E-File IRS Form 5498 Series for the 2025 Tax Year

If you are responsible for managing IRAs, HSAs, ESAs, or QAs, filing the IRS Form 5498 series is an essential part of year-end reporting.

E-File Your 5498 Forms at an Affordable Price

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

Pricing Includes

Bulk Filing

Schedule Filing

Transmittal Form 1096

USPS Address Validation

Error Checks

Expert Support

Add-ons Available

| Electronic Delivery | $ 0.50/form |

| Postal Mailing | $1.75/form |

E-File Form 5498 series with TaxZerone

Who Should File Form 5498s?

- Form 5498

Banks, credit unions, and other custodians that manage Individual Retirement Accounts (IRAs). - Form 5498-ESA

Organizations that administer Coverdell Education Savings Accounts (ESAs). - Form 5498-SA

Institutions responsible for Health Savings Accounts (HSAs) and Archer MSAs. - Form 5498-QA

Organizations that administer Qualified ABLE (Achieving a Better Life Experience) accounts.

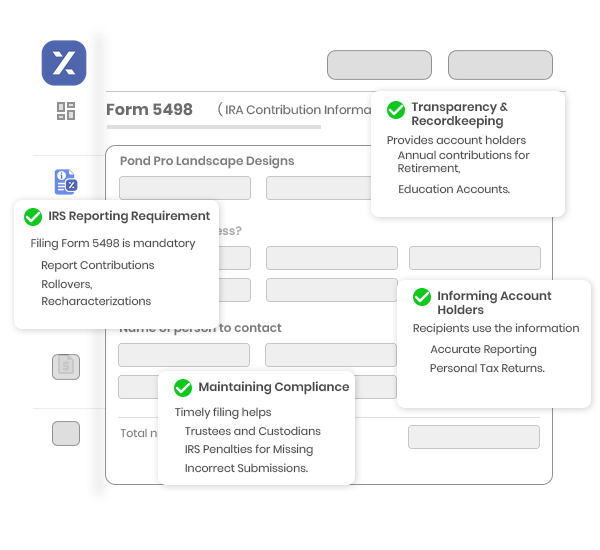

Why Should You File Form 5498s?

- IRS Reporting Requirement

Filing Form 5498 is mandatory to report contributions, rollovers, recharacterizations, and fair market values to the IRS. - Informing Account Holders

Recipients use the information on Form 5498 to verify their contributions and ensure accurate reporting on their personal tax returns. - Maintaining Compliance

Timely filing helps trustees and custodians avoid IRS penalties for missing or incorrect submissions. - Transparency & Recordkeeping

Provides account holders with a verified record of their annual contributions for retirement, health, or education accounts.

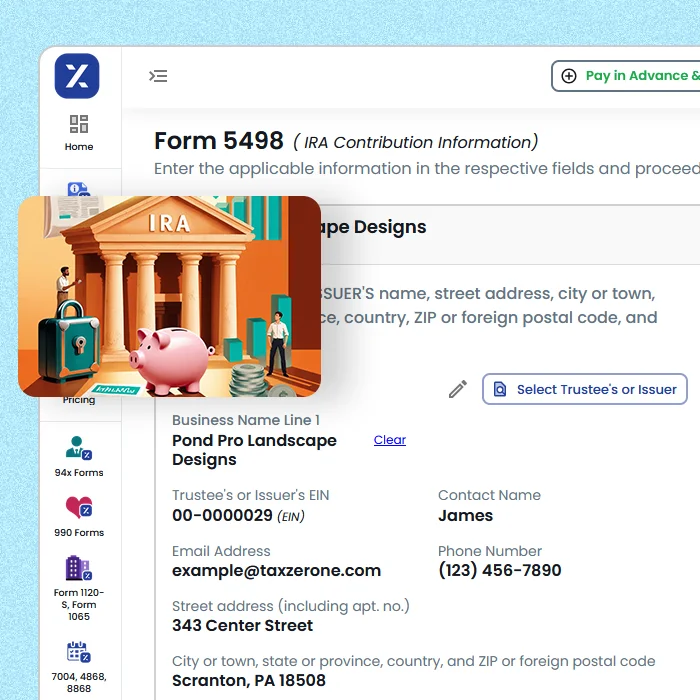

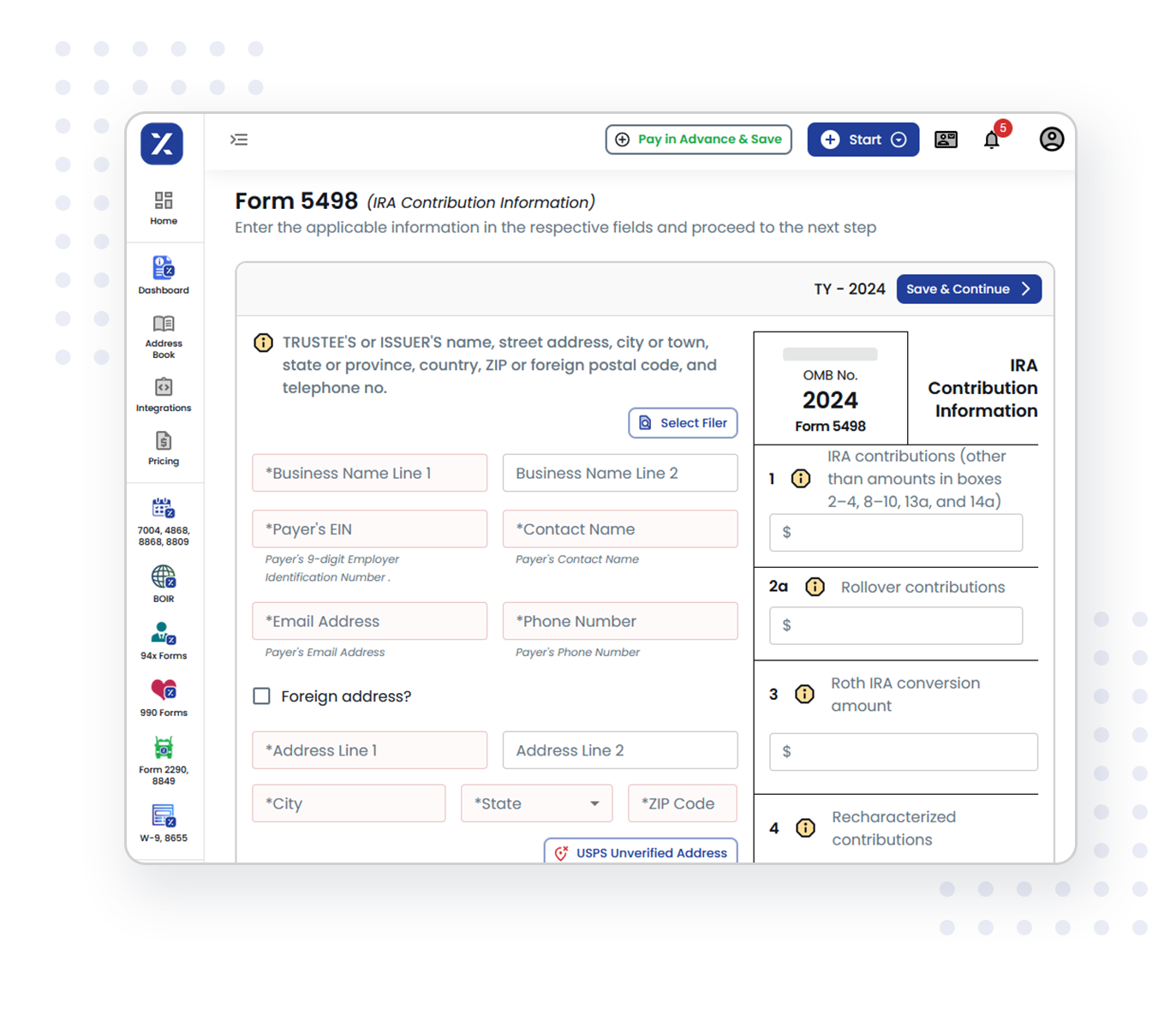

How to E-File IRS 5498 forms using TaxZerone?

E-File your 5498 Forms in 3 Simple Steps

Enter the required details

Enter the trustee or custodian and account holder details.

Provide the account details

Fill in the required details for each account holder including their account type and contribution amount

Transmit to the IRS

Review and securely transmit the return to the IRS. Deliver recipient copies electronically via ZeroneVault.

Benefits of E-Filing the Form 5498 Series with TaxZerone

IRS-Authorized

File your forms with TaxZerone - an IRS authorized e-file provider. We make sure your submissions are handled with high accuracy.

Recipient Copy Distribution

Easily deliver recipient copies via ZeroneVault - fast, secure, and fully IRS-compliant!

Smart Validation System

Ensure your return is accurate and IRS compliant with our advanced validation system which will help you avoid errors.

IRIS Support

TaxZerone supports IRIS (Information Returns Intake System) for all electronic filing of information return.

Bulk Filing

Having multiple forms to file? Our bulk filing feature allows you to upload and file thousands of returns in just a few clicks.

Schedule Filing

With our schedule filing feature, you can prepare the returns ahead of time and choose the exact date you want them submit to the IRS.

Real-Time Updates

From submission to acceptance, track the status of your filings. Get instant notifications and stay always in the loop.

Affordable Pricing

Whether you are filing one form or many, our affordable pricing makes sure you only pay for what you need - no hidden fees.

Expert Support

Having Queries? Our dedicated support team is here to assist you via Email, Phone (in English & Spanish) and Live chat.

Hear What Our Clients Say About Us

- Sophia Davis

- Mason Reed

- Abigail Clark

Common Use Cases

- Recording rollovers or transfers into an ESA

- Providing contribution details to parents/ beneficiaries for education expense tracking.

- Documenting contributions to Archer MSAs or Medicare Advantage MSAs

- Tracking employer vs. employee contributions for healthcare savings accounts

- Providing recipients with annual HSA/MSA contribution summaries

- Documenting annual contributions made to Qualified ABLE (Achieving a Better Life Experience) accounts.

- Recording rollovers or transfers from other ABLE accounts or 529 plans

- Providing year-end fair market value (FMV) of ABLE accounts

- Supplying beneficiaries with annual ABLE account contribution and balance summaries

Competitor Comparison: Why Choose TaxZeronefor 5498 Series E-Filing

| Feature | TaxZerone | Other E-file Platforms | Paper Filing (Manual) |

|---|---|---|---|

| IRS-Authorized E-File Provider | Yes | Varies | No |

| Form Coverage | Supports all 5498 series (5498, 5498-ESA, 5498-SA) | Limited coverage (not all forms supported) | Not Applicable |

| Pricing | As low as $0.59 per form (for 1000+) | Higher filing fees, hidden charges | Printing, postage & manual costs |

| Real-Time Error Validation | Automatic validation before IRS submission | Limited checks | Manual review only |

| Bulk Upload | Accepts extension files | Limited or unavailable | Not possible |

| Corrections & Re-file | Free corrections for rejected returns | Extra charges | Manual corrections, resubmission delays |

| Delivery Options | E-delivery & Postal Mailing | Limited | Manual printing & mailing |

| Recipient Access Portal | ZeroneVault (Secure & IRS-compliant portal) | Not available | Not available |

| Filing Scheduler | Schedule filings in advance | Limited | Not possible |

| Reminders | Email reminders sent before IRS deadlines | Not available | Not available |

| Customer Support | U.S. based support | Limited or email-only | None |

Ready to efile IRS Form 5498 Series?

E-file securely with TaxZerone — IRS authorized, simple, and affordable. Stay compliant, save time, and experience smooth support every step of the way.

Frequently Asked Questions

1. What forms are included in the 5498 series?

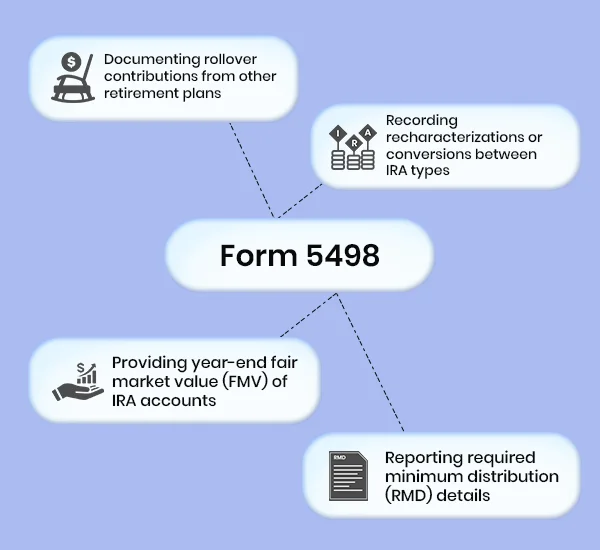

- Form 5498 - Report contributions, rollovers, fair market value (FMV), and required minimum distributions (RMDs) for Individual Retirement Arrangements (IRAs).

- Form 5498-ESA - Report contributions to a Coverdell Education Savings Account (ESA).

- Form 5498-SA - Report contributions and FMV of Health Savings Accounts (HSAs), Archer MSAs, and Medicare Advantage MSAs.

- Form 5498-QA - Report contributions, rollovers, and fair market value (FMV) for Qualified ABLE (Achieving a Better Life Experience) accounts.

2. Who needs to file Form 5498 series?

Any financial institution, bank, or trustee that manages IRAs, HSAs, MSAs, ESAs, or QAs is required to file the applicable Form 5498 series with the IRS and send a copy to the account holder

3. Do I need to send recipient copies?

New here?

Get the support you need.

Resources

Explore the instructions of form 5498, instructions of form 5498-esa, instructions of form 5498-sa and tips to make filing your 5498 series forms simple and Quick.

Blogs

Stay informed with blogs covering IRS updates, IRS deadlines for 5498 forms, and smart filing strategies to ensure your 5498 forms are accurate and on time.

Support Article

Not sure where to begin? Our Support articles will guide you through the 5498 forms filing process with clear answers.

Still have questions about 5498 forms?

Reach out to our friendly support team for all your Queries.