Time left to file before the deadline (Feb 02, 2026):

File IRS Form 1042-S Online

Easily report U.S.-source income paid to foreign individuals and entities with TaxZerone — an IRS-authorized e-file provider designed for accuracy, security, and bulk compliance filing.

Affordable Pricing

Starting at $2.49per form, with high-volume filing rates as low as $0.59 per form.

What Is Form 1042-S Used For?

IRS Form 1042-S is used by withholding agents to report:

- U.S.-source income paid to foreign individuals, entities, or intermediaries

- The amount of federal tax withheld

- Applicable treaty benefits or exemptions

- Reclassifications, adjustments, and corrections

The IRS uses this form to ensure proper withholding on payments made to foreign persons, while recipients rely on it for tax reporting in their home countries.

Understanding U.S.-Source Income for Foreign Persons

Any payment made to a nonresident alien, foreign corporation, foreign partnership, foreign estate, or foreign trust that is considered U.S.-source income may require Form 1042-S.

Common types of reportable income include:

- Interest and dividends

- Royalties

- Scholarships & fellowships

- Compensation for services

- Rents & real estate income

- Broker proceeds

- Prizes, awards & grants

Whether the payment is taxable or exempt, the transaction must usually be reported

on Form 1042-S.

Who Must File Form 1042-S?

You must file Form 1042-S if you are a withholding agent who makes U.S.-source payments to foreign persons. This includes:

- Businesses of all types

- Educational institutions

- Financial institutions

- Government agencies

- Government agencies

- Nonprofit organizations

- Trusts and estates

- Individuals acting as withholding agents

A separate Form 1042-S must be filed for each recipient and each type of income paid.

Filing is required even when no tax was withheld, such as payments exempt under a tax treaty or treated as effectively connected income (ECI).

Payments made to residents of U.S. territories are generally not reportable if the beneficial owner is a U.S. citizen, national, or resident alien.

3 Easy Steps to E-file IRS Form 1042-S

With TaxZerone, the filing process is simple and intuitive.

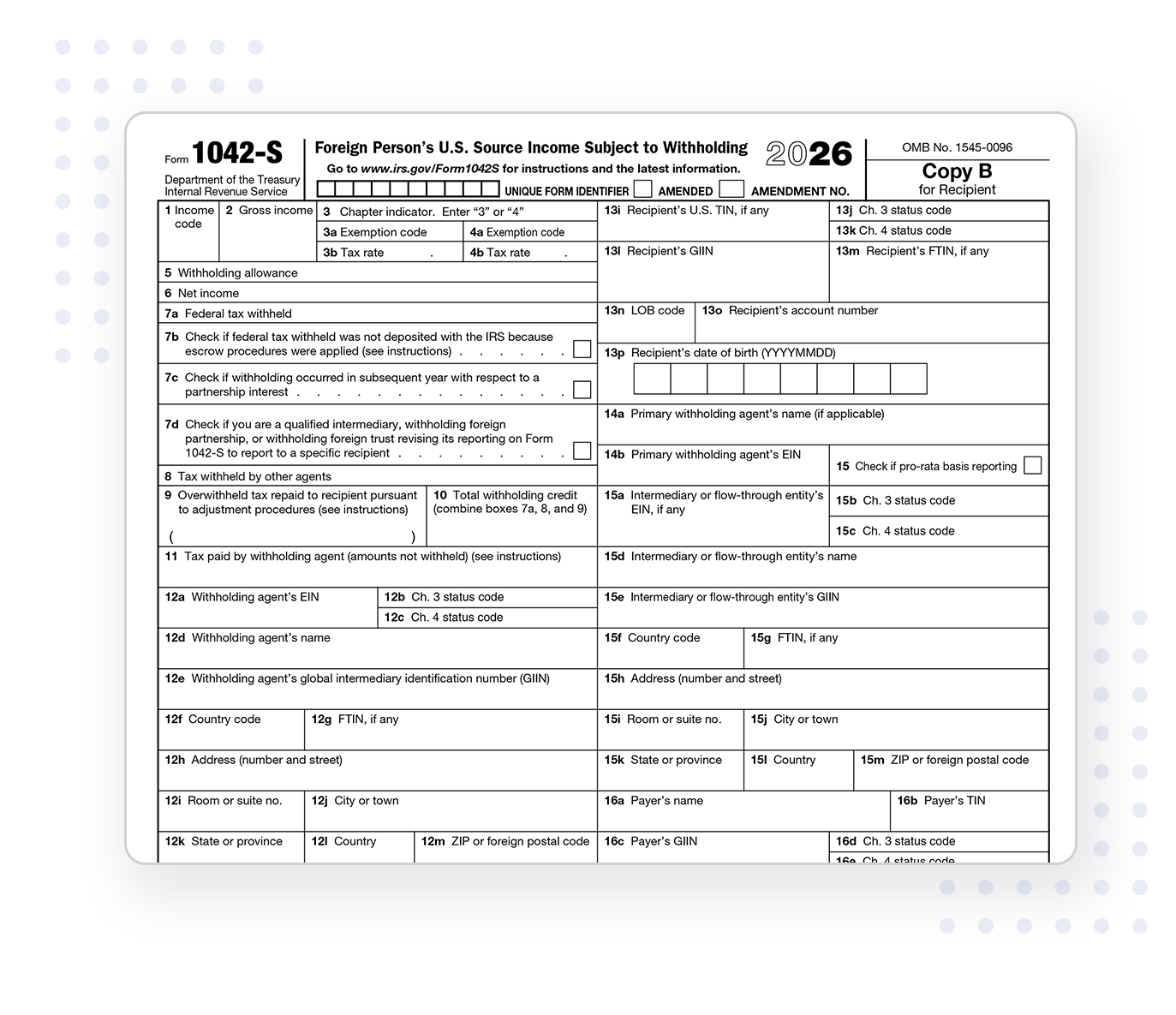

Enter Payer & Recipient Information

Provide withholding agent details and recipient information including name, address, TIN/ITIN, and Chapter 3 or Chapter 4 status.

Report Income & Withholding

Enter the appropriate income codes, exemption codes, withholding amounts, treaty benefits, and tax rates.

Review & Transmit

Use built-in error checks to ensure accuracy, then securely transmit your form to the IRS. Instantly send recipient copies by ZeroneVault or postal mail.

Powerful Features That Simplify Your 1042-S E-filing

IRS Authorized

E-file confidently through a trusted IRS-authorized provider.

Deliver Recipient Copies

Send secure beneficiary copies through ZeroneVault or via postal mail.

Bulk Filing Support

Upload thousands of 1042-S forms at once — ideal for universities, payroll teams, financial institutions, and global businesses.

Real-Time Status Updates

Track your IRS submission every step of the way.

Affordable Pricing

Transparent pricing designed for both single filers and large enterprises.

Expert Assistance

TaxZerone’s support team provides guidance on income codes, treaty benefits, and withholding requirements.

Form 1042-S Deadlines for the 2025 Tax Year

Stay compliant with the IRS deadlines for reporting payments to foreign individuals and entities.

| Filing Requirement | Deadline |

|---|---|

| Furnish recipient copies | March 16, 2026 |

| File Form 1042-S with IRS (electronic) | March 16, 2026 |

Summary

- March 16, 2026 → Provide copies to foreign recipients

- March 16, 2026 → E-file Form 1042-S with the IRS

Running Out of Time? File for an Extension

Get additional time to file or send recipient copies by requesting an extension below.

Form 8809

Request an Extension to File Information Returns

- Need more time to file your 1042 s form? E-file Form 8809 to request an automatic 30-day extension to file 1042s Form with the IRS.

Form 15397

Request an Extension to File Information Returns

- Need more time to send recipient copies of 1042-s form? File Form 15397 to request a one-time 30-day extension to furnish 1042s recipient statements.

File Extension in Mins

Form 1042-S Penalties

The IRS imposes penalties if you file Form 1042-S late, submit incorrect information, or fail to furnish recipient copies on time. Penalties apply per form, which can become costly for high-volume filers.

Penalties for Late Filing With the IRS

If you fail to file a correct Form 1042-S by the due date (including extensions), and no reasonable cause applies, the IRS may impose the following penalties:

- $60 per form if filed within 30 days after the due date Maximum: $683,000 per year (or $239,000 for small businesses)

- $130 per form if filed more than 30 days late but on or before August 1 Maximum: $2,049,000 per year (or $683,000 for small businesses)

- $340 per form if filed after August 1 or not filed at all Maximum: $4,098,500 per year (or $1,366,000 for small businesses)

A small business is defined as having average annual gross receipts of $5 million or less for the previous 3 tax years.

Penalties for Incorrect or Incomplete Forms

These penalties apply to errors such as missing or invalid TINs, incorrect income codes, wrong Chapter 3/4 status, incorrect treaty benefit claims, or mismatched withholding amounts.

Penalty amounts follow the same three tiers as late filing penalties.

Penalties for Failure to Furnish Recipient Copies

You must provide correct Copies B, C, and D of Form 1042-S to recipients by the required deadline. Penalties may apply separately from IRS filing penalties:

- Up to $340 per failure, with a maximum of $4,098,500 ($1,366,000 for small businesses)

- Reduced penalties apply if recipient copies are furnished by August 1, matching IRS late-filing penalty tiers.

Intentional Disregard Penalty

If the IRS determines intentional disregard of filing or furnishing requirements:

- Penalty is the greater of $680 per form or 10% of the amount that should have been reported

- No maximum limit applies

- Also applies when electronic filing is required but not completed, without a waiver or reasonable cause.

Extension to File Form 1042-S (Form 8809)

If you need more time to file Form 1042-S with the IRS, you can request an automatic extension by submitting Form 8809, Application for Extension of Time to File Information Returns.

How the 1042-S Filing Extension Works

- Filing Form 8809 provides a 30-day automatic extension to file Form 1042-S with the IRS.

- You must submit Form 8809 on or before March 15 (the original filing deadline).

- The extension applies only to filing with the IRS — it does NOT extend the deadline to furnish recipient copies, which must still be provided by March 15.

Common Errors When Filing Form 1042-S

Avoid these frequent mistakes to prevent IRS rejections:

- Incorrect income code or exemption code

- Wrong withholding rate or treaty claim

- Mismatched recipient information

- Missing Chapter 4 (FATCA) classification

- Reporting U.S. person income incorrectly

- Late submissions or incorrect tax year

How to Amend an Error on

Form 1042-S

Made a mistake? You can easily file an amendment.

To amend Form 1042-S:

- Check the “Amended” box on the form

- Update the information with the correct details

- Retransmit the amended form electronically

- Send updated recipient copies

With TaxZerone, amending Form 1042-S is simple — just update the form and resubmit. No paper forms required.

Simplify Your Form 1042-S Filing with TaxZerone

TaxZerone makes foreign income reporting fast, reliable, and stress-free:

- Built-in validations for codes, rates, and classifications

- Quick and guided filing workflow

- Simple bulk-upload functionality

- Transparent and competitive pricing

- Fully encrypted and secure e-filing

Frequently Asked Questions

1. What is the difference between Form 1042 and Form 1042-S?

2. What information is required to e-file Form 1042-S?

- Withholding agent details (name, EIN, address)

- Recipient information (name, foreign address, TIN/ITIN if applicable)

- Income codes and exemption codes

- Tax rate or treaty claim

- Federal tax withheld

- Chapter 3 or Chapter 4 status

- Any adjustments or corrections

3. Are treaty benefits reported on Form 1042-S?

- Enter the treaty country

- Report the applicable treaty article

- Use the correct exemption code

- Apply the correct reduced tax rate

4. Do I need to file Form 1042-S if no tax was withheld?

- U.S.-source

- Made to a foreign person

- Reportable under IRS rules