E-file IRS Form 940 for the 2024 tax year

File the annual FUTA tax return online with TaxZerone effortlessly and efficiently. Complete your Form 940 filing and stay tax compliant.

E-file Form 940 at the best price in the industry

Our flat pricing offers you exceptional value. This means what you see listed is what you can expect to pay—not a cent more.

$6.99

Flat fee. No hidden charges.

File Form 940 for your business with the IRS in just 3 simple steps

Follow the steps below to report FUTA taxes for the tax year.

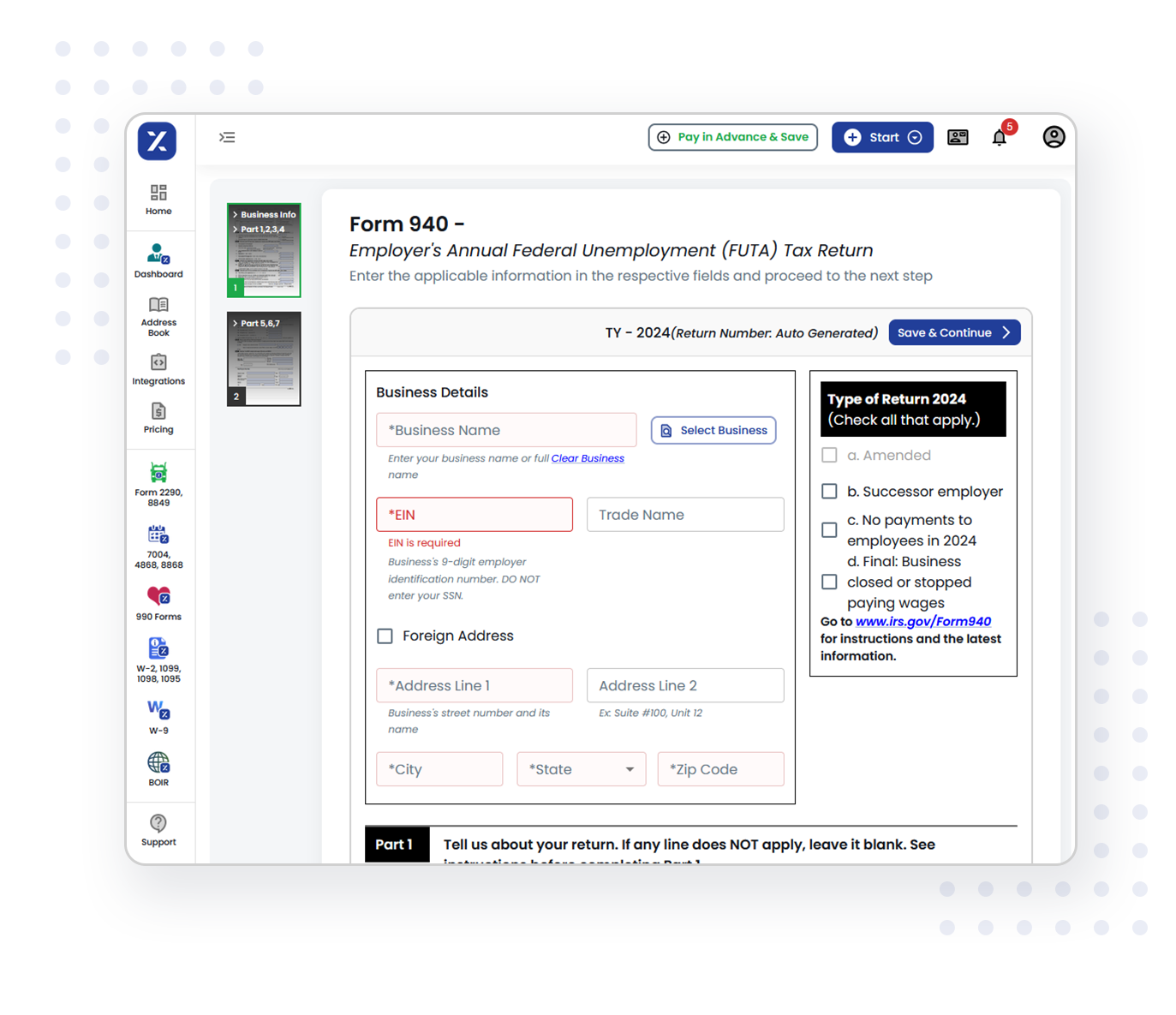

Enter Form 940 information

Provide the business information along with payment made to employees and FUTA taxes applicable.

Pay the balance due and sign Form 940

Select the payment method that suits you to pay the FUTA balance due and e-sign the return.

Transmit the return to the IRS

Make sure the information provided is accurate, and transmit your 940 return to the IRS.

Get notified as soon as your return is accepted.

Top reasons to choose TaxZerone for Form 940 e-filing

Here's how TaxZerone simplifies Form 940 filing for your business.

IRS-authorized

Your tax filings are processed securely and in compliance with all regulations. Confidently e-file your Form 940, knowing that it will be accepted and processed by the IRS without any issues.

Built-in business validation

Get benefitted from our in-built smart validations acting as your virtual tax assistant. These checks not only save time but also minimize errors and ensure precise and error-free submissions for your peace of mind.

Real-time updates

Stay informed with instant notifications about your filing's status. Get notified instantly as soon as the IRS processes your 940 return. Also, track the status from your dashboard.

Competitive pricing

File your Form 940 at the most competitive rates without compromise. No hidden fees or unexpected charges. Get top-notch, cost-effective solutions for your tax filing needs.

E-sign Form 940

Complete your 940 filing swiftly using 94x online signature PIN. Don't you have an online signature PIN? Use Form 8453-EMP to e-sign your return and transmit it to the IRS securely.

E-filing simplified

Experience a user-friendly and streamlined process. Our intuitive interface ensures quick completion of the filing process in just minutes. Enjoy a stress-free tax filing experience that saves you time and effort.

E-file Form 940 in just a few minutes using TaxZerone

Choose a simplified tax filing process. Choose TaxZerone. It's that simple.

Takes only a few minutes