Revised IRS Form 941 for 2024

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

As a business owner, one of your quarterly responsibilities is completing Federal Form 941. To be compliant and avoid IRS penalties, you must file Form 941 every quarter without fail.

As the COVID-19 pandemic has officially ended, the IRS has revised Form 941 for 2024 to reflect the conclusion of pandemic-related tax relief programs. The new version removes several lines that were added specifically to account for COVID-related tax credits, such as the Employee Retention Credit and sick/family leave credits. These changes simplify the filing process for employers moving forward.

Here, we’ll walk you through the key updates to IRS Form 941 for 2024, important filing deadlines, and the steps to ensure compliance with the revised tax requirements.

Key Changes in IRS Form 941 for 2024

The 2024 version of the form has been revised to accommodate the following updates:

Social Security and Medicare Tax for 2024:

- The Social Security tax rate on taxable wages is 6.2% for both the employer and employee. The wage base limit for Social Security is $168,600.

- The Medicare tax rate remains unchanged at 1.45% for both the employee and employer. There is no wage base limit for Medicare tax.

- Social Security and Medicare taxes apply to the wages of household workers you pay $2,700 or more in cash wages in 2024.

- Social Security and Medicare taxes also apply to election workers who are paid $2,300 or more in cash or equivalent compensation in 2024.

New Form 941 (sp):

- Form 941-SS, Employer’s QUARTERLY Federal Tax Return for American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands, as well as Form 941-PR, Planilla para la Declaración Federal TRIMESTRAL del Patrono, were discontinued after the fourth quarter of 2023. Starting in 2024, employers in U.S. territories should file Form 941. If you prefer the form and instructions in Spanish, you can file the new Form 941 (sp).

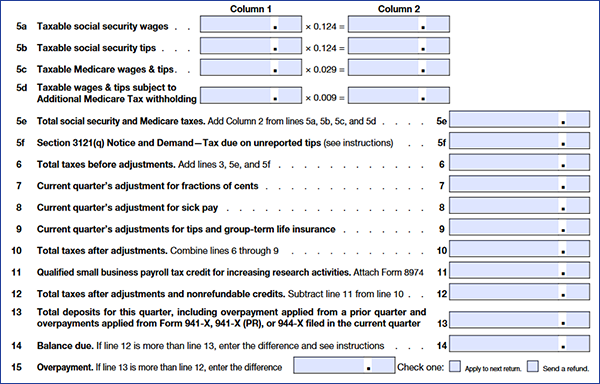

Below are the lines that have been removed from Form 941 for 2024:

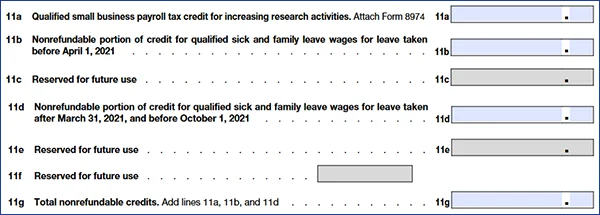

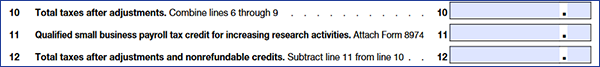

- In Part 1, Lines 11a to 11g have been removed. Instead, Line 11 will now include information regarding Form 8974 (Payroll Tax Credit for Qualified Small Businesses for Increasing Research Activities). Refer to the image attached below.

- Form 941, 2023

- Revised Form 941, 2024

- Lines 13a to 13i have also been removed. Instead, Line 13 will now include information on the total deposits for the quarter, including overpayments applied from a prior quarter and overpayments from Form 941-X, Form 941-X (PR), Form 944-X, or Form 944-X (SP) filed in the current quarter.

- In Part 3, Lines 19 to 28 have been removed.

What are the Form 941 quarterly deadlines for the 2024 tax year?

Form 941 is due by the last day of the month following the end of each quarter. For example, wages paid during the 1st quarter (January through March) must generally be reported by April 30.

The deadlines for Form 941 in 2024 are listed below:

| Reporting Quarter | Deadline |

|---|---|

| Q-1 (January - March) | April 30, 2024 |

| Q-2 (April - June) | July 31, 2024 |

| Q-3 (July - September) | October 31, 2024 |

| Q-4 (October - December) | January 31, 2025 |

How to E-file Form 941 for the 2024 Tax Year with TaxZerone?

Follow the simple steps outlined below to complete and submit your forms to the IRS in minutes!

Step 1: Sign in or create a free TaxZerone account today!

Step 2: Select Form 941 from the list of forms and enter the details.

Step 3: Review and transmit the return to the IRS.

Form 941 has undergone substantial modifications for the 2024 tax year, including reduced Social Security and Medicare tax limits and the elimination of COVID-19 credits. Employers must meet quarterly filing requirements. Using an IRS-authorized platform, such as TaxZerone, simplifies the process while maintaining accuracy and compliance.

Ready to get started with Form 941 e-filing?

TaxZerone has incorporated all the IRS changes in Form 941 for the 2024 tax year.

Click the button below and start your filing process with TaxZerone.

Takes 3 simple steps