Time left to file before the deadline (Feb 02, 2026):

E-File IRS Form 1099 Series for the 2025 Tax Year

If you are a business owner, tax professional, or financial institution, TaxZerone makes your e-filing faster and easier.

E-File Your 1099 Forms at the best price with TaxZerone

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

Pricing Includes

Bulk Filing

Schedule Filing

Error Checks

Transmittal Form 1096

USPS Address Validation

Expert Support

Add-ons Available

| State Filing | $ 0.99/form |

| Electronic Delivery | $ 0.50/form |

| Postal Mailing | $1.75/form |

E-File Form 1099 series with TaxZerone

Who Should File Form 1099s?

- Businesses & Employers

Report payments made to independent contractors or vendors. - Financial Institutions

Report interest, dividends, and investment income. - Government Agencies

Report certain government payments like unemployment benefits. - Lenders & Brokers

Report cancellations of debt, real estate sales, or securities transactions.

Why File Form 1099s?

- Maintain Accurate Records

Ensure transparency with vendors, contractors, and stakeholders. - Build Trust & Credibility

Timely and accurate filing shows professionalism. - Stay IRS Compliant

Avoid penalties and interest for late or incorrect filings. - Reduce Audit Risks

Proper filing demonstrates transparency and reduces the chance of IRS scrutiny.

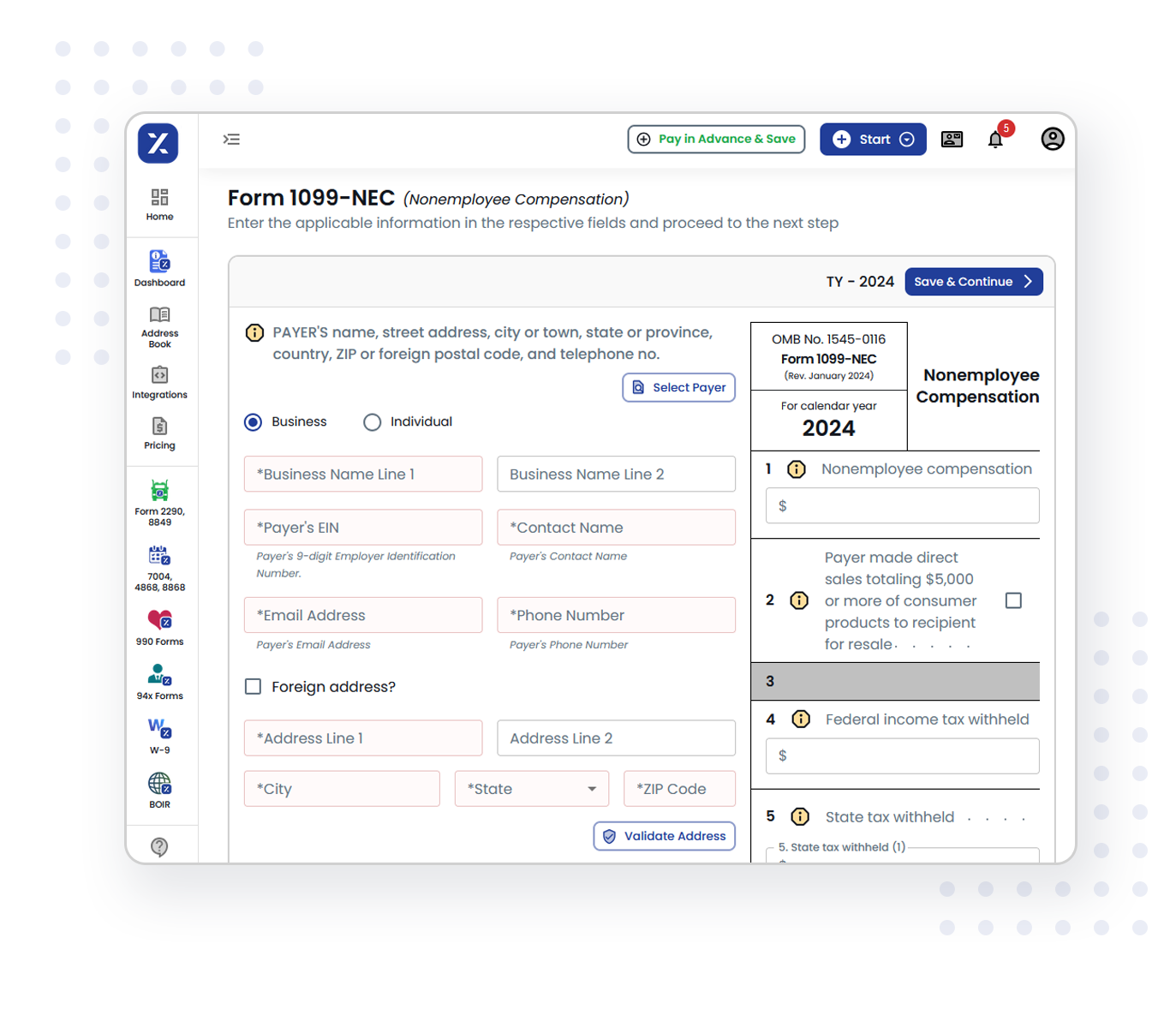

How to E-File IRS 1099 forms using TaxZerone?

E-File your 1099 Forms in 3 Simple Steps

Choose Your Form

Select the 1099 form you need to file and enter the recipient & payment details.

Review & Submit

Our built-in error checks ensure accuracy before securely transmitting your form to the IRS.

Deliver Recipient Copies

Instantly send your recipient copies via ZeroneVault, Email, or Postal Mailing.

Benefits of E-Filing the Form 1099 Series with TaxZerone

Simple Filing

TaxZerone guides you through a simple step-by-step filing process, ideal for first-time and experienced filers.

IRS-authorized

TaxZerone is an IRS-authorized e-file provider, which means your filings are processed securely and in full compliance with IRS requirements.

ZeroneVault

Send recipient copies via ZeroneVault or postal mail through our integrated delivery system.

IRIS Support

TaxZerone supports IRIS (Information Returns Intake System) for all electronic filing of information return.

Bulk Filing

Having multiple forms to file? Our bulk filing feature allows you to upload and file multiple returns in just a few clicks.

Schedule Filing

TaxZerone’s schedule filing feature will help you to prepare the returns ahead of time and choose the exact date you want them to submit to the IRS.

Supports All State 1099 Forms

TaxZerone provides seamless support for filing the complete range of 1099 state forms, ensuring accuracy and compliance.

Supports 1099 Corrections

TaxZerone supports 1099 corrections, making it easy to update and resubmit forms accurately with the IRS.

Expert Support

Our friendly support team is available via live chat, Email, and Phone (in English & Spanish) to guide you every step from preparing your forms to final submission.

Hear What Our Clients Say About Us

-Rachel Barnes

-Samella Ramon Horsle

-Mary Eadson

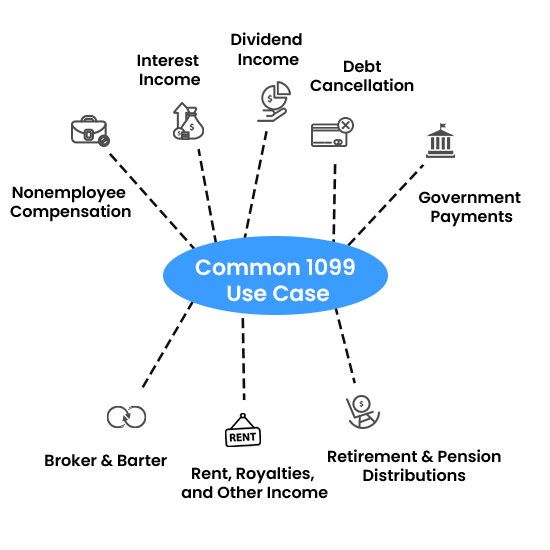

Common Use Cases

- Reporting Nonemployee Compensation

- Interest Income Reporting

- Dividend Income Reporting

- Debt Cancellation

- Government Payments

- Broker & Barter Transactions

- Rent, Royalties, and Other Income

- Retirement & Pension Distributions

Competitor Comparison: Why Choose TaxZerone

for 1099 Series E-Filing

| Feature | TaxZerone | Other E-file Platforms | Paper Filing (Manual) |

|---|---|---|---|

| IRS-Authorized E-File Provider | Yes | Varies | No |

| Form Coverage | Supports all 1099 series (1099-NEC, 1099-MISC, 1099-DIV, 1099-INT, etc) | Limited coverage (not all forms supported) | Not Applicable |

| Pricing | As low as $0.59 per form (for 1000+) | Higher filing fees, hidden charges | Printing, postage & manual costs |

| Real-Time Error Validation | Automatic validation before IRS submission | Limited checks | Manual review only |

| Bulk Upload | Accepts extension files | Limited or unavailable | Not possible |

| Corrections & Re-file | Free corrections for rejected returns | Extra charges | Manual corrections, resubmission delays |

| Delivery Options | E-delivery & Postal Mailing | Limited | Manual printing & mailing |

| Recipient Access Portal | ZeroneVault (Secure & IRS-compliant portal) | Not available | Not available |

| Filing Scheduler | Schedule filings in advance | Limited | Not possible |

| Reminders | Email reminders sent before IRS deadlines | Not available | Not available |

| Customer Support | U.S. based support | Limited or email-only | None |

Ready to eFile Your 1099s?

E-file Your 1099s the Smart Way with TaxZerone — Fast, Accurate & IRS-Approved.

Frequently Asked Questions

1. Can I file multiple 1099s at once?

2. Do I need to send a copy to the recipient?

3. When is the deadline for filing Form 1099s?

New here?

Get the support you need.

Still have questions about 1099 forms?

Reach out to our friendly support team for all your Queries.