Attention Nonprofits! E-file Form 990-EZ for the 2025 Tax Year Return to report financial details and remain IRS-compliant.

E-File IRS Form 990-EZ for the 2025 Tax Year

- Quickly report your nonprofit’s annual financial information with TaxZerone.

- TaxZerone supports all additional Schedules for FREE!

- We support tax years 2025, 2024, and 2023.

File Form 990-EZ online for just $89.99.

TaxZerone offers competitive pricing with a simple, fast, and affordable e-filing process for nonprofits.

No additional or hidden cost for supporting schedules.

Who Should File IRS Form 990-EZ?

To determine if Form 990-EZ suits your nonprofit, consider the following eligibility criteria:

- Gross Receipts : Nonprofits with gross receipts below $200,000 can opt for Form 990-EZ instead of the more comprehensive Form 990.

- Total Assets : Organizations with total assets under $500,000 at the end of the reporting year are eligible to file Form 990-EZ.

- Nonprofit Type : This form is typically used by mid-sized public charities, social welfare organizations, and other specific tax-exempt groups. Verify that your organization’s tax-exempt classification meets IRS guidelines for Form 990-EZ.

If your organization exceeds these thresholds, you may need to file the standard Form 990. For smaller nonprofits with gross receipts of $50,000 or less, Form 990-N (e-Postcard) may be a more suitable option.

Form 990-EZ e-filing made easy with TaxZerone

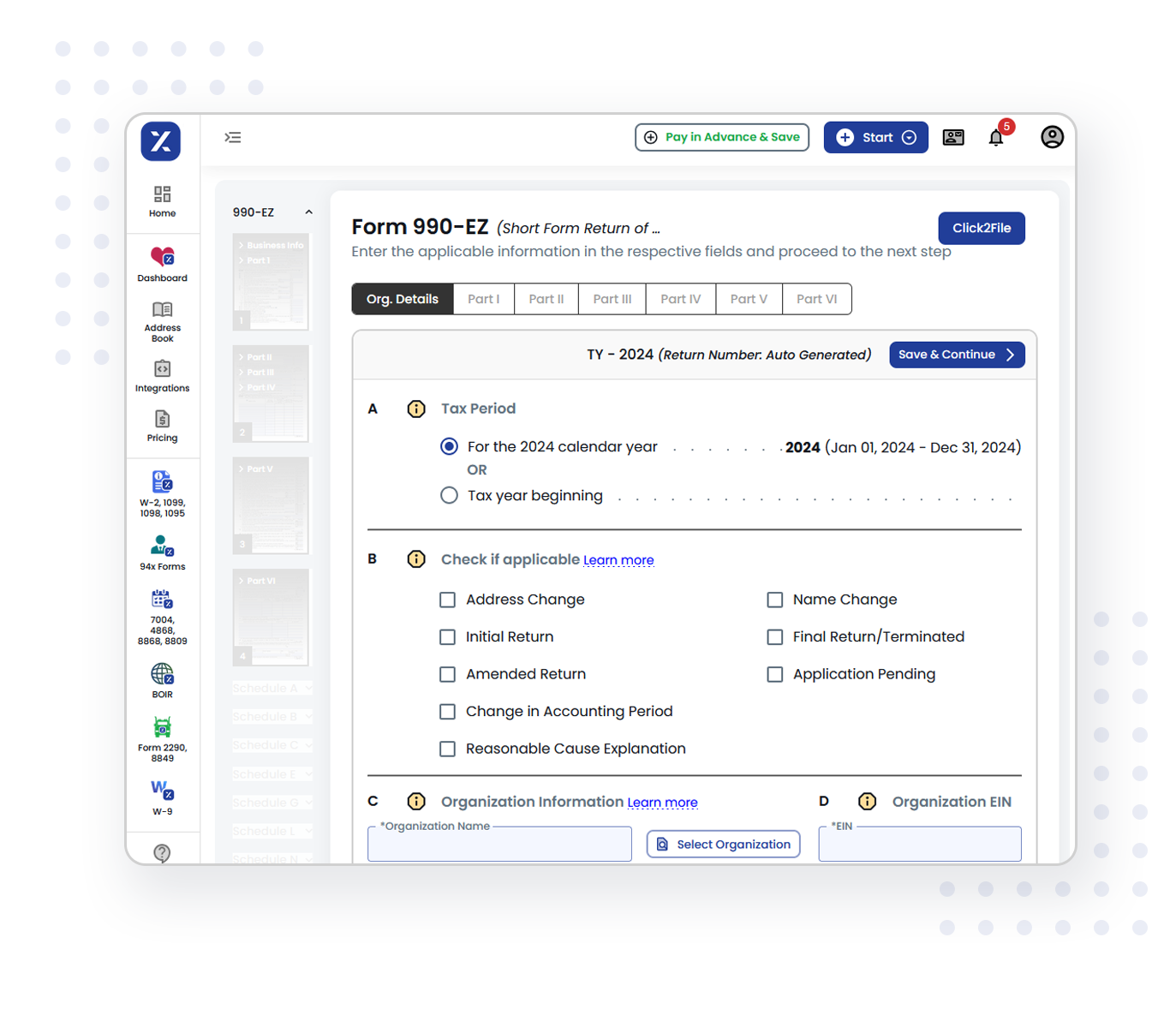

Follow the steps below to file Form 990-EZ for your exempt organization.

Provide Organization Details

Choose the tax year for which you want to file a return, and provide your organization’s details.

Preview the return

Review the information provided in the return for accuracy before transmitting.

Transmit to the IRS

Transmit your 990-EZ return to the IRS and get the acceptance in just a few hours.

Stay tax compliant with the IRS

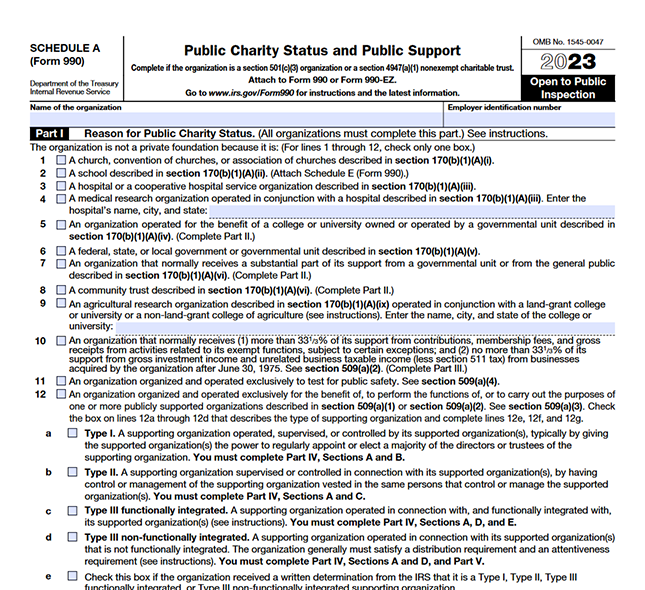

Schedules for Form 990-EZ

TaxZerone supports all the 990-EZ schedules for FREE!

These schedules will be auto-generated while you file your 990-EZ form with us.

- Schedule A - Public Charity Status and Public Support.

- Schedule B - Schedule of Contributors.

- Schedule C - Political Campaign and Lobbying Activities.

- Schedule E - Schools.

- Schedule G - Supplemental Information Regarding Fundraising or Gaming Activities.

- Schedule L - Transactions With Interested Persons.

- Schedule N - Liquidation, Termination, Dissolution, or Significant Disposition of Assets.

- Schedule O - Supplemental Information to Form 990-EZ.

Get More Information on Form 990-EZ Instructions

Why Choose TaxZerone?

Check out the features that make TaxZerone an ideal choice for exempt organizations to e-file 990-EZ returns.

Get Instant Updates on Your Filing Status

Once you've completed filing Form 990-EZ online, our system keeps you informed about the status of your return. No more waiting to confirm your tax-exempt status—get updates in real time.

IRS-authorized

File your 990-EZ return through TaxZerone, an e-file service provider authorized by the IRS, and be assured that the IRS will accept your return.

Guided Filing

Access step-by-step instructions to complete filing quickly. You can also access our help articles to understand Form 990-EZ Tax return better.

Pay Securely with PayPal

Complete your filing with confidence using PayPal. It's fast, secure, and offers added payment flexibility—no need to enter card details directly.

Click2File for Effortless Filing

With Click2File, we automatically transfer relevant data from your previous return to your current one, making filing even easier and faster.

Free Retransmission

If the IRS rejects your 990-T due to any errors, you can correct the issues and retransmit the return without any additional fee.

Secure E-filing

Advanced security measures to ensure your personal information is kept safe throughout the e-filing process. Your 990-EZ return will be submitted securely to the IRS.

Easy E-filing

Simple navigating and a user-friendly interface to e-file Form 990-EZ within minutes. Just answer a series of simple questions, and we'll cover the rest!

Accurate and Compliant

Our platform supports built-in IRS validation checks that minimize errors to ensure that your 990-EZ return is accurate and accepted by the IRS.

TaxZerone supports filing for multiple tax years, helping you efficiently manage past and current returns.

Benefits of Filing Form 990-EZ Online with Us

Simplified Reporting

Only report essential financial and operational details relevant to mid-sized organizations.

Time-Saving

Complete your form faster with fewer sections, thanks to the streamlined format.

Avoid Costly Penalties

Meet IRS deadlines and safeguard your tax-exempt status.

Resources to Help You File Accurately

Explore our resources to ensure a smooth filing process:

- Step-by-Step Filing Guide Get a clear, easy-to-follow guide for each section of Form 990-EZ.

- Eligibility Checklist Confirm that Form 990-EZ is the appropriate form for your organization.

- IRS Filing Instructions Access the latest filing guidelines directly from the IRS website.

Hear What Our Clients Say About Us

- Brian Jackson

- Kevin Kent

-Ronald Lee

Keep Enjoying Your Tax-Exempt Status with TaxZerone

It's time to simplify your e-filing process with TaxZerone!

E-file Form 990-EZ and keep enjoying the benefits of your tax-exempt status!

Frequently Asked Questions

1. What is IRS Form 990-EZ?

IRS Form 990-EZ is a simplified version of Form 990, which serves as an annual information return filed by tax-exempt organizations under section 501(c) of the Internal Revenue Code. Exempt organizations with gross receipts less than $200,000 and total assets less than $500,000 must file Form 990-EZ with the IRS.

The 990-EZ short form is specifically designed for small to medium-sized tax-exempt organizations, including specific nonprofits and charities.

2. When is the deadline to file Form 990-EZ?

3. Why Should I File Form 990-EZ?

4. When should Form 990-T filed along with Form 990-EZ?

5. How to extend Form 990-EZ deadline?

6. How does Form 990 differ from Form 990-EZ?

| Form 990 | Form 990-EZ |

|---|---|

| Filed by large organizations with gross receipts ≥ $200,000 or total assets ≥ $500,000 | Filed by mid-size organizations with gross receipts < $200,000 and total assets < $500,000 |

| It is a long and more detailed form | It is a short form of Form 990 |

7. How to correct errors in previously filed Form 990-EZ?

- If you used TaxZerone to file the original return:

- Go to Exempt Organization Forms dashboard.

- Choose Form 990-EZ.

- Clicking on “Amend Return” will automatically transfer all field values from the original return to the amended one.

- You must provide a reason for the amendment, correct any errors, and submit the amended return to the IRS.

- In case you filed your original Form 990-EZ with another service provider, easily make amendments using TaxZerone.

Related Resources

Form 990-EZ Instructions

Read the Instructions for Form 990-EZ and file easily using TaxZerone.

Form 990-EZ Due Date

Know more about the Due Date of Form 990-EZ and file your form on time.

Form 990-EZ Schedules

Learn more about Form 990-EZ Schedules to file accurately.