Time left to file before the deadline (Feb 02, 2026):

E-File Form 1098-Q Online

Looking to report Qualifying Longevity Annuity Contract information (QLAC)? File Form 1098-Q securely through our IRS-authorized e-filing service.

Affordable Pricing

Starting at just $2.49, with prices as low as $0.59 per form for bulk filings.

For your return volume

3 Quick Steps to File Form 1098-Q Online with TaxZerone

Filing Form 1098-Q online with TaxZerone is quick and easy.

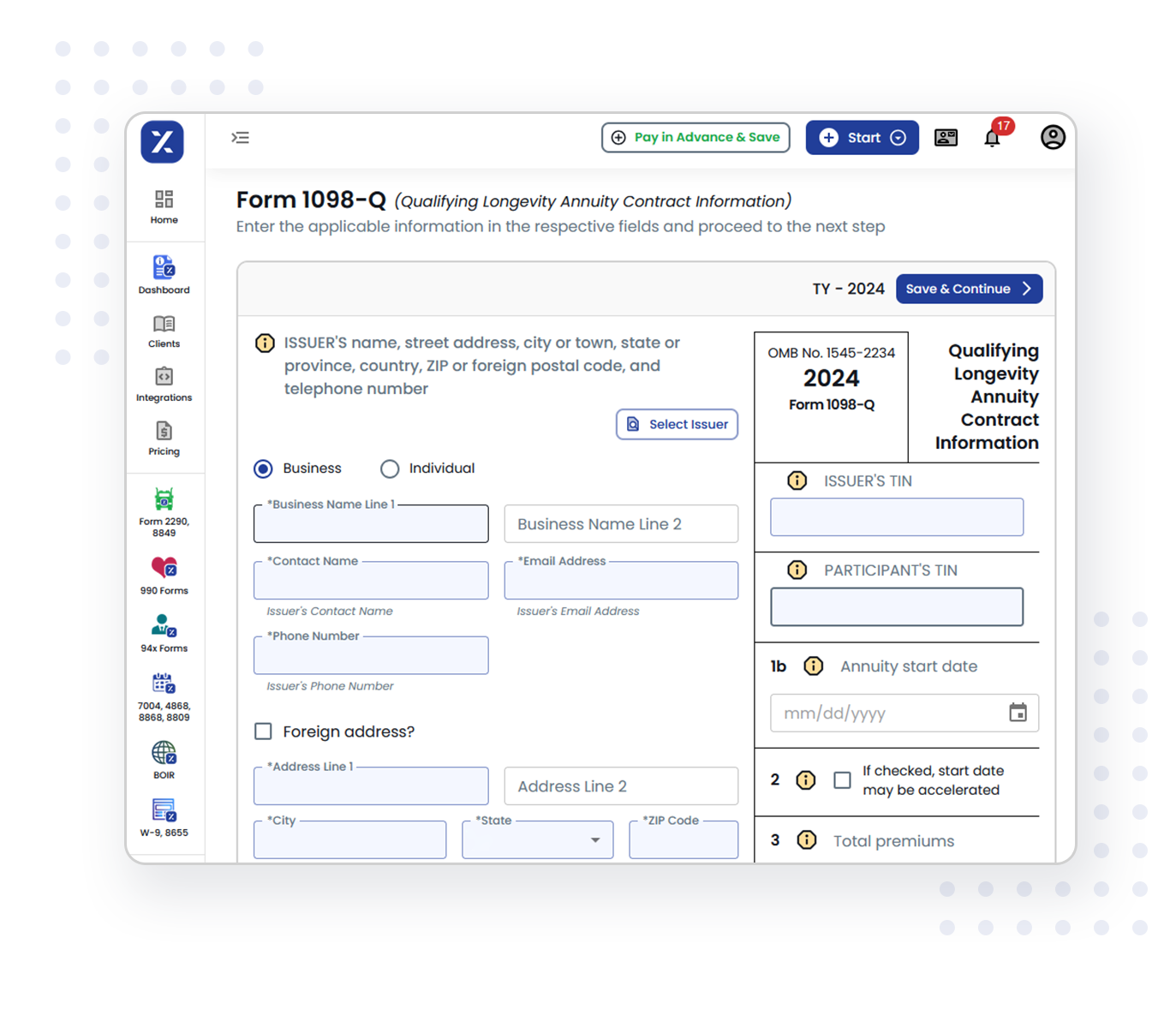

Enter Issuer & Participant Information

Provide the issuer’s name, TIN, and address, along with the participant’s name, TIN, address and Account number.

Report QLAC Details

Enter the amount of the QLAC premium, annuity start date, and other required contract information.

Review and Transmit

Review and transmit the form to the IRS, then provide the participant's copy via ZeroneVault or postal mail.

Why Choose TaxZerone for file Form 1098-Q Online?

TaxZerone is a reliable e-filing solution for reporting Qualifying Longevity Annuity Contracts (QLACs). Here’s why:

IRS Form Validations

Our system automatically checks for errors and missing details, ensuring your submission is accurate and

IRS-compliant with built-in validation.

Bulk Filing Made Easy

Quickly upload and e-file multiple Forms at once, saving time and effort for both small and large submissions.

Instant Recipient Copy Delivery

Share recipient copies securely via ZeroneVault or postal mail, ensuring timely, hassle-free delivery without manual printing.

Affordable Pricing

TaxZerone offers affordable pricing for all your tax filing needs, making it easy for businesses to file forms accurately and efficiently at competitive rates.

Quick and Simple Form Entry

Our user-friendly platform makes it easy to enter your details. Just fill in the fields, and we'll handle the

rest—no inconvenience or confusion.

Expert Support

Our friendly support team is here to help you with any questions or issues you encounter during filing, helping every step of the way.

Form 1098-Q Filing Deadline for the 2025 Tax Year

Recipient Copy Deadline:

Deadline: February 2, 2026

Provide copies to annuity owners via ZeroneVault or postal mailing.

IRS E-Filing Deadline

Deadline: March 2, 2026

File electronically for a faster and smooth experience.

Paper Filing Deadline

Deadline: March 2, 2026

If you are filing on paper, file manually and mail to the IRS.

Late filings may result in IRS penalties, so ensure timely submission.

Start Filing Now!More Time Required to File? Request an Extension

Request additional time below to complete filing or send recipient statements.

Form 8809

Request an Extension to File Information Returns

- Need extra time to file your 1098 q forms? E-file Form 8809 to request an automatic 30-day extension to submit your form to the IRS.

Form 15397

Request an Extension to File Information Returns

- Need extra time to provide recipient copies of 1098 q forms? File Form 15397 to request a one-time 30-day extension to furnish recipient statements.

File Extension in Mins

Why Get Started with TaxZerone Today?

Filing Form 1098-Q online is quick and hassle-free with TaxZerone. You can:

- File accurately with built-in error checks.

- Save time with bulk filing options.

- Benefit from the best pricing in the industry.

- Securely access your documents anytime with ZeroneVault.

Start your e-filing today and complete Form 1098-Q in just 3 simple steps!

Frequently Asked Questions

1. Who needs to file Form 1098-Q?

Insurance companies, financial institutions, and retirement plan administrators that issue Qualifying Longevity Annuity Contracts (QLACs) are required to file Form 1098-Q with the IRS

2. What is the deadline for filing Form 1098-Q?

3. Can I file multiple Form 1098-Qs at once?

4. What happens if I make a mistake on Form 1098-Q?

If you discover an error on a previously filed Form 1098-Q, you can easily correct and resubmit it through TaxZerone. Our platform offers a straightforward correction process, allowing you to update incorrect information with the IRS. Making timely corrections helps avoid compliance issues and ensures accurate reporting for annuitants.

Still have questions?

If you're looking for more answers, refer to our Knowledge Base & FAQs page or get in touch with our customer support team.

Contact us