The form can be filed by an authorized officer, program administrator, or their designated representative.

- Form 5498-QA must be filed each year, even if no contributions were made, as long as the account was open at any time during the tax year.

What Must Be Reported?

- For every designated beneficiary, the ABLE program must report:

- Total contributions made during the year

- Rollovers or program-to-program transfers into the ABLE account

- Fair Market Value (FMV) of the account as of December 31

- Whether the account was opened during the tax year

- Eligibility information of the beneficiary, including the basis of eligibility and disability-type code

Even if no contributions were made, the Fair Market Value must still be reported.

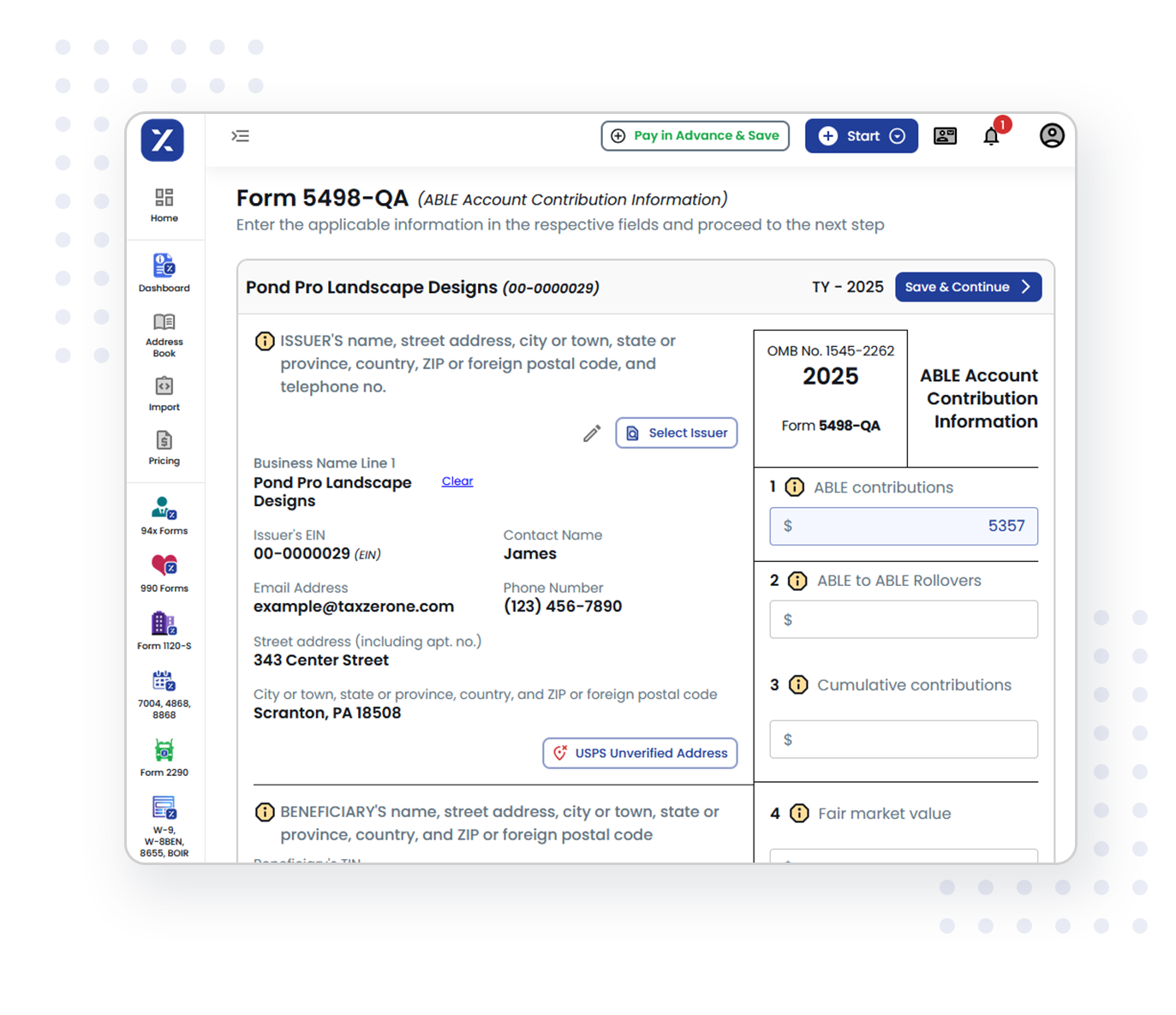

3 Easy Steps to E-File IRS Form 5498-QA

With TaxZerone, e-filing is fast, secure, and accurate—just follow three simple steps.

Enter Account & Beneficiary Details

Provide ABLE program and beneficiary details (names, addresses, TINs, account numbers).

Report Contributions & Account Value

Enter contributions, rollovers, and year-end FMV.

Review & Transmit

Check for accuracy, then submit directly to the IRS. Send form copies securely to beneficiaries using ZeroneVault or postal mail.

Explore Powerful Features That Simplify Your E-filing

IRS Authorized

File confidently through an IRS-authorized e-file provider trusted for accuracy and security.

Deliver Beneficiary Copies

Easily distribute beneficiary copies through ZeroneVault or postal mail.

Bulk Filing Made Easy

Upload and e-file multiple 5498-QA forms at once — perfect for ABLE administrators managing high filing volumes.

Real-Time Updates

Track your filing status at every stage for complete visibility and peace of mind.

Affordable Pricing

Transparent pricing tailored for every filer — whether you’re filing one or hundreds of forms.

Expert Assistance

Get personalized guidance from TaxZerone’s support team whenever you need help.

Form 5498-QA Deadlines for the 2025 Tax Year

Stay compliant by keeping track of the key dates for filing and reporting ABLE account information.

Provide Fair Market Value (FMV) Statement

Deadline: February 02, 2026

Send the ABLE account’s FMV statement to the beneficiary.

Provide Contribution Details to Beneficiary

Deadline: March 16, 2026

Share contribution information with the beneficiary.

File Form 5498-QA with the IRS

Deadline: June 01, 2026

Submit Form 5498-QA to the IRS.

Timely filing ensures accurate IRS reporting and helps beneficiaries maintain proper records for their ABLE accounts.

E-file NowCommon Errors When Filing Form 5498-QA

Avoid these issues to ensure smooth IRS acceptance:

- Missing or incorrect beneficiary information

- Incorrect FMV or contribution values

- Forgetting to include rollover or transfer details

- Late submissions or wrong tax year selection

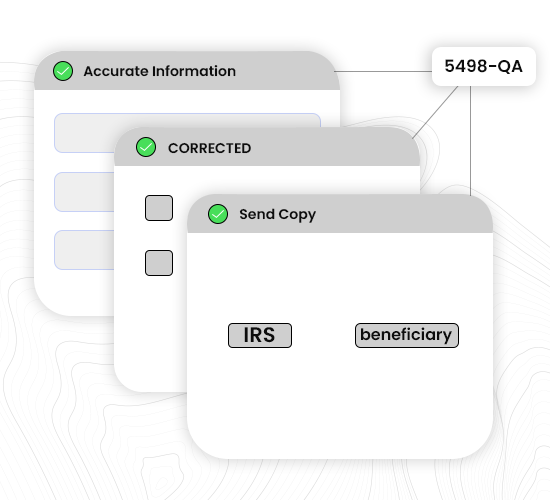

How to Correct an Error in

Form 5498-QA

If you’ve already filed and found an error:

- File a corrected Form 5498-QA with accurate information.

- Check the “CORRECTED” box at the top of the form.

- Send corrected copies to both the IRS and the beneficiary.

With TaxZerone, you can easily edit and retransmit corrected forms electronically — no paper handling required.

Simplify Your Form 5498-QA Filing with TaxZerone

E-file your Form 5498-QA effortlessly with TaxZerone — a fast, secure, and affordable e-filing platform trusted by filers across the U.S.

- Built-in error checks for every submission

- File multiple forms at once to save valuable time.

- Your data is fully encrypted and protected.

Frequently Asked Questions

1. What is the difference between Form 5498-QA and Form 1099-QA?

Form 5498-QA reports ABLE account contributions and rollovers; Form 1099-QA reports distributions or withdrawals. Together, they record total ABLE activity to the IRS.

2. What information is required to e-file Form 5498-QA?

You’ll need:

- ABLE program details (name, address, TIN)

- Designated beneficiary information (name, TIN, account number)

- Total annual contributions and rollovers

- Fair Market Value (FMV) as of December 31

- Any program-to-program transfers

3. Can an ABLE account receive rollovers from another account?

Yes. An ABLE account can receive rollovers or program-to-program transfers from another qualified ABLE account belonging to the same beneficiary or a qualifying family member. These transactions must be reported on Form 5498-QA.

4. Are there contribution limits for ABLE accounts reported on Form 5498-QA?

Yes. Annual contributions to an ABLE account cannot exceed the annual gift tax exclusion limit (for 2024, it’s $18,000). Working beneficiaries may also be eligible to contribute additional amounts under the ABLE to Work Act.

5. What if no contributions were made during the year — is Form 5498-QA still required?

Yes. Even if no new contributions were made, the Fair Market Value (FMV) of the ABLE account must still be reported annually using Form 5498-QA.