E-File Form 1098 Series for the 2025 Tax Year

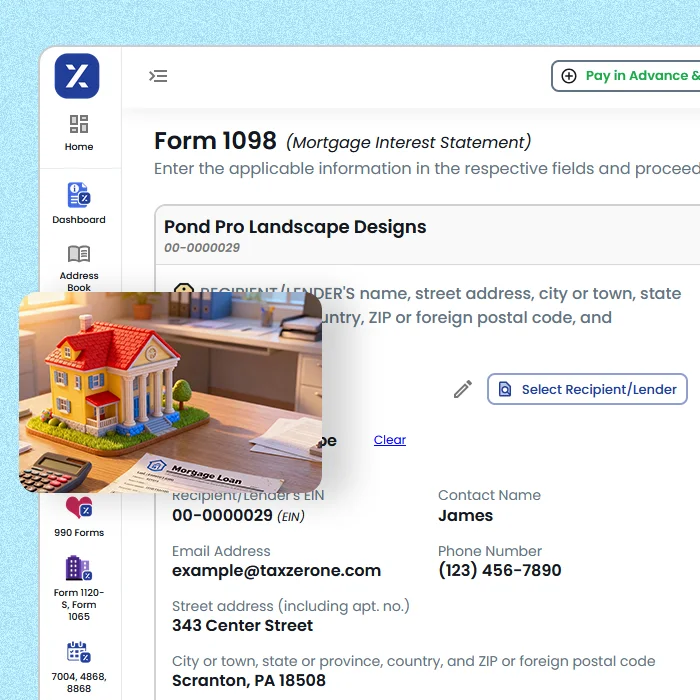

If you are a lender, financial institution, or educational organization, filing your Form 1098 series with TaxZerone is simple and accurate.

E-File Your 1098 Forms at the best price with TaxZerone

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

Pricing Includes

Bulk Filing

Schedule Filing

Transmittal Form 1096

USPS Address Validation

Error Checks

Expert Support

Add-ons Available

| Electronic Delivery | $ 0.50/form |

| Postal Mailing | $1.75/form |

E-File Form 1098 Series Quickly and Accurately with TaxZerone

Who Should File Form 1098s?

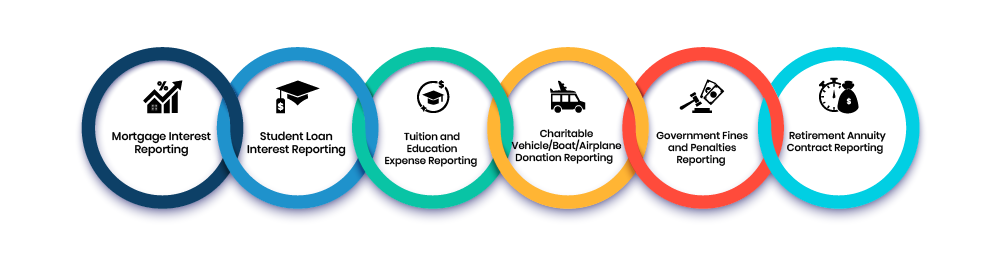

- Form 1098

Lenders, banks, mortgage companies, credit unions, and other financial institutions - Form 1098-C

Charitable organizations that receive a donation of a motor vehicle, boat, or airplane. - Form 1098-E

Financial institutions, government agencies, or educational loan lenders - Form 1098-F

Governmental entities or agencies that have assessed and collected fines, penalties, or other amounts - Form 1098-T

Eligible educational institutions (colleges, universities, vocational schools) - Form 1098-Q

Insurance companies or plan administrators that issue or maintain a Qualifying Longevity Annuity Contract (QLAC).

Why File Form 1098s?

- By filing 1098 forms, institutions and organizations help taxpayers to file their returns correctly and avoid IRS issues.

- Filing Form 1098s helps taxpayers claim eligible deductions and credits on their tax returns.

- Filing these forms provides official documentation of payments received or contributions made.

- Filing will ensure transparency in financial transactions like mortgage interest, tuition and donations.

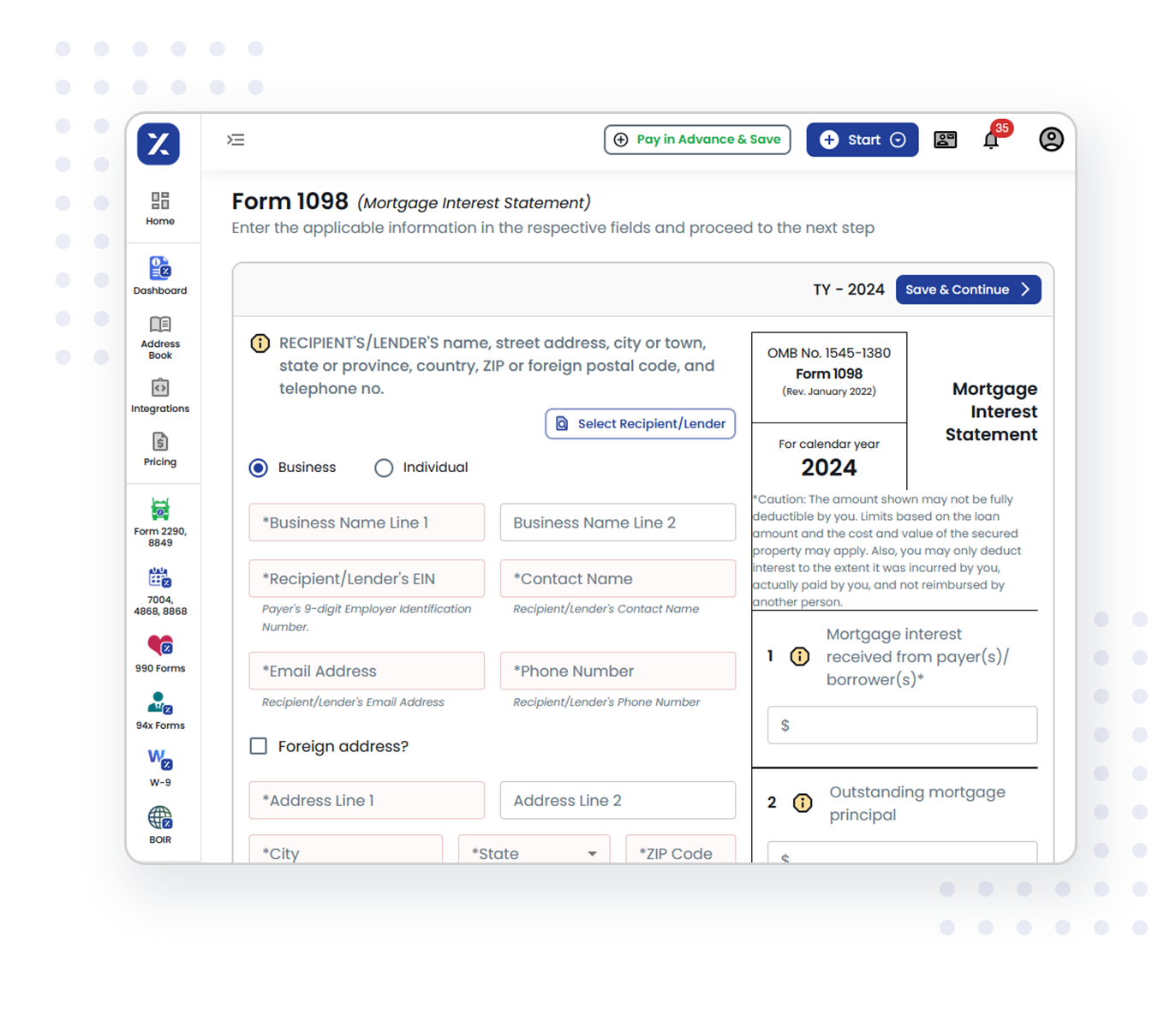

How to E-File Form 1098 series forms using TaxZerone?

E-File your 1098 Forms in 3 Simple Steps

Choose Your Form

Select the applicable form and enter all the required details

Transmit to the IRS

Our built-in error checks ensure accuracy before securely transmitting your form to the IRS.

Deliver Recipient Copies

Deliver your recipient copies via ZeroneVault or Postal Mailing.

Benefits of E-Filing the Form 1098 Series with TaxZerone

Easy Filing

With TaxZerone’s step-by-step instructions, you will be guided clearly through the entire process from entering your information to transmitting return to the IRS.

Bulk Upload

Struggling with filing multiple forms? No worries – TaxZerone's Bulk upload feature will help you to file multiple forms at once.

ZeroneVault

Deliver your recipient’s copy instantly with ZeroneVault – a secure way to send the copy of the form.

IRIS Support

TaxZerone supports IRIS (Information Returns Intake System) for all electronic filing of information return.

Real-Time Updates

Stay informed at every step of your Form 1098 filing with TaxZerone, from submission to IRS acceptance, through timely email notifications sent directly to your inbox.

Schedule Filing

With our schedule filing feature, you can prepare the returns ahead of time and choose the exact date you want them submit to the IRS.

Affordable Pricing

TaxZerone offers an affordable price in the industry, making reliable and IRS-compliant e-filing accessible for everyone.

Smart Validations

Our smart system validates your forms for any errors before sending them to the IRS, so you can file with confidence.

Expert Support

Stuck with filing-related Queries? Our expert support team is there to guide you via Email, Phone (English & Spanish), and live chat.

Hear What Our Clients Say About Us

- Harper Lewis

- Jackson Hayes

- Madison Taylor

Common Use Cases

Competitor Comparison: Why Choose TaxZeronefor 1098 Series E-Filing

| Feature | TaxZerone | Other E-file Platforms | Paper Filing (Manual) |

|---|---|---|---|

| IRS-Authorized E-File Provider | Yes | Varies | No |

| Form Coverage | Supports all 1098 series (1098, 1098-C, 1098-E, 1098-F, 1098-T, 1098-Q) | Limited coverage (not all forms supported) | Not Applicable |

| Pricing | As low as $0.59 per form (for 1000+) | Higher filing fees, hidden charges | Printing, postage & manual costs |

| Real-Time Error Validation | Automatic validation before IRS submission | Limited checks | Manual review only |

| Bulk Upload | Accepts extension files | Limited or unavailable | Not possible |

| Corrections & Re-file | Free corrections for rejected returns | Extra charges | Manual corrections, resubmission delays |

| Delivery Options | E-delivery & Postal Mailing | Limited | Manual printing & mailing |

| Recipient Access Portal | ZeroneVault (Secure & IRS-compliant portal) | Not available | Not available |

| Filing Scheduler | Schedule filings in advance | Limited | Not possible |

| Reminders | Email reminders sent before IRS deadlines | Not available | Not available |

| Customer Support | U.S. based support | Limited or email-only | None |

Ready to E-File your 1098 forms?

E-file your Form 1098 series with TaxZerone today! We makes electronic filing simple, secure, and affordable.

Frequently Asked Questions

1. What is the Form 1098 series used for?

2. Which forms are included in the Form 1098 series at TaxZerone?

The forms included in the 1098 series is

- Form 1098 - Mortgage Interest Statement

- Form 1098-C - Contributions of Motor Vehicles, Boats, and Airplanes

- Form 1098-E - Student Loan Interest Statement

- Form 1098-F - Fines, Penalties, and Other Amounts

- Form 1098-T - Tuition Statement

- Form 1098-Q - Qualifying Longevity Annuity Contract Information

3. Do I need to file 1098 forms electronically?

New here?

Get the support you need.

Still have questions about 1098 forms?

Reach out to our friendly support team for all your Queries.