E-file IRS Form 5227 for the 2025 Tax Year

E-file Form 5227 with TaxZerone to report the financial activities of a split-interest trust, disclose charitable deductions and distributions, and determine private foundation status and subject to certain excise taxes under Chapter 42.

File Form 5227 online for $179.99.

TaxZerone offers reliable e-filing solutions to keep your nonprofit reporting compliant and stress-free

No additional or hidden cost for supporting schedules.

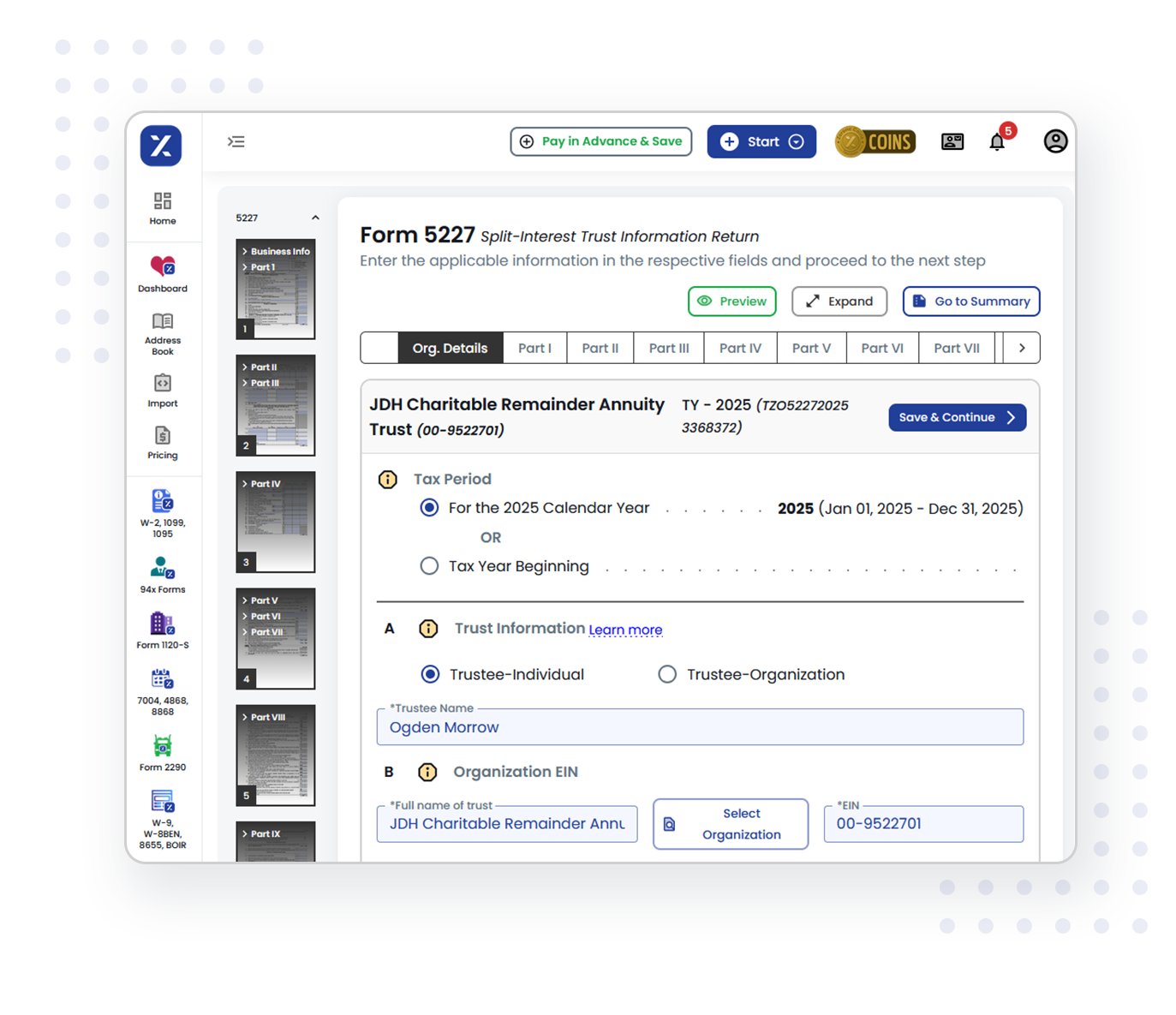

E-file Form 5227 with TaxZerone in 3 simple steps!

Select Form 5227 and Provide Trust Details

Choose the tax year you want to file a return and provide your trust’s basic details.

Enter Trust Information

Fill in financial activities, charitable deductions, and distribution data.

Review and Transmit to the IRS

Double-check your return, submit it securely, and get instant confirmation from the IRS.

Supporting Form and Schedules for Form 5227

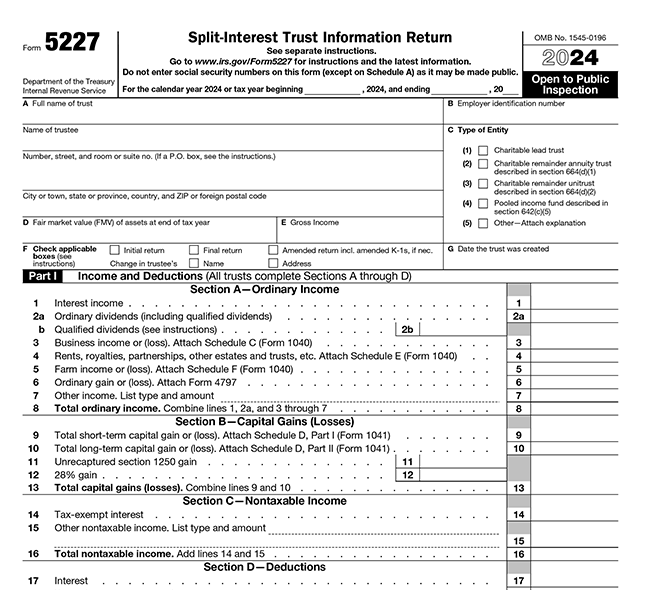

Form 5227 may require you to attach or reference supporting forms and

schedules, depending on the trust’s activities.

Common supporting forms and schedules include:

- Schedule A (Form 5227) - This applies to all types of trusts

- Form 990-T - Exempt Organization Business Income Tax Return Required if the trust has unrelated business taxable income (UBTI).

- Schedule K-1 (Form 1041) - Beneficiary’s Share of Income, Deductions, Credits, etc.

- Form 4797 - Sales of Business Property

- Schedule E (Form 1040) - Supplemental Income and Loss from Rental royalties, partnerships, other estates and trusts

- Schedule D (Form 1041) - Used if the trust has capital gains or losses.

Why Choose TaxZerone?

Check out the features that make TaxZerone an ideal choice for split-interest trusts to e-file 5227 returns.

Real-Time Status Updates

Stay informed at every step. TaxZerone provides real-time updates on your return’s status after submission—no more guessing or delays.

IRS-Authorized Provider

File with confidence using TaxZerone, an IRS-authorized e-filing provider that ensures smooth Form 5227 submission.

Step-by-Step Guidance

Quickly complete your filing with clear instructions and helpful articles to better understand Form 5227.

Pay securely with PayPal

File confidently with PayPal, a fast, secure, and flexible payment method, where you can make payments without entering your card details directly.

Top-Level Security

TaxZerone protects your privacy with advanced measures, ensuring your Form 5227 is safely submitted to the IRS.

Free Retransmission

If the IRS rejects your 5227 returns, fix errors and resend it without any additional fee.

Seamless Filing Experience

With TaxZerone’s user-friendly design, e-filing Form 5227 is now a breeze. Simply respond to questions, and our system takes care of the rest.

Reliable Accuracy and Compliance

Our platform includes automatic IRS validation checks to catch potential errors early. This helps ensure your Form 5227 is submitted accurately and reduces the risk of rejection by the IRS.

File with Confidence

Our smart validation system looks up for common errors before you file—helping you submit a precise, rejection-free Form 5227. Get it right the first time with our built-in accuracy checks.

TaxZerone allows you to file returns for multiple tax years, making it easy to manage both past and current filings efficiently.

E-file Form 5227 NowHear What Our Clients Say About TaxZerone

Stay Tax Compliant with TaxZerone

It's time to simplify your e-filing process with TaxZerone!

E-file Form 5227 and keep enjoying the benefits of your tax-exempt status!

Frequently Asked Questions

1. What is IRS Form 5227 used for?

2. What kind of information is reported on Form 5227?

3. When is Form 5227 due?

4. Does Form 5227 Require Payment of Taxes?

5. What are the penalties for filing Form 5227 late or incorrectly?

The penalty is $25 for each day the failure continues with a maximum of $12,500 for any one return. However, if the trust has gross income greater than $318,500, the penalty is $125 for each day the failure continues with a maximum of $63,500 for any one return.