Essential Forms

Easily manage key IRS forms like Form W-9, Form W-8BEN, Form 8655, FinCEN BOIR and more.

Business Tax Forms

File your business income tax returns, such as Form 1120-S, quickly and accurately.

Tools & Calculators

Quickly calaculate taxes and find deadline with our trusted tools.

990 EIN Finder

Locate and verify nonprofit EINs with ease for IRS Form 990

Form 2290 Tax Calculator

Estimate your HVUT quickly

Form 7004 Due Date Calculator

Find the exact extension deadline

Contact & Support

Reach out for personalized help

Resources & Articles

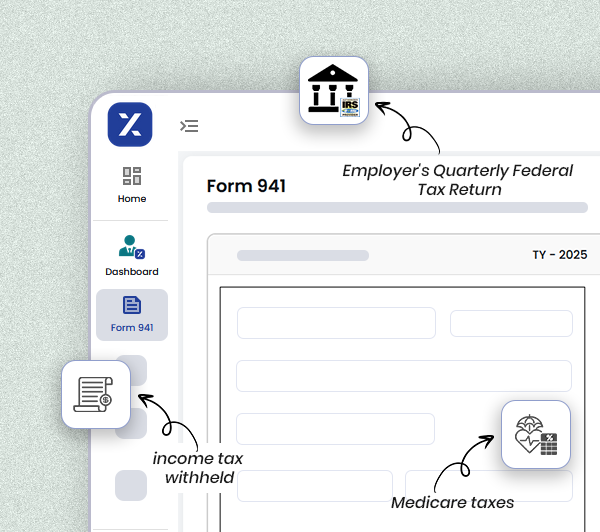

In-depth form breakdowns

Guides & How -To-Articles

Knowledge Center

Walkthroughs, expert Q&As and Tutorials

Knowledge Base

Step-by-Step guide and FAQs

Blog & Trending Topics

Tax tips, industry changes and updated

Learning Hub

YouTube Videos

Walkthroughs, export Q&As and Tutorials