Request Free Form W-8BEN Online

Easily request your client’s Certificate of Foreign Status (Form W-8BEN) with TaxZerone. Perfect for non-U.S. freelancers, investors, and international individuals earning U.S. income.

100% Free —Forever

No subscriptions.

You can request unlimited W-8BEN forms completely free, anytime you need.

Whether you're an individual or business, our platform is built to save you time—and money—without compromising quality.

How to Request W-8BEN Form Online Using TaxZerone

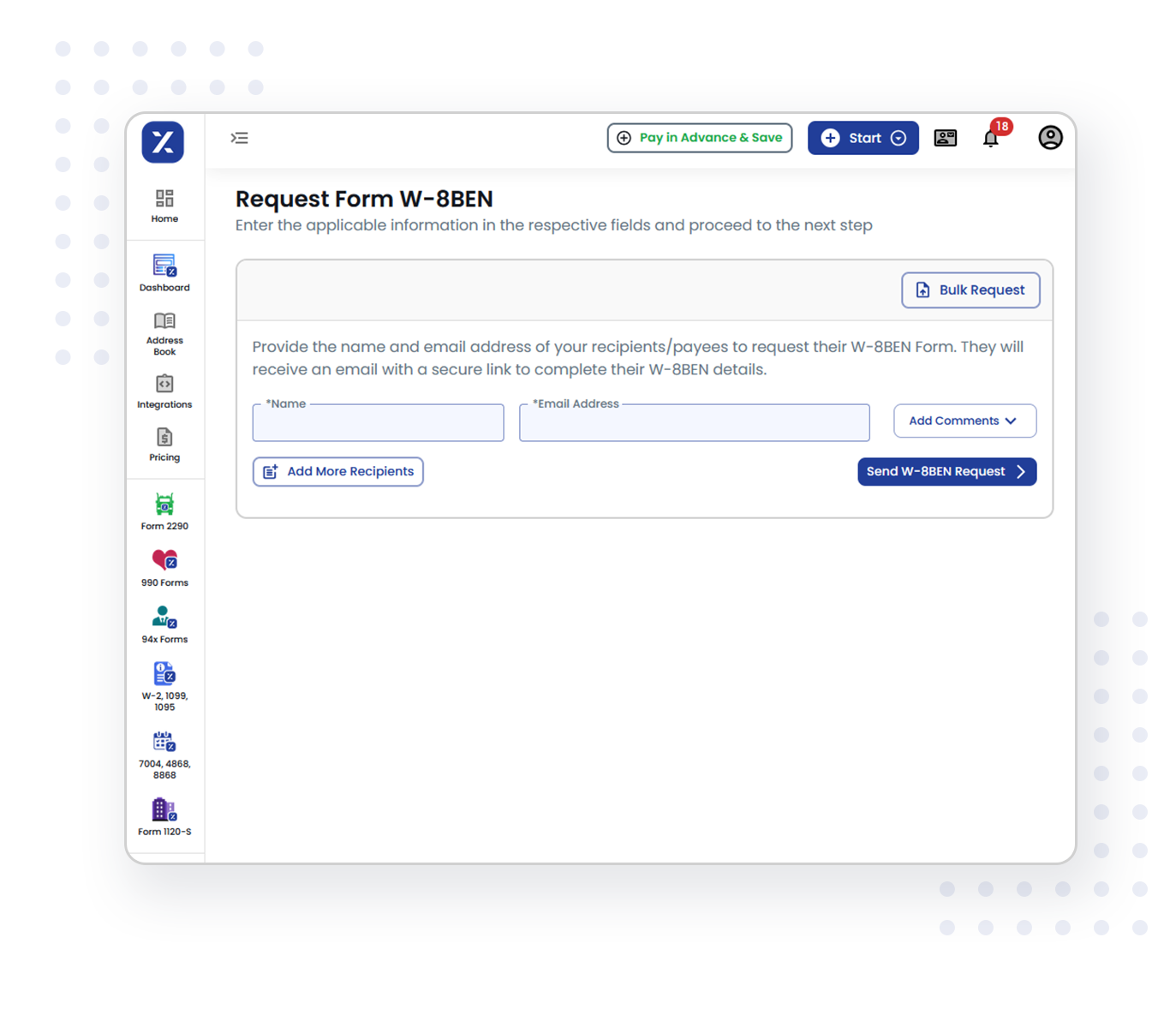

Invite the Recipient

Enter the recipient’s name and email address to send an invitation to fill out the W-8BEN form.

Recipient Fills & Signs

The recipient completes their information and electronically signs the form.

Download & Save

Download the completed form instantly and print it for your records or share it with your payer.

Why Choose TaxZerone for W-8BEN Requests Online?

World Global Support

TaxZerone helps you complete the form accurately with the right treaty benefits, no matter where you are.

Secure Portal

Your clients can easily submit and access their W-8BEN forms through ZeroneVault, our secure platform designed to keep their data safe.

Download & Print Anytime

Easily access, download, and print your completed forms whenever you need them - no waiting, no restrictions.

IRS Compliant

Our forms are 100% IRS-compliant and updated with the latest tax regulations and requirements.

Mobile Friendly

Request forms on any device - desktop, tablet, or mobile. Works seamlessly everywhere.

Expert Guidance

Have any questions? Our support team is here to help with expert guidance whenever you need it.

Choose TaxZerone for a simplified, secure, and accurate form w 8ben request process.

Get Started NowTrusted by Thousands

Join thousands of satisfied users who have simplified their tax compliance with TaxZerone.

Forms Generated

Success Rate

Countries Supported

Email Support Available

What Our Users Say

Join thousands of satisfied users from around the world who have simplified their tax compliance with TaxZerone.

- Sarah Mitchell, UK

- Maria Santos, Philippines

- Lucas Silva, Brazil

Ready to Request Form W-8BEN Online?

TaxZerone makes the process simple and stress-free.

Frequently Asked Questions

1. What is Form W-8BEN?

Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals), is used by foreign individuals to certify their non-U.S. status. This IRS form allows them to claim reduced withholding rates or exemptions under applicable tax treaties. It helps prevent the standard 30% withholding on U.S. source income.

U.S. persons use the W-9 form for similar tax reporting purposes.

2. Where do I send Form W-8BEN?

Do NOT send Form W-8BEN to the IRS. Instead, provide it directly to:

- The withholding agent (the person or entity paying you income)

- Your bank, broker, or financial institution

- The partnership allocating income to you

- Any Foreign Financial Institution (FFI) requesting it for account documentation

The form should be given to whoever is requesting it from you, typically before any payment is made to you or credited to your account.

3. Who needs to fill out Form W-8BEN?

Nonresident alien individuals who are beneficial owners of U.S. source income must complete Form W-8BEN. This includes foreign persons receiving dividends, interest, rents, royalties, or other FDAP income. Account holders at foreign financial institutions and foreign partners in U.S. partnerships also need this form.

4. What types of U.S. income are subject to 30% withholding tax for foreign persons?

- Interest (including certain original issue discount (OID))

- Dividends

- Rents

- Royalties

- Premiums

- Annuities

- Compensation for, or in expectation of, services performed;

- Substitute payments in a securities lending transaction; or

- Other fixed or determinable annual or periodical gains, profits, or income.

5. What income types require Form W-8BEN to avoid backup withholding?

- Broker proceeds - Income from securities transactions

- Short-term OID - Original Issue Discount for 183 days or less

- Foreign source income - Interest, dividends, rents, or royalties from foreign sources

- Gaming proceeds - Winnings from blackjack, baccarat, craps, roulette, or big-6 wheel; and

- Transportation income - U.S. source gross transportation income, as defined in section 887(b)(1), that are taxable under section 887(a).

6. How long does my W-8BEN form stay valid?

For example, if signed on September 30, 2024, it remains valid through December 31, 2027. However, if your circumstances change—like moving to the U.S. or changing tax residency—you must submit a new form within 30 days of the change.

7. What's the difference between lines 6a and 6b, and do I need to fill them out?

- Line 6a: This is where you provide your Foreign Tax Identifying Number(FTIN) - essentially your tax ID number from your home country.

- Line 6b: This is a checkbox you use instead of line 6a if you don't have an FTIN and aren't legally required to get one.

Do you need to fill them out?

- Use Line 6a if: You have a tax ID number from your home country

- Use Line 6b if:

- Your country doesn't issue tax ID numbers, OR

- You're not legally required to have one in your country

- Skip both if:

- You're a U.S. territory resident, OR

- Your country is on the IRS list of jurisdictions that don't issue foreign TINs

8. What is the difference between Form W-8BEN and Form W-9?

| Aspect | Form W-8BEN | Form W-9 |

|---|---|---|

| Who Should Use It | Non-U.S. individuals (foreign persons) receiving income from U.S. sources | U.S. citizens, U.S. residents, and domestic entities |

| Main Purpose | To certify foreign status and claim tax treaty benefits (if applicable) | To provide a Taxpayer Identification Number (TIN) to requesters for tax reporting |

| Used For | Reducing or eliminating U.S. tax withholding on certain U.S.-sourced income | Reporting payments like freelance work, interest, or dividends via Form 1099 |

| Type of Taxpayer | Provided to the U.S. company; not filed with the IRS | Provided to the U.S. company or requester; not submitted to the IRS |

| Tax Withholding | 30% withholding may apply unless a tax treaty benefit is claimed | No withholding if correct TIN is provided; 24% backup withholding if TIN is missing or incorrect |