Time left to file before the deadline (Feb 02, 2026):

File Form 1099-S for Tax Year 2025 with Ease

Easily report real estate transactions with TaxZerone’s seamless and accurate e-filing solution for Form 1099-S.

Affordable Pricing

Starting at just $2.49 per form, with bulk filing options as low as $0.59 per form.

For your return volume

Filing Requirements for Form 1099-S

Ensure your 1099-S filing is quick and accurate! Here's what you'll need:

- Filer Information: Name, TIN, and Address.

- Transferor Information: Name, TIN, and Address.

- Transaction Details:

- Date of Closing.

- Gross Proceeds from the sale.

- Description of the property.

- Buyer’s part of real estate tax

3 Simple Steps to File Form 1099-S

Filing your Form 1099-S with TaxZerone is fast, easy, and secure. Here’s how you can do it in just three simple steps:

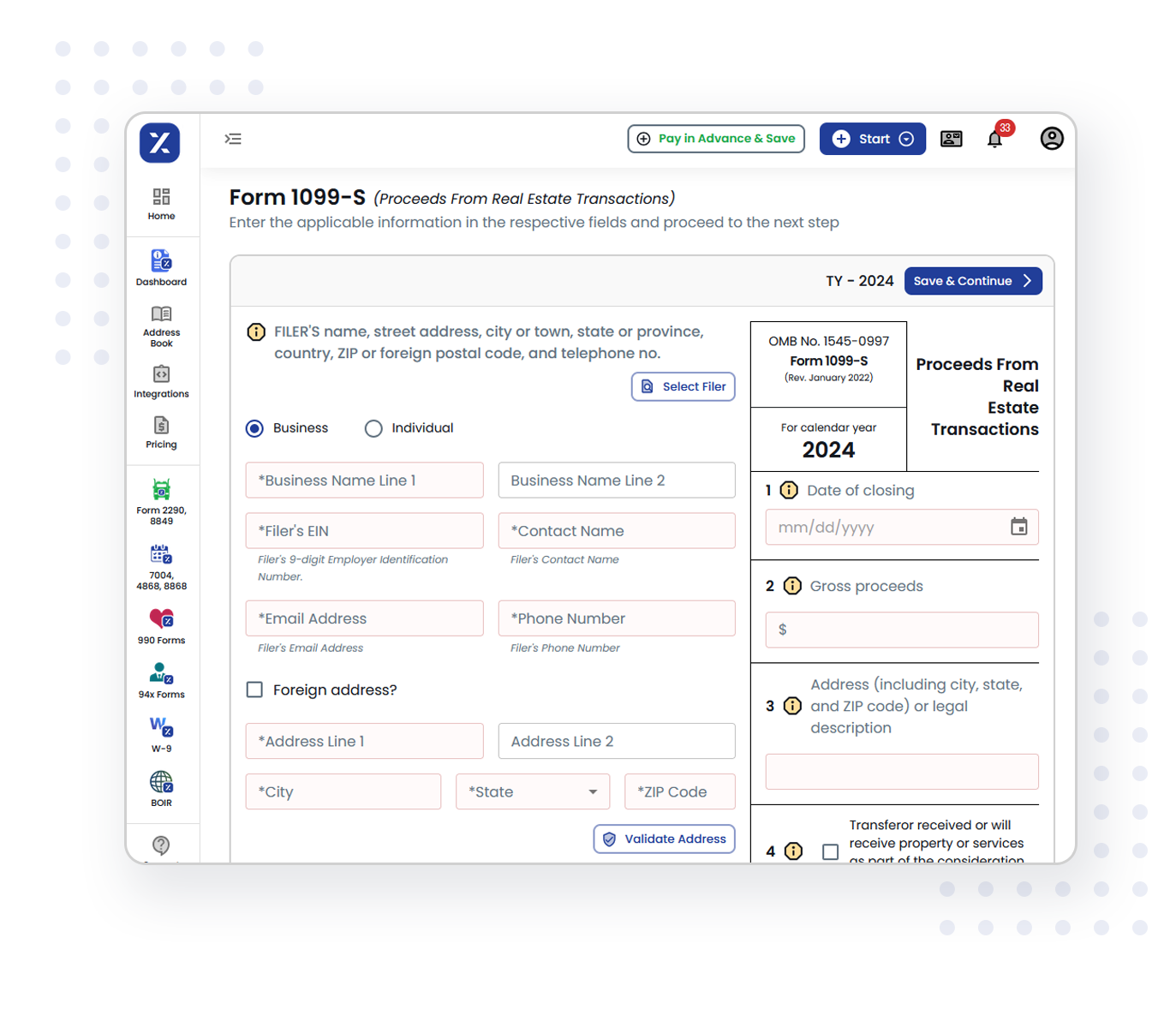

Enter Transaction Details

Provide essential information like filer and transferor details, gross proceeds, and property description.

Review & Transmit

Check your entries with TaxZerone’s IRS validations, ensuring accuracy before secure submission to the IRS.

Send Transferor Copy

Easily share the transferor’s copy electronically via ZeroneVault or opt for postal delivery.

Why Choose TaxZerone for Form 1099-S E-filing?

TaxZerone is the trusted e-filing solution for businesses of all sizes. Here’s why:

IRS Form Validations

Minimize errors with automated validations that ensure compliance with IRS standards.

Bulk Upload Support

Easily upload and file multiple forms, saving time for those handling multiple transactions.

Secure Sharing of Transferor Copies

Effortlessly deliver the transfer’s copy securely via ZeroneVault for safe electronic sharing or choose postal mail for a more traditional option.

Competitive pricing

Enjoy affordable rates tailored to your filing needs, with prices decreasing as your volume increases.

Form-based Filing

A user-friendly interface ensures you only need to fill out essential fields; we’ll handle the rest.

Guided Filing Process

Receive real-time assistance and helpful prompts to confidently complete your filing.

Important Deadlines for Filing Form 1099-S

Send Transferor Copies

Deadline: February 17, 2026

Share transferor copies electronically via ZeroneVault or choose postal delivery.

File with the IRS (e-file)

Deadline: March 31, 2026

Ensure timely submission by filing your form 1099-S electronically.

File with the IRS (paper)

Deadline: March 2, 2026

Submit paper filings if applicable.

Save Time with TaxZerone

Streamline your real estate reporting by filing Form 1099-S on time and stress-free.

Start Filing Now!More Time Required to File? Request an Extension

If you need additional time to file or send recipient statements,

you can request an extension using the forms below.

Form 8809

Request an Extension to File Information Returns

- Need extra time to file your form 1099 s? E-file Form 8809 to request an automatic 30-day extension to submit your 1099s to the IRS.

Form 15397

Request an Extension to File Information Returns

- Need extra time to provide recipient copies of form 1099 s? File Form 15397 to request a one-time 30-day extension to furnish 1099 recipient statements.

File Extension in Mins

E-file Form 1099-S Pricing Calculator

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Postal Mailing | Price Per Form |

|---|---|

| Per Form | $1.75 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Electronic Delivery | Price Per Form |

|---|---|

| Per Form | $0.50 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

State Filing Not Required for Form 1099-S

There are no state-specific tax filing requirements for Form 1099-S. TaxZerone ensures your federal filing is complete and compliant, so you don’t need to worry about any additional state-level reporting.

Schedule Filing: Stay Organized and File On Time

Take the stress out of last-minute filing! With Schedule Filing, you can plan your Form 1099-S submissions in advance, and we’ll take care of the filing process when the time comes.

Set Your Filing Date

Select a filing date that suits your schedule, and we’ll ensure your Form 1099-S is promptly and accurately submitted to the IRS.

Ensure Data Accuracy

Give the transferor the opportunity to review their 1099-S forms before submission, allowing for early corrections and ensuring precise reporting.

Avoid IRS Corrections

Scheduling your filing lets you validate all details ahead of time, reducing errors and eliminating the hassle of filing IRS correction forms later.

Share Transferor Copies with Ease

TaxZerone simplifies the delivery of Form 1099-S copies to your transferor, ensuring secure and timely distribution. Choose the method that best suits your business needs:

Electronic Sharing via ZeroneVault

- Seamlessly share transferor copies through ZeroneVault, a user-friendly and secure platform.

- Transferors can instantly access their forms online, removing the need for printing or mailing.

- Rely on ZeroneVault’s robust data protection to handle sensitive tax information with the highest level of security.

Reliable Postal Mailing

- Prefer physical copies? TaxZerone’s postal service ensures professional and timely delivery of Form 1099-S to the transferor.

- Meet IRS deadlines effortlessly while saving time and effort by letting TaxZerone manage the mailing process.

Get Started with TaxZerone Today

Filing Form 1099-S online has never been easier. With TaxZerone, you can:

- File quickly and accurately.

- Stay compliant with IRS requirements.

- Save time with bulk upload.

- File at the best price in the industry.

Start your e-filing process today and complete your Form 1099-S in just 3 simple steps!

Takes 3 steps and less than 5 minutes

Frequently Asked Questions

1. What is Form 1099-S?

2. Who Needs to File Form 1099-S?

- Real Estate Agents and Brokers: If they are involved in managing the sale, they must ensure Form 1099-S is filed.

- Title or Closing Companies: Often designated as the party responsible for filing as they oversee the settlement process.

- Transferors (Sellers): If no third party is designated, the seller must ensure the form is submitted to the IRS.

3. When is the Deadline for Filing Form 1099-S?

- Transferor Copy: The seller must receive their copy by February 17, 2026 of the year following the transaction.

- Paper Filing to IRS: Due by March 2, 2026.

- E-Filing to IRS: Due by March 31, 2026.

Meeting these deadlines is crucial to avoid penalties and ensure compliance with tax regulations.

4. What are the Penalties for Late Filing for Form 1099-S?

Penalties Based on Filing Delays:

- Filed Within 30 Days of the Deadline:

A penalty of $60 per form applies. The maximum penalty: - $239,000 for small businesses (annual gross receipts of $5 million or less).

- $683,000 for large businesses (gross receipts over $5 million).

- Filed After 30 Days but By August 1:

The penalty increases to $130 per form. Maximum penalties rise to: - $683,000 for small businesses.

- $2,049,000 for large businesses.

- Filed After August 1 or Not Filed at All:

A penalty of $340 per form is imposed. Maximum penalties are: - $1,366,000 for small businesses.

- $4,098,500 for large businesses.

Additional Penalties for Errors:

- Intentional Disregard: If the filer knowingly fails to submit Form 1099-S, the penalty jumps to $680 per form, with no maximum cap.

Filing accurate and timely returns ensures compliance with IRS regulations and avoids costly penalties that can heavily impact businesses.