E-File IRS Form 990-T for the 2025 Tax Year

- Effortlessly report your nonprofit’s unrelated business income (UBI) with TaxZerone.

- You can file all additional forms, such as 3800, 3468, 8911, and 8936 for FREE!

- TaxZerone supports tax years 2025, and 2024.

File Form 990-T online for $129.99.

TaxZerone helps you file your unrelated business income tax with accuracy, convenience, and reliability.

No additional or hidden cost for supporting schedules.

Why Choose TaxZerone?

Check out the features that make TaxZerone an ideal choice for exempt organizations to e-file 990-T returns.

Seamless Status Tracking

Know exactly where your filing stands. Once submitted, TaxZerone informs you with real-time updates on your return's status. No more waiting for your tax-exempt status!

IRS-authorized

File with confidence. TaxZerone is an IRS-authorized e-filing provider, ensuring your 990-T is seamlessly accepted by the IRS

Guided Filing

Access step-by-step instructions to complete filing quickly. You can also access our help articles to understand Form 990-T return better.

Pay Securely with PayPal

Complete your filing with confidence using PayPal. It's fast, secure, and offers added payment flexibility—no need to enter card details directly.

Unparalleled Security

Your privacy is paramount. TaxZerone utilizes advanced security measures to safeguard your information throughout the e-filing process. Rest assured, your 990-T is submitted securely to the IRS.

Free Retransmission

If the IRS rejects your 990-T due to any errors, you can correct the issues and retransmit the return without any additional fee.

Effortless Navigation

TaxZerone's intuitive interface lets you complete your entire 990-T e-filing in minutes. Simply answer a series of clear questions, and our software will handle the rest.

Accuracy and Compliance

Built-in IRS validation checks are integrated seamlessly within our platform. These proactive measures minimize errors, ensuring your 990-T is filed accurately, and minimizing the chances of IRS rejections.

TaxZerone supports filing for multiple tax years, helping you efficiently manage past and current returns.

E-File Form 990-T NowSimplified e-filing process

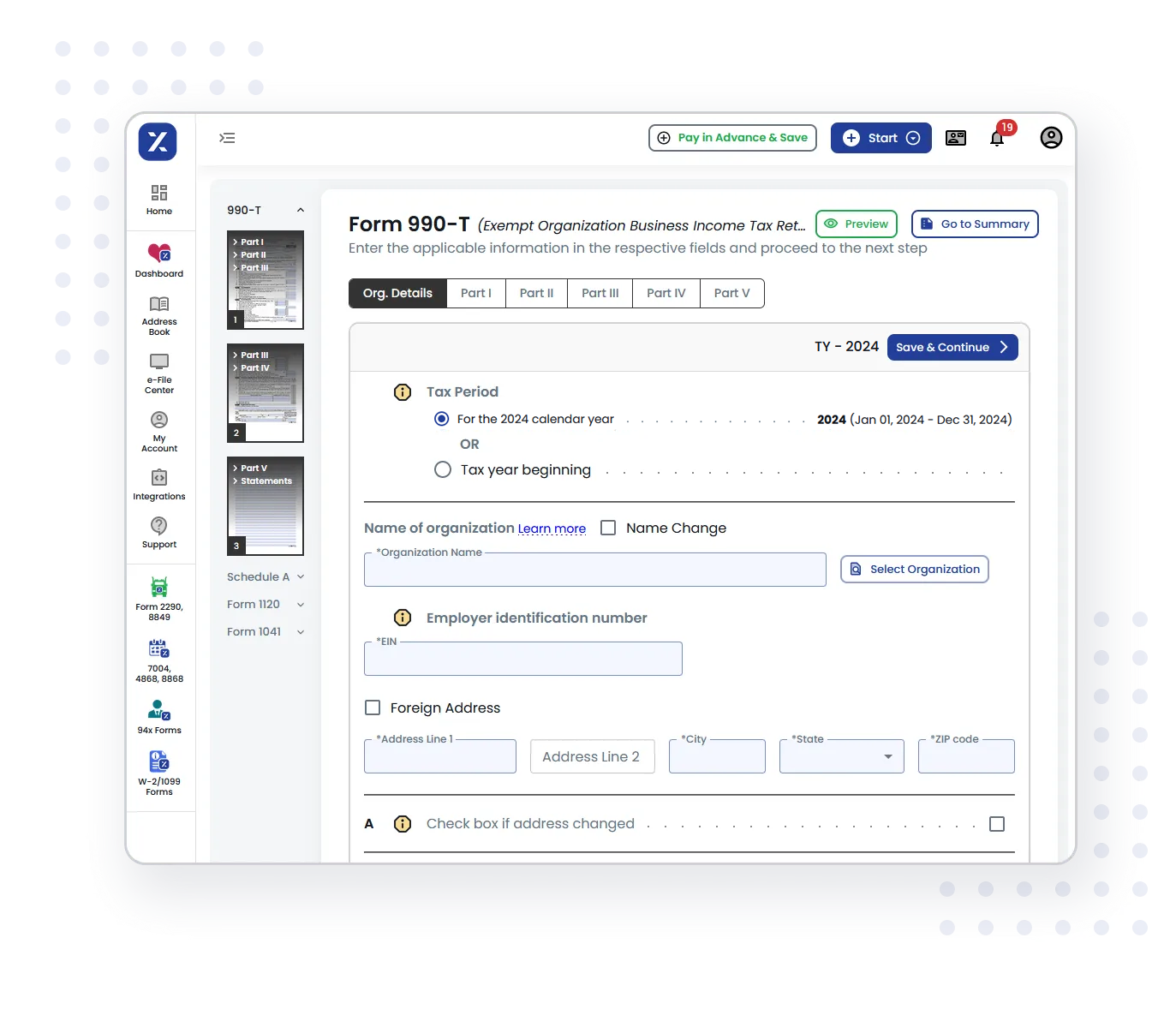

Form 990-T e-filing made simple with TaxZerone

Follow the steps below to file Form 990-T for your exempt organization.

Provide Organization Details

Choose the tax year you want to file a return and provide your organization’s details.

Preview the return

Review the information provided in the return for accuracy before transmitting.

Transmit to the IRS

Transmit your 990-T return to the IRS and get the acceptance in just a few hours.

Stay tax compliant with the IRS

Supporting Forms for 990-T

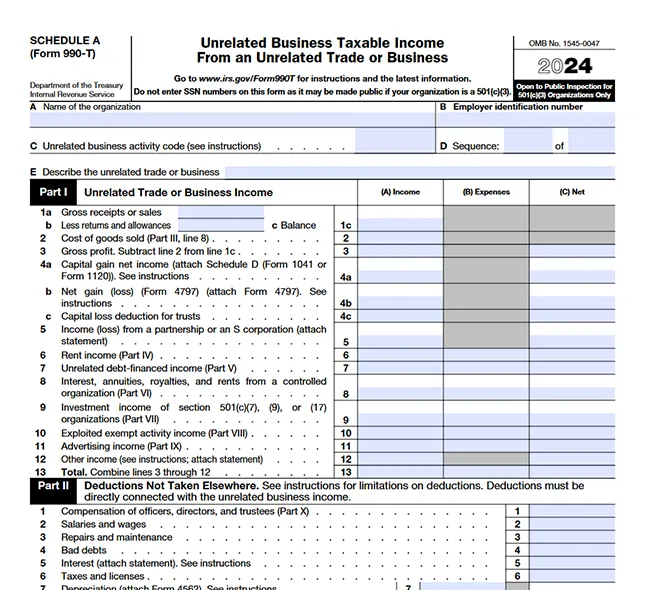

TaxZerone currently supports the following 990-T schedules and other related forms for FREE!

They will be auto-generated while you file your 990-T form with us.

- Schedule A - Unrelated Business Taxable Income From an Unrelated Trade or Business

- 1120 Schedule D - Capital Gains and Losses

- 1041 Schedule D - Capital Gains and Losses

- 1041 Schedule I - Alternative Minimum Tax—Estates and Trusts

- Form 4797, Sales of Business Property

- Form 4562, Depreciation and Amortization

- Form 8949, Sales and Other Dispositions of Capital Assets

- Form 8995, Qualified Business Income Deduction Simplified Computation

- Form 2220, Underpayment of Estimated Tax by Corporations

Get More Information on Form 990-T Instructions and Schedule A Instructions

Hear What Our Clients Say About TaxZerone

e-filing process so much easier and faster. Highly recommended!

Stay Tax-Exempt Status with TaxZerone

It's time to simplify your e-filing process with TaxZerone!

E-file Form 990-T and keep enjoying the benefits of your tax-exempt status!

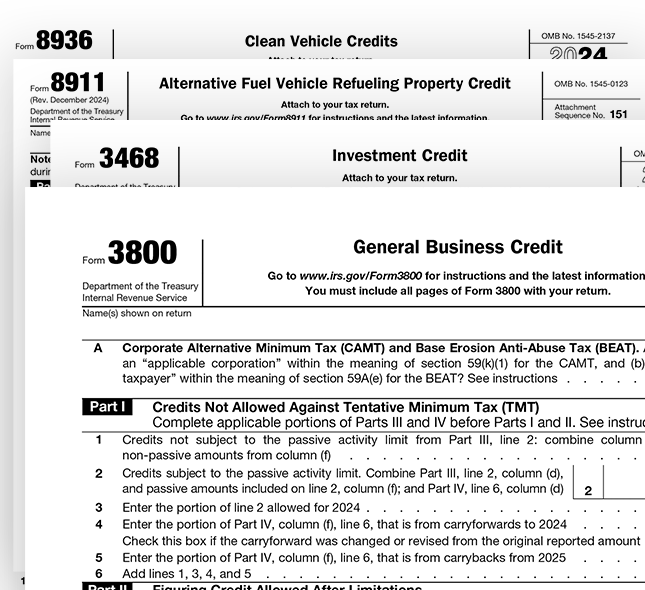

Claiming Credits with Form 990-T

When filing your Form 990-T, your exempt organization may be eligible to claim various credits to reduce your tax liability. To accurately claim these credits, you'll need to complete and attach specific forms to your 990-T return.

TaxZerone supports the following IRS forms, making it easy to claim your eligible credits:

- Form 3800 - General Business Credit Claim credits for activities like research and development, investment in certain properties, and energy efficiency improvements.

- Form 3468 - Investment Credit

Claim credits for investments in energy property, new equipment, and qualified rehabilitation expenditures. - Form 8911 - Alternative Fuel Vehicle Refueling Property Credit Claim credits for investments in alternative fuel vehicle refueling property, such as fueling stations and dispensers.

- Form 8936 - Clean Vehicle Credits Claim credits for purchases of qualified plug-in electric drive motor vehicles, fuel cell vehicles, and certain motorcycles.

Each of these forms covers a unique set of credits, making it easy to maximize your organization’s tax benefits. TaxZerone supports all these forms, ensuring a seamless experience as you file Form 990-T with the necessary attachments.

E-File Form 990-TFrequently Asked Questions - Form 990-T

1. What is IRS Form 990-T?

2. When is the deadline to file Form 990-T?

3. Who must file Form 990-T?

4. How to extend the deadline of Form 990-T?

5. How does Form 990 differ from Form 990-T?

- Form 990 is filed by large organizations with gross receipts ≥ $200,000 or total assets ≥ $500,000 during the tax year.

- Form 990-T is a supporting form filed by nonprofits when they have an unrelated business income of $1000 or more in the tax year.

Related Resources

Form 990-T Instructions

Read the Instructions for Form 990-T to file accurately with TaxZerone.

Form 990-T Due Date

Know more about the Due Date of Form 990-T and file your form on time.

Form 990-T Schedules

Learn more about Form 990-T Schedule A and file easily.