📢 Need more time to provide recipient copies? File Form 15397 now to request a one-time 30-day extension.

File IRS Form 15397 Online for 2025 Tax Year

Easily request a 30-day extension to furnish recipient copies of certain information returns. It covers Form W-2, 1099, 1098, 1095, and more.

Running out of time to distribute your recipient copies?

Get an online extension to meet your deadline and stay compliant with the IRS.

File for just

$9.99

What is IRS Form 15397?

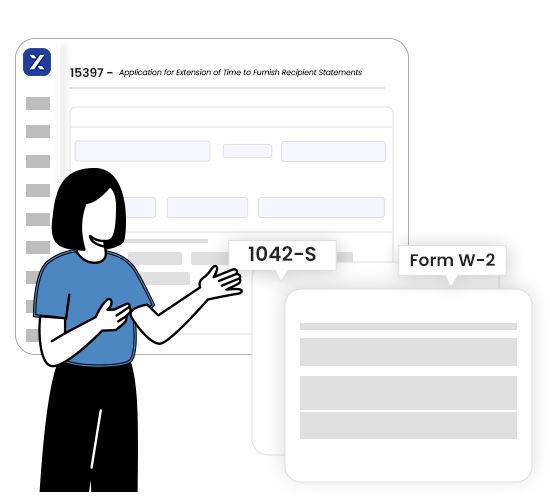

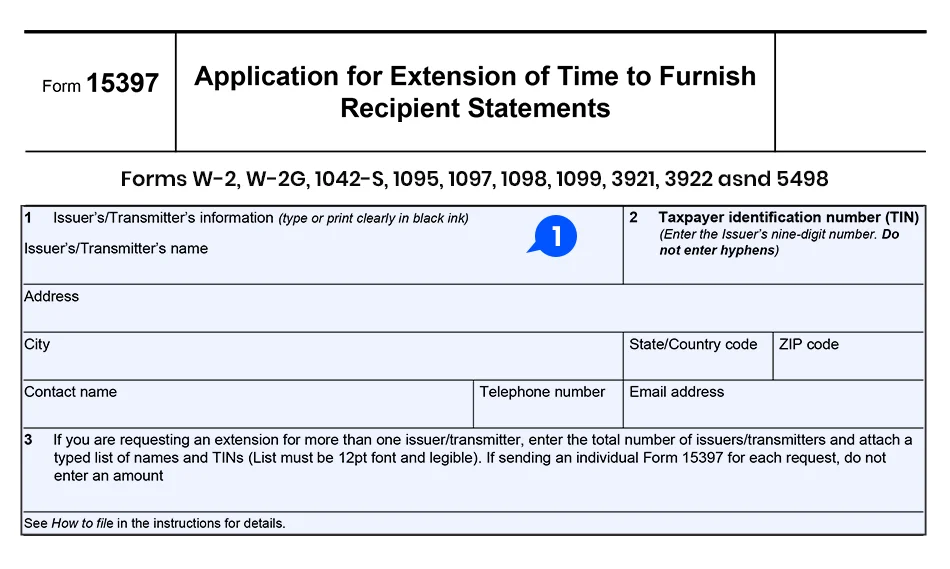

Form 15397 (Application for Extension of Time to Furnish Recipient Statements) allows issuers or transmitters to request a one-time 30-day extension to distribute recipient copies of certain information returns.

Who Should File Form 15397?

You should file Form 15397 if you furnish recipient copies of information returns and need more time, including:

- Employers issuing Forms W-2

- Businesses or payers furnishing 1099 forms

- Financial institutions providing savings or contribution statements

- Health coverage providers furnishing ACA forms

- Trusts, estates, or other required issuers

- Transmitters unable to meet the recipient furnishing deadline

The request must be submitted by the original recipient due date.

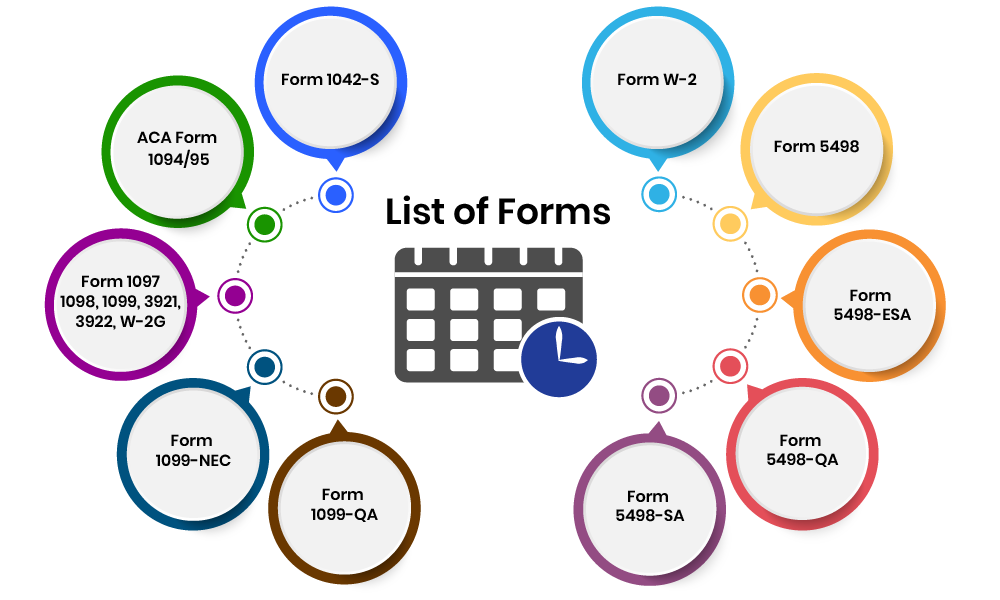

Which information returns are covered under Form 15397?

The following forms are eligible for a deadline extension

How to File Form 15397 in 3 simple steps with TaxZerone?

You can file the form online in minutes and request an extension by following these steps.

Enter Your Information

Enter the issuer’s/transmitter’s name, TIN, address, and contact details.

Select Forms for Extension

Choose the form to request an extension and briefly explain the reason.

Review & Transmit

Review your details carefully. TaxZerone will securely fax your form to the IRS.

Why choose TaxZerone?

Explore the powerful features of TaxZerone today!

Fast Filing

File your extension online in just a few minutes by following our form 15397 instructions.

Affordable Pricing

TaxZerone offers clear, transparent pricing with zero hidden charges. You can file without breaking the bank.

Smart Error Detection

TaxZerone's built-in error check will review your data to ensure your form doesn’t have any error and filed accurately.

ZeroneVault

You can easily share the recipient copies through ZeroneVault. It will allow you to send files securely.

Free Retransmission

If your extension request is ever rejected, you can retransmit it at no additional cost until the Internal Revenue Service accepts it.

Dedicated Customer Support

Our support team is always there to help you with any questions or filing issues or guidance throughout the process.

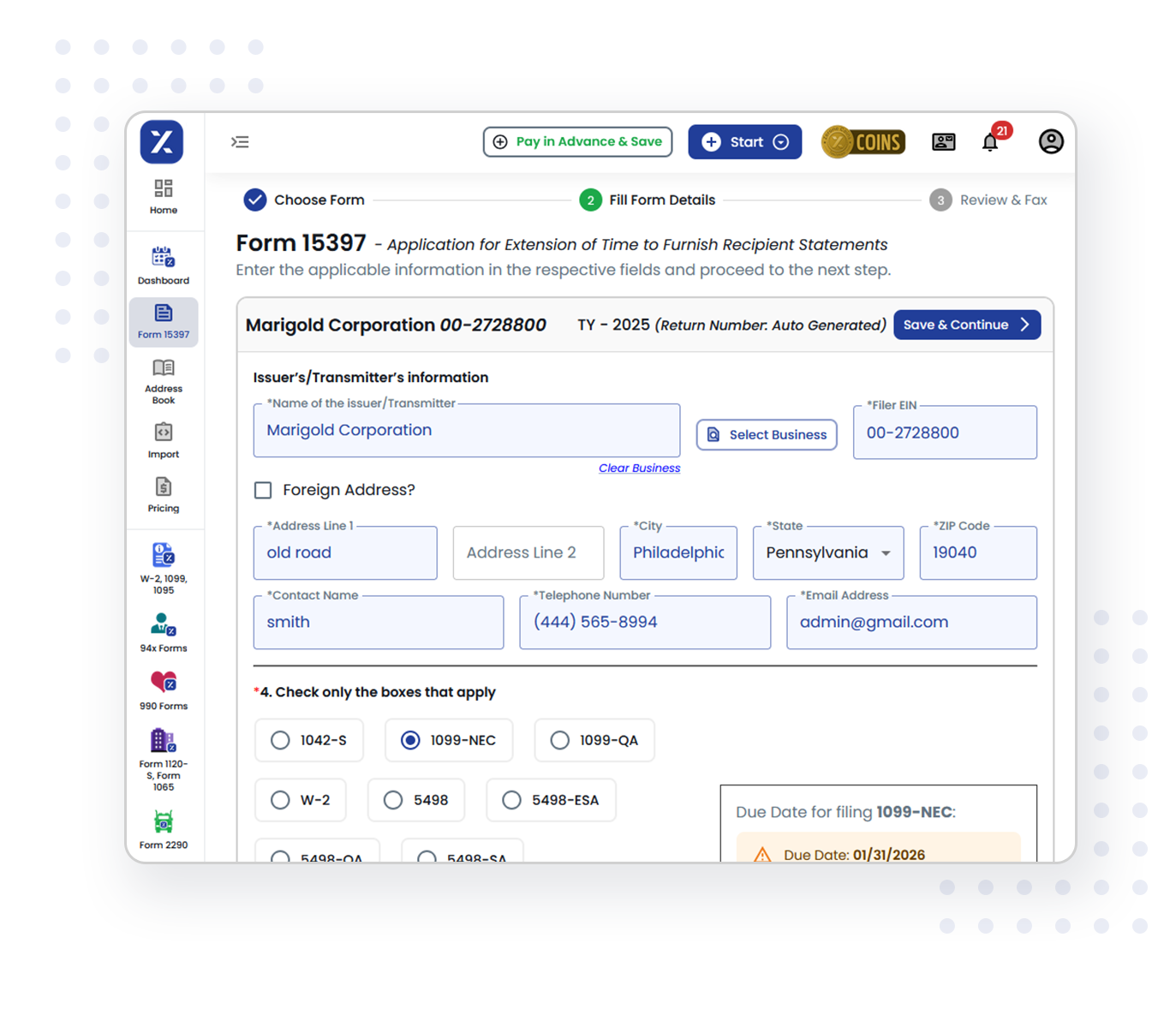

What Information Is Required to Complete IRS Form 15397?

To request an extension, make sure you have the following details ready:

1. Issuer’s or Transmitter’s Information

- Name

- Employer Identification Number (EIN)

- Mailing address

- Contact number

2. Form(s) Requiring an Extension

Select the specific information return(s) for which you are requesting additional time.

3. Reason for the Extension Request

Briefly explain why you need extra time to furnish recipient copies.

Common Mistakes to Avoid When Filing Form 15397

Even small errors can lead to IRS rejection or delays in approving your extension request.

Incorrect or missing TIN

Providing wrong or incomplete Taxpayer Identification Numbers (TIN) of issuers or transmitters.

Not attaching the required list

When requesting an extension for multiple issuers or transmitters, failing to attach a typed list of all names along with their TINs.

Missing signature

The IRS will not accept the request if the form is unsigned by an authorized person.

Entering a total when filing separate forms

If you file a separate Form 15397 for each issuer, do not enter the total number of issuers on the form.

Assuming the Extension Applies to IRS Filing

This form only extends the time to furnish statements to recipients, not the time to file information returns with the IRS.

Filing Too Early

Do not file the form before January 1st of the tax year, even if an extension is needed.

IRS Form 15397 vs Form 8809

| Comparison | Form 15397 | Form 8809 |

|---|---|---|

| Purpose | Extend time to furnish recipient copies | Extend time to file with IRS/SSA |

| Applies To | Employees and payees | IRS or SSA |

| Extension Length | One-time 30 days | 30 days (second extension limited) |

| Covers Recipient Deadlines | Yes | No |

| Filing Method | Online and fax | E-file or Paper |

Download Official IRS Form 15397 and Instructions

Access the IRS forms directly:

Ready to extend your information return recipient copy deadline?

File with TaxZerone today for easy filing and faster processing.

Frequently Asked Questions

1. Can I file Form 8809 instead of Form 15397?

- Form 8809 (Extension of Time to File Information Returns) gives you additional time to submit information return forms to the IRS.

- Form 15397 (Extension of Time to Furnish Recipient Statements) gives you additional time to send copies of the forms to employees or recipients.

2. When is the deadline to file Form 15397?

Form 15397 must be filed on or before the original due date of the return for which you are requesting an extension, but not earlier than January 1.

Example:

If you need additional time to furnish Form W-2 recipient copies, you must file Form 15397 on or before February 2, 2026.

3. How to file an extension Form 15397?

You can file an extension online or fax it to the given address:

Internal Revenue Service Technical Services Operation

Attn: Extension of Time Coordinator

877-477-0572 (International: 304-579-4105)

4. What reasons are accepted by the IRS for requesting a Form 15397 extension?

The IRS may accept the following reasons:

- Natural disasters, fires, or other catastrophic events that disrupt business operations.

- Illness, death or other unavoidable causes.

- Missing or late Schedule 1 or other input information

- Major technical breakdowns that make it impossible to distribute statements on time

- First-year business start-up challenges affecting preparation timelines

5. How long is the extension granted under Form 15397?

The IRS generally grants a single-time 30-day extension for furnishing recipient statements. This extension provides additional time to ensure all statements are prepared and distributed accurately.