E-File W-2 & W-2c Forms Online for the 2025 Tax Year

File your wage tax forms, such as W-2 and W-2c using TaxZerone to stay IRS compliant and avoid costly penalties.

E-File Your Wages Tax Forms at an Affordable Price

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

Pricing Includes

Bulk Filing

Schedule Filing

Transmittal Form W-3

USPS Address Validation

Error Checks

Expert Support

Add-ons Available

| State Filing | $ 0.99/form |

| Electronic Delivery | $ 0.50/form |

| Postal Mailing | $1.75/form |

E-File Wage Tax Forms with TaxZerone

Who Should File Wage Tax Forms?

Form W-2

- Any business, organization, or individual that pays wages and withheld federal income tax, Social Security, or Medicare taxes

- Household Employers paying workers of $2,700 or more annually.

- Employers providing employees with taxable fringe benefits.

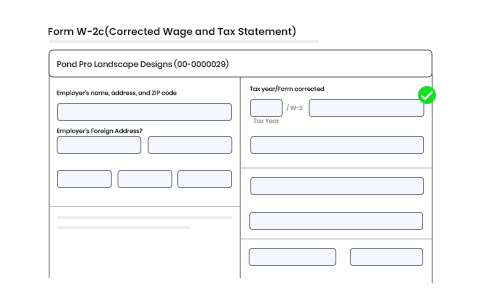

Form W-2C

- Employer Errors in Original W-2 such as incorrect employee name, SSN, EIN, wrong wage, tip, or errors in tax withholding amounts

- Incorrect reporting of retirement plan contributions, dependent care benefits, or other fringe benefits.

- If payroll records are updated or corrected after the original W-2 was filed.

Why File Wage Tax Forms?

- Wage tax forms confirm that withheld taxes have been reported correctly.

- Employees rely on wage tax forms like Form W-2 to file their own income tax returns

- Filing timely and accurate wage tax forms shows professionalism and builds trust with employees and authorities.

- Filing helps you stay compliant at both federal and state levels.

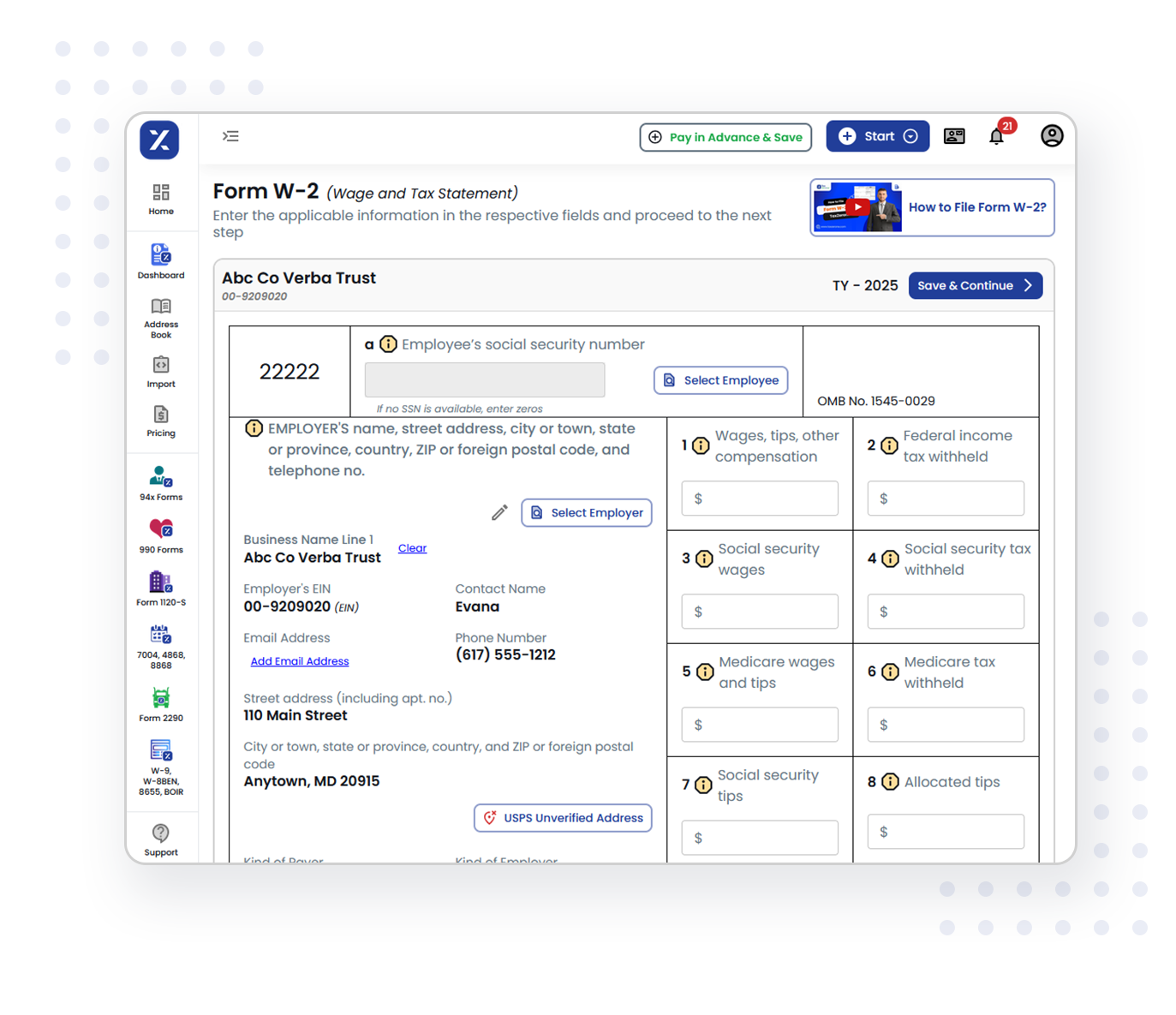

How to E-File Wage Tax Forms using TaxZerone?

Enter all the required fields

Enter the required details for the chosen form type.

Transmit to the IRS

Review and transmit your return to the IRS.

Send Recipient’s Copy

Deliver your recipient’s copy through ZeroneVault or postal mailing.

Benefits of E-filing Wage Tax forms with TaxZerone?

IRS Authorized

TaxZerone is an IRS-authorized e-file provider. We ensure your wage tax forms (W-2 or W-2c) are filed accurately and securely with the IRS.

Bulk Upload

Quickly upload and file multiple wage tax forms simultaneously with TaxZerone, which will save you time and make the e-filing easier.

Share Employee Copies

TaxZerone helps you to share the employee copies - either instantly through ZeroneVault or by sending them right to their mailbox.

State Filing Support

You can file both your federal and state returns using TaxZerone. We ensure that you stay compliant with specific state requirements while also meeting federal regulations.

Real-Time Updates

TaxZerone keeps you informed at every stage from filing your wage tax forms to IRS acceptance by sending timely email updates straight to your inbox.

Schedule Filing

With our schedule filing feature, you can prepare your wage tax forms in advance and select the exact date you want your return to be submitted to the IRS.

Affordable Pricing

Whether you are filing single or multiple wage tax forms, TaxZerone offers affordable pricing in the industry.

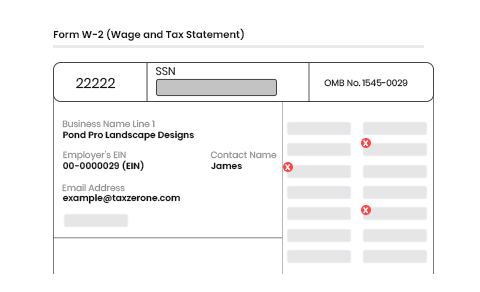

Smart Validation System

Ensure your W2 and W-2c forms meet SSA standards with our advanced validation system, which will minimize errors and avoid costly rejections.

Expert Support

Have questions? Our friendly support team is ready to help you via email, phone (in English or Spanish), and live chat.

Hear What Our Clients Say About Us

- Austin Wright

- Avery Collins

- Savannah Clarke

Common Use Cases

Form W-2

- Reporting employee wages, tips, and other compensation.

- Reporting federal income tax, Social Security, and Medicare tax withheld.

- Reporting state and local wages and taxes withheld.

- Providing employees with necessary details to file their personal tax returns.

- Reporting taxable fringe benefits, retirement plan contributions, and dependent care benefits.

Form W-2C

- Correcting an employee’s name or Social Security Number (SSN).

- Fixing incorrect wage or tax withholding amounts.

- Correcting retirement plan contributions or fringe benefit reporting.

- Updating state or local wage/tax information.

- Adjusting payroll records after year-end due to errors or amendments.

Competitor Comparison: Why Choose TaxZerone for W-2/W-2C E-Filing

| Feature | TaxZerone | Other E-file Platforms | Paper Filing (Manual) |

|---|---|---|---|

| IRS-Authorized E-File Provider | Yes | Varies | No |

| Form Coverage | Supports Form W-2 and W-2C | Limited coverage | Not Applicable |

| Pricing | As low as $0.59 per form (for 1000+) | Higher filing fees, hidden charges | Printing, postage & manual costs |

| Real-Time Error Validation | Automatic validation before IRS submission | Limited checks | Manual review only |

| Bulk Upload | Accepts extension files | Limited or unavailable | Not possible |

| Corrections & Re-file | Free corrections for rejected returns | Extra charges | Manual corrections, resubmission delays |

| Delivery Options | E-delivery & Postal Mailing | Limited | Manual printing & mailing |

| Recipient Access Portal | ZeroneVault (Secure & IRS-compliant portal) | Not available | Not available |

| Filing Scheduler | Schedule filings in advance | Limited | Not possible |

| Reminders | Email reminders sent before IRS deadlines | Not available | Not available |

| Customer Support | U.S. based support | Limited or email-only | None |

Ready to eFile Your Wage Tax Form?

E-file today and get it securely submitted to the IRS in minutes!

Frequently Asked Questions

1. What is Form W-2?

2. Who needs to file Form W-2?

3. What is Form W-2c?

4. Can I file multiple W-2 or W-2c forms at once?

5. How can I distribute employee copies of W-2 or W-2c with TaxZerone?

6. Which states require W-2 filing and its deadline?

| State | Deadline |

|---|---|

| Alabama (AL),Arizona (AZ), Arkansas (AR) ,Colorado (CO), Connecticut (CT), Delaware (DE),District of Columbia (DC) , Georgia (GA),Hawaii (HI), Idaho (ID), Illinois (IL), Indiana (IN), Kansas (KS), Kentucky (KY), Louisiana (LA), Maine (ME) ,Maryland (MD),Massachusetts (MA) ,Michigan (MI),Minnesota (MN),Mississippi (MS),Missouri (MO),Montana (MT),Nebraska (NE), New Mexico (NM) , North Carolina (NC), North Dakota (ND) ,Ohio (OH),Oklahoma (OK), Oregon (OR) ,Pennsylvania (PA),Rhode Island (RI) , South Carolina (SC), Utah (UT) ,Vermont (VT),Virginia (VA),West Virginia (WV),Wisconsin (WI) | January 31 |

| Iowa (IA), New Jersey (NJ) | February 15 |

New here?

Get the support you need.

Still have questions about Wage Tax Forms?

Reach out to our friendly support team for all your Queries.