📢Attention S Corporations! E-file your 2025 Form 1120-S online and securely deliver Schedule K-1s to shareholders.

File IRS Form 1120-S Online for the 2025 Tax Year

E-file your S corporation’s income tax return with ease. TaxZerone offers a secure, accurate, and IRS-authorized way to file Form 1120-S online - whether you're filing for a single S corp or managing multiple entities.

File Form 1120-S Online for Just $179.99

One flat fee. No hidden charges. Your complete 1120-S e-filing includes K-1 generation for all shareholders.

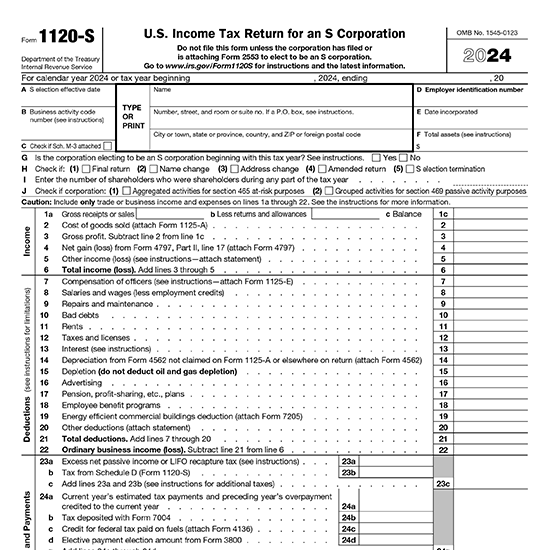

What is IRS Form 1120-S?

IRS Form 1120-S is the annual income tax return filed by S corporations. It reports your company’s income, gains, losses, deductions, and credits - and it’s also used to generate Schedule K-1 for shareholders to report on their personal returns.

Form 1120-S is crucial for maintaining S corporation compliance. Late or incorrect filings can result in penalties or loss of S Corp status.

What You’ll Need to File 1120-S

- Corporation Details: Name, EIN, business address, incorporation date

- Income and Expenses: Revenue, cost of goods sold, deductions, and credits

- Shareholder Information: Name, TIN, percentage ownership, and distributions

- K-1 Allocations: Profit/loss distributions to each shareholder

- Balance Sheet Details: Assets, liabilities, and retained earnings

Eligibility Checklist: Is Form 1120-S Right for Your Business?

Before you file, make sure your business qualifies:

- Your business is a domestic corporation or an LLC that has filed and received IRS approval for

Form 2553 (Election by a Small Business Corporation). - You have income, gains, losses, deductions, or credits to report from U.S. operations.

- Your company has 100 or fewer shareholders.

- All shareholders are U.S. persons (individuals, estates, certain trusts, or qualifying exempt organizations).

- You issue only one class of stock.

If your business meets these criteria, you are required to file Form 1120-S to report your S Corporation’s income and distribute Schedule K-1s to shareholders for their individual tax filings.

Still Unsure?

Contact Our Support

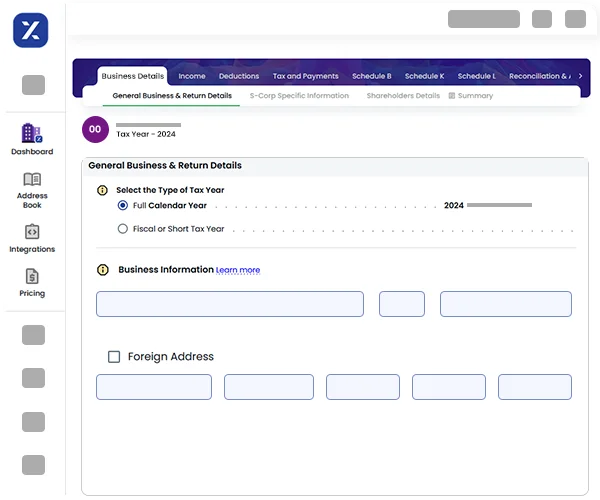

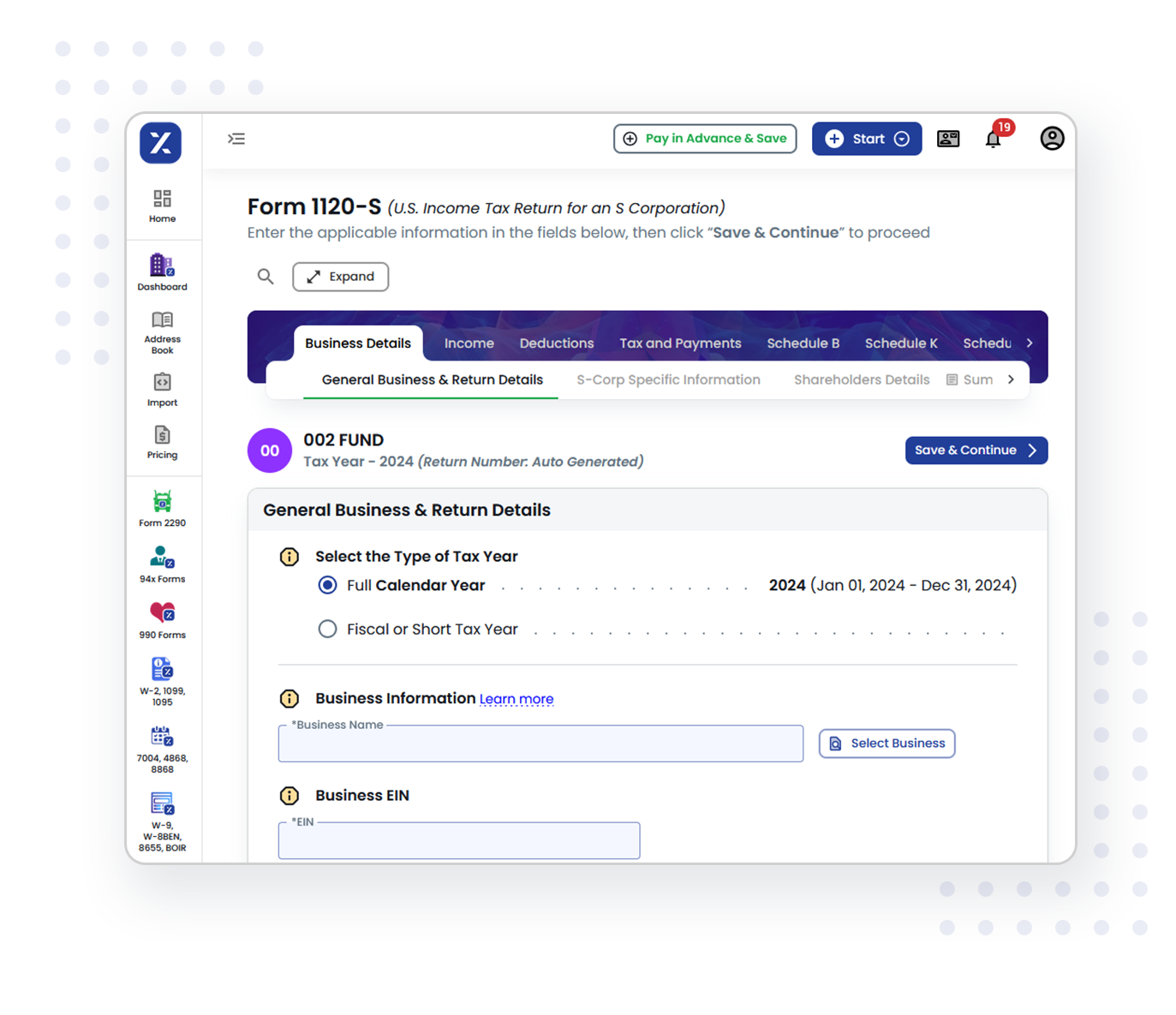

How to E-file Form 1120-S with TaxZerone

Filing your Form 1120-S is quick and easy - just follow these steps:

Enter Company Details

Choose Form 1120-S after login and enter corporation and shareholder details via our intuitive interface.

Add Income, Expenses & K-1 Data

Input your business income, deductions, and automatically generate K-1s for shareholders.

Validate & E-file

Our built-in validation checks help ensure your return meets IRS standards before submission.

Distribute K-1s to Shareholders.

After filing, easily send K-1s digitally via ZeroneVault or by mail.

Why Choose TaxZerone for Form 1120-S E-filing?

IRS-Authorized Provider

Submit your corporate tax return with full confidence on a trusted, IRS-approved platform.

Guided Filing

Even if it’s your first time filing 1120-S, our system guides you through every section.

K-1 Auto-Generation

Simplify shareholder reporting with automatic Schedule K-1 generation and delivery.

Quick Repeat Filing

Returning users can copy prior-year data for faster, easier submissions.

Advanced Error Checks

We scan for missing TINs, calculation errors, and common mistakes-minimizing IRS rejections.

Transparent Pricing

No hidden charges. Pricing that scales with your needs.

Key Schedules Included with IRS Form 1120-S

When filing your S Corporation tax return, several crucial schedules must accompany Form 1120-S to provide a comprehensive financial and tax overview to the IRS:

- Schedule K: This schedule summarizes each shareholder’s share of the corporation’s income, deductions, credits, and other tax-related items for the year.

- Schedule K-1: Provided individually to each shareholder, Schedule K-1 details their specific portion of the S Corporation’s income or loss to be reported on their personal tax returns.

- Schedule L: Presents the corporation’s balance sheet, showing assets, liabilities, and equity at the start and end of the tax year.

- Schedule M-1: Reconciles the difference between the corporation’s book income (financial accounting) and taxable income on the return.

- Schedule M-2: Tracks changes in the corporation’s retained earnings and accumulated adjustments during the year.

Completing these schedules accurately is essential to comply with IRS regulations and helps prevent errors or delays in processing your tax return.

Stay Compliant, File Online

Filing Form 1120-S Made Simple for Small Corporations & First-Time Filers

Starting an S Corporation comes with big responsibilities-and filing your first Form 1120-S doesn’t have to be overwhelming. At TaxZerone, we simplify the process so you can focus on running your business, not navigating IRS complexities.

Why This Matters for Small Corporations

- Straightforward Pricing: A single flat fee with no surprise charges-perfect for businesses managing tight budgets.

- Step-by-Step Guidance: Our platform is designed for filers with little to no prior experience, breaking down IRS requirements into easy steps.

- Automatic K-1 Generation: Instantly generate and distribute Schedule K-1s for all shareholders without extra work.

- Error-Free Filing: Built-in validation checks catch common mistakes that could delay your return or trigger IRS notices.

First-Time Filers Get Extra Peace of Mind

- Clear Explanations at Every Step: We keep things easy to understand by avoiding complex tax terminology.

- Free Resources & FAQs: Access practical guides tailored for new S Corporation owners.

- Dedicated Support Team: Whether it’s your first filing or you just need reassurance, our experts are ready to help.

Special Pricing for CPAs & Tax Professionals

Got more than one 1120-S to file? Let’s talk savings. We offer exclusive bulk discounts, flexible pricing, and white-glove support for tax professionals and CPAs handling multiple businesses.

- Bigger filings = Bigger discounts

- Save time with reusable business profiles

📞 Contact Us Now to unlock your custom CPA pricing and make this tax season your easiest yet.

For Fiscal-Year S Corporations

If your S corp uses a fiscal year (any year ending on a month other than December), the due date is:

The 15th day of the 3rd month after your fiscal year ends.

Example:

- If your fiscal year ends June 30, 2026, your 1120-S is due September 15, 2026.

- If your fiscal year ends September 30, 2026, your 1120-S is due December 15, 2026.

Need more time to file Form 1120-S?

You can request an extension by filing IRS Form 7004 before the due date.

Form 1120-S Filing Deadlines – 2025 Tax Year

These deadlines apply if your S corporation uses a calendar year (Jan 1 – Dec 31).

| Filing Type | Deadline |

|---|---|

| File with IRS (E-file) | March 16, 2026 |

| Shareholder K-1 distribution | March 16, 2026 |

| With Extension (Form 7004) | September 15, 2026 |

Penalties for Late or Inaccurate Filing

Avoid costly penalties by filing on time:

- Late filing: $245 per shareholder for each month late (max 12 months). If you owe tax, add 5% of the unpaid amount each month (max 25%). If your 2025 return is over 60 days late, you’ll pay at least the smaller of your tax due or $510. IRS 1120-S/PDF

- Missing/incorrect K-1s: $330 per K-1 (rises for intentional disregard).

If you’re unsure, contact a CPA or our support - we’ll help you avoid errors and penalties.

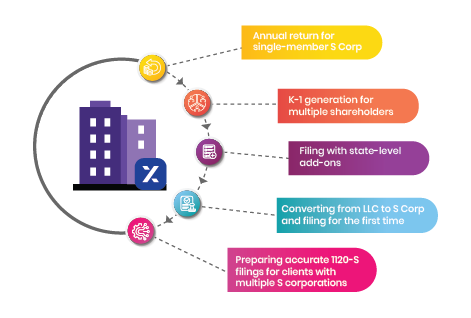

Common Use Cases

- Annual return for single-member S Corp

- K-1 generation for multiple shareholders

- Filing with state-level add-ons

- Converting from LLC to S Corp and filing for the first time

- Preparing accurate 1120-S filings for clients with multiple S corporations

Not sure if you need to file Form 1120-S? Our support team can help you determine your requirements.

Common Mistakes to Avoid

(Pro Tips from a Tax Expert)

- Make sure your shareholder compensation is “reasonable.” The IRS often audits S Corps that report high distributions but low salaries.

- If your S Corp had no activity this year, you still must file 1120-S (just mark it as a final or zero-activity return).

- Double-check TINs to avoid rejection

- Don’t miss the K-1 delivery deadline

- Match total distributions with retained earnings

- Use correct codes on Schedule K

Competitor Comparison: Why TaxZerone Wins

| Feature | TaxZerone | Other E-file Platforms |

|---|---|---|

| IRS-Authorized | ✅ 100% trusted by the IRS | ✅ Available |

| Built-in Error Validation | ✅ Automatic error check before submission | ⚠️Limited or manual checks |

| K-1 Generation & Delivery | ✅ Instant K-1 creation + postal & digital delivery options | ✅ Basic K-1 generation only |

| Transparent Pricing | ✅ Flat fee + clear add-ons (no surprises) | ❌ Hidden charges & upsells |

| Support Team Access | ✅ Expert help via chat, email, & phone | Limited or delayed support |