Streamline Your 1099 State Filing Process

Effortlessly file 1099 forms for any state with our secure and reliable platform. Simplify compliance and avoid penalties with seamless state-specific filing solutions.

Supported States for 1099 Filing

Easily navigate the state requirements with our detailed guide. Select your state below to learn about its specific filing process. Explore the list of states we support for 1099 filing.

Click on a state to learn about its filing requirements and deadlines.

Why Choose Our 1099 State Filing Service?

State-Specific Compliance

Meet unique state reporting requirements effortlessly.

Secure Platform

Ensure your data is protected with advanced encryption.

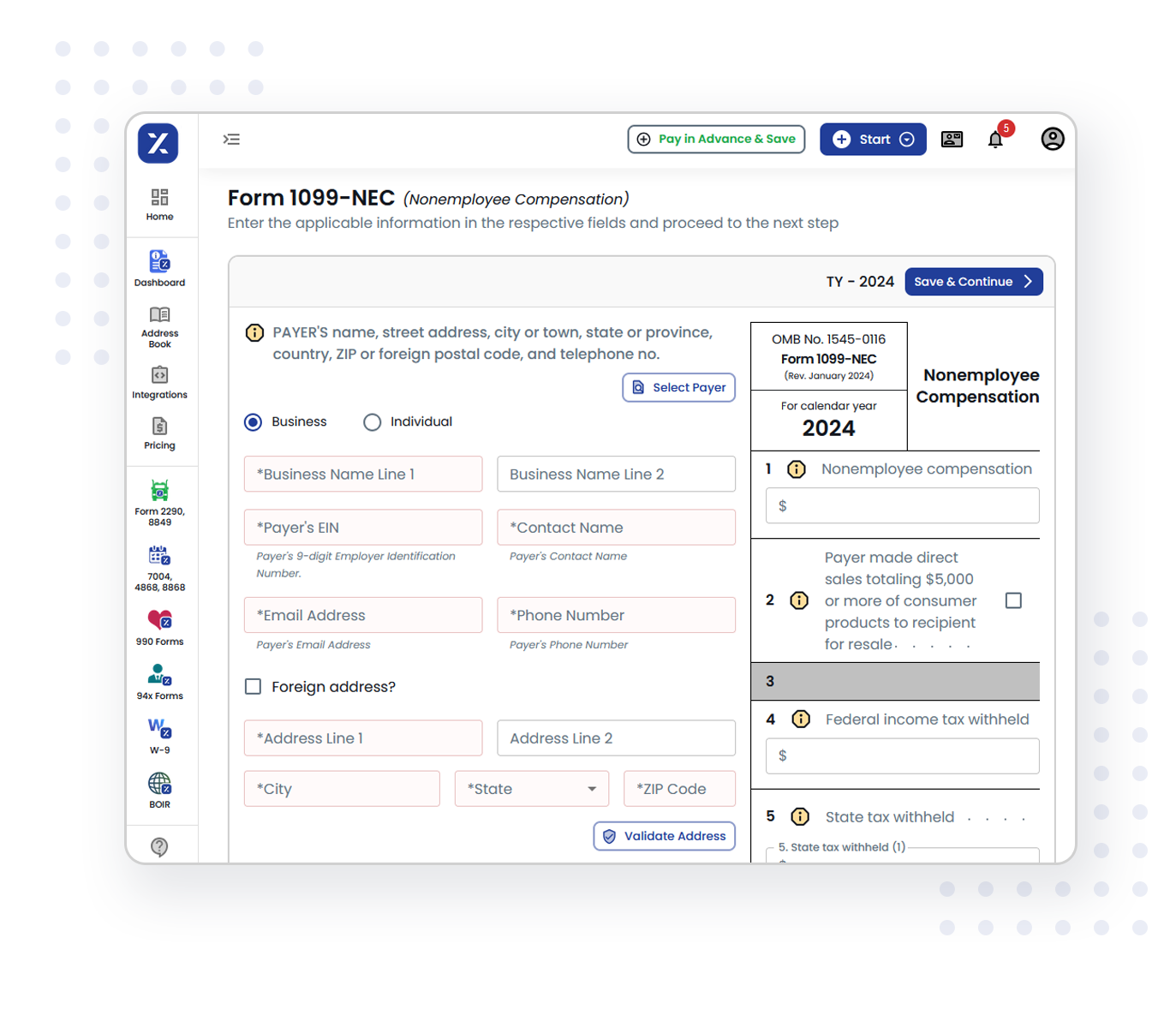

Ease of Use

User-friendly interface for efficient filing.

Quick Processing

File forms in minutes and meet deadlines without stress.

Step-by-Step Guide to File 1099 State Forms

Select the state where you need to file 1099 forms.

Upload or manually enter the required information.

Review and confirm your details.

Submit the forms directly to the state tax authorities.

Who Can Use This Service?

- Small business owners filing 1099s for contractors.

- Accountants and tax professionals managing multiple client filings.

- Enterprises needing bulk 1099 submissions.

- Freelancers and independent contractors fulfilling state tax obligations.