📢Attention Partnerships! E-file your 2025 Form 1065 online and securely deliver Schedule K-1s to partners.

Time left to file before the deadline

(March 16, 2026):

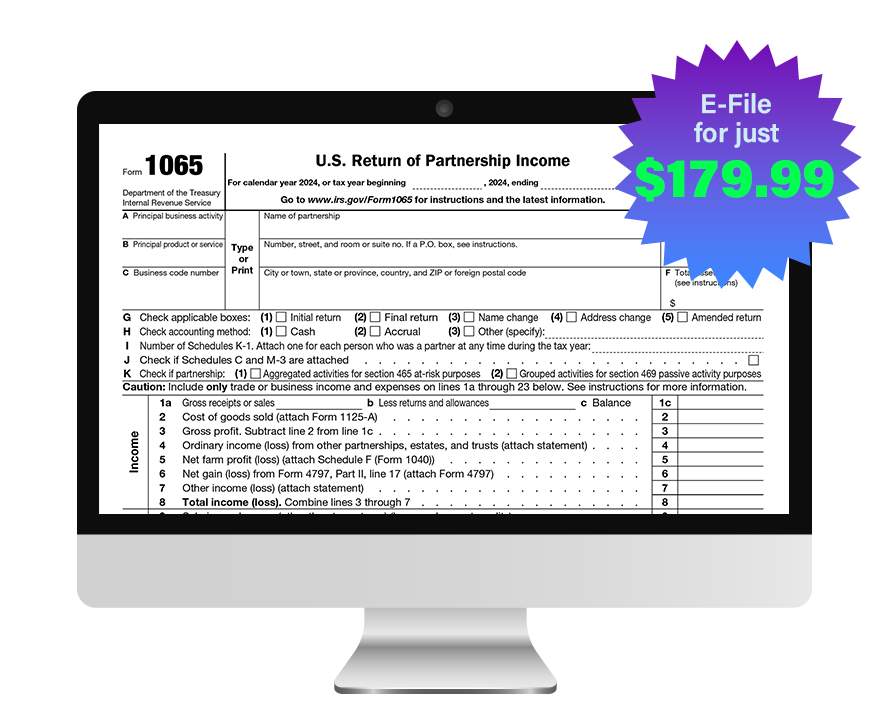

File IRS Form 1065 Online for the 2025 Tax Year

E-file your partnership’s income tax return with ease. TaxZerone provides a secure and accurate platform for filing Form 1065 online, whether you operate a domestic partnership or a

multi-member LLC taxed as a partnership.

File Form 1065 Online for just $179.99

One flat fee. No hidden charges. Your complete 1065 e-filing includes Schedule K-1 generation for all partners.

What You’ll Need to File 1065

To file IRS Form 1065 through TaxZerone, ensure you have the following:

- Partnership Details: Legal name, EIN, business address, date the partnership began

- Income and Expenses: Gross receipts, cost of goods sold, operating expenses, and applicable credits

- Partner Information: Name, TIN, percentage ownership, and distributions for each partner

- K-1 Allocations: Profit, loss, and capital allocations to every partner

- Balance Sheet Details: Beginning and ending assets, liabilities, and capital accounts

Filing again next year? TaxZerone securely stores your past filings so you can reuse partnership and partner details for faster filing.

Eligibility Checklist: Is Form 1065 Right for Your Business?

Before you file, make sure your business qualifies:

- Your business is a domestic partnership or

multi-member LLC taxed as a partnership. - You have income, gains, losses, deductions, or credits to report from business activities.

- You have two or more partners (individuals, corporations, LLCs, or other entities).

- The entity is not taxed as a C corporation or S corporation for federal income tax purposes.

If your business meets these criteria, you are generally required to file Form 1065 to report the partnership’s income and issue Schedule K-1s to partners for their individual or entity returns.

Still Unsure?

Contact Our Support

Who Must File Form 1065?

Domestic Partnerships

Every domestic partnership is generally required to file Form 1065, U.S. Return of Partnership Income, unless it has no income, deductions, or credits to report for the tax year. This includes partnerships formed under state law and multi-member LLCs classified as partnerships for federal tax purposes.

Foreign Partnerships

Foreign partnerships must file Form 1065 if they have income effectively connected with a U.S. trade or business or have U.S. source income. Filing is required even if the partnership’s main operations are outside the U.S. or if all partners are foreign persons.

Exceptions for Foreign Partnerships:

- A foreign partnership with U.S. partners is not required to file if it had no effectively connected income, U.S. source income of $20,000 or less.

- Less than 1% of partnership items attributable to U.S. partners, and it does not meet withholding partnership definitions.

- Foreign partnerships without any U.S. partners and no effectively connected income generally do not have to file Form 1065.

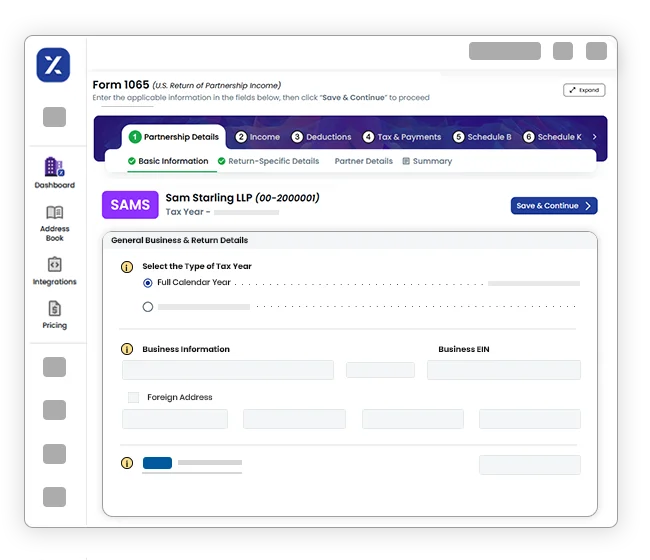

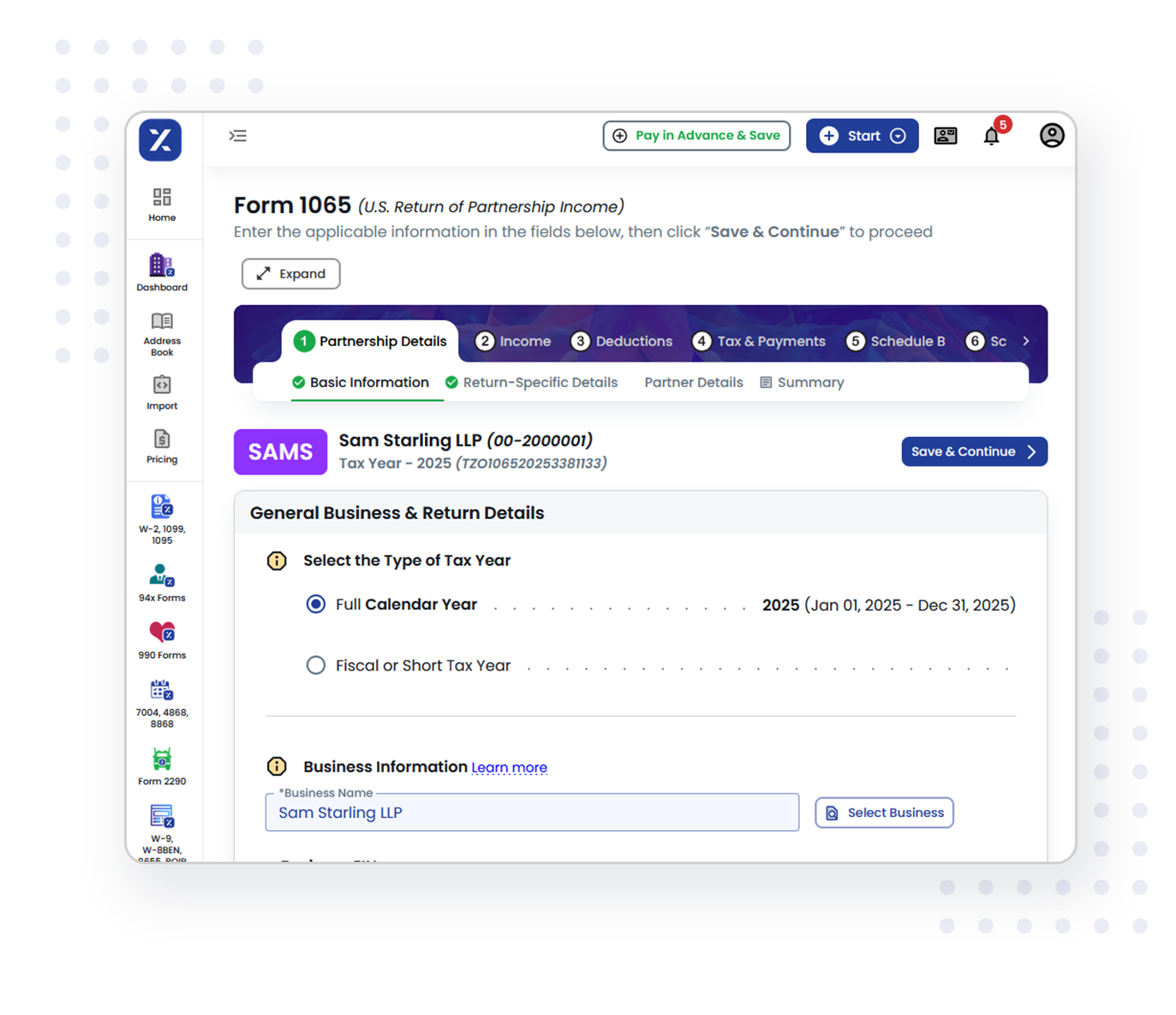

How to E-file Form 1065 with TaxZerone

Filing your Form 1065 is quick and streamlined—just follow these steps:

Enter Partnership Details

Choose Form 1065 after login and enter partnership and partner details using our intuitive interface.

Add Income, Deductions & Balance Sheet

Enter business income, deductions, and other tax items while automatically creating K-1s for each partner.

Validate & E-file

Run built-in checks to confirm that your return is complete and compliant with IRS rules, then transmit electronically.

Distribute K-1s to Partners

After acceptance, deliver K-1s digitally via ZeroneVault or send by mail using our add-on services.

Why Choose TaxZerone for Form 1065 E-filing?

Trusted IRS E-file Provider

File your partnership return on a reliable, IRS-compliant platform that ensures smooth processing.

Guided Filing

Step-by-step screens guide you through each part of Form 1065 and associated schedules.

K-1 Auto-Generation

Generate Schedule K-1s for every partner and support electronic and postal delivery.

Quick Repeat Filing

Reuse prior-year data for returning partnerships to accelerate setup and reduce data entry.

Advanced Error Checks

Automatic validation helps identify missing TINs, inconsistent totals, and other common 1065 errors.

Transparent Pricing

No surprise fees—just a clear base price and optional add-ons that scale with your needs.

Filing Form 1065 Made Simple for Partnerships &

First-Time Filers

Starting or managing a partnership comes with important tax responsibilities,

but filing your first Form 1065 is easier than you think. TaxZerone streamlines the process

so you can focus on running your business instead of decoding IRS forms.

Why This Matters for Partnerships

- Straightforward Pricing: A single flat fee with clear add-ons, ideal for partnerships of all sizes and budget-conscious businesses.

- Step-by-Step Guidance: The platform walks you through each section of Form 1065 using plain language.

- Automatic K-1 Generation: Instantly generate and prepare Schedule K-1s for all partners.

- Error-Reduced Filing: Built-in checks help you avoid common mistakes that could trigger delays or notices.

First-Time Filers Get Extra Peace of Mind

- Clear Explanations at Every Step: Complex partnership tax concepts are simplified with easy-to-follow prompts.

- Dedicated Support Team: Dedicated Support Team:

- Beginner-Friendly Interface: A clean, intuitive layout helps first-time filers move through Form 1065 with confidence, without feeling overwhelmed.

- Save & Resume Anytime: Start your return now and pick it up later without losing progress—perfect when you’re still gathering partner or financial details.

Special Pricing for CPAs & Tax Professionals

Handling multiple partnership returns? Enjoy volume savings and additional support.

- Bigger filing volume means better discounts.

- Save time with reusable business and partner profiles.

- Get white-glove onboarding and priority support during peak season.

📞 Contact Us Now to unlock your custom CPA pricing and streamline partnership filings.

Form 1065 Filing Deadlines – 2025 Tax Year

These deadlines apply if your partnership uses a calendar year (Jan 1 – Dec 31).

| Filing Type | Deadline |

|---|---|

| File with IRS (E-file) | March 16, 2026 |

| Partner K-1 Distribution | March 16, 2026 |

| With Extension (Form 7004) | September 15, 2026 |

For Fiscal-Year Partnerships

If your partnership uses a fiscal year, the Form 1065 due date is:

The 15th day of the 3rd month after the fiscal year ends.

Examples:

Fiscal year ending June 30, 2026 → Form 1065 due September 15, 2026.

Fiscal year ending September 30, 2026 → Form 1065 due December 15, 2026.

Need more time to file Form 1065?

You can request an automatic

6-month extension extension by filing Form 7004 on or before the original due date.

Penalties for Late or Inaccurate Filing

Avoid penalties by filing a complete and accurate return on time.

- Late filing may trigger per-partner monthly penalties, up to a maximum number of months set by the IRS.

- If tax is owed, additional percentage-based penalties and interest may apply until the balance is paid.

- Incomplete, late, or incorrect Schedule K-1s can also result in separate penalties per K-1.

If you are unsure, contact a CPA or our support team to help you reduce the risk of errors and penalties.

Common Mistakes to Avoid

- Not reconciling partner capital accounts and balance sheet totals.

- Omitting or misreporting guaranteed payments to partners.

- Using incorrect ownership percentages when allocating income or loss on K-1s.

- Missing K-1 delivery deadlines to partners.

- Not applying the correct codes for various income, deductions, and credits on Schedule K.